Crypto Yield Offer Has Collapsed – Bitcoin Magazine

Below is an excerpt from a recent issue of Bitcoin Magazine Pro, Bitcoin Magazine premium market’s newsletter. To be among the first to receive this insight and other market analysis on the bitcoin chain straight to your inbox, Subscribe now.

Speculation and returns

This cycle has been supercharged with speculation and returns, leading all the way back to the first Grayscale Bitcoin Trust premium arbitrage opportunity. This opportunity in the market encouraged hedge funds and trading shops from around the world to step up to capture the premium spread. It was a ripe time to make money, especially in early 2021 before the trade collapsed and turned into the significant discount we see today.

The same story existed in the perpetual futures market, where we saw 7-day average annualized funding rates reach as high as 120%. This is the implied annual return that long positions paid in the market to short positions. There was an abundance of opportunities in the GBTC and futures markets alone for returns and quick returns – not even mentioning buckets of DeFi, staking tokens, failed projects and Ponzi schemes that generated even higher return opportunities in 2020 and 2021.

There is an ongoing vicious feedback loop where higher prices drive more speculation and leverage, which in turn leads to higher returns. Now we are dealing with this cycle in reverse. Lower prices wipe out more speculation and leverage while washing out any “return opportunities”. As a result, crops everywhere have collapsed.

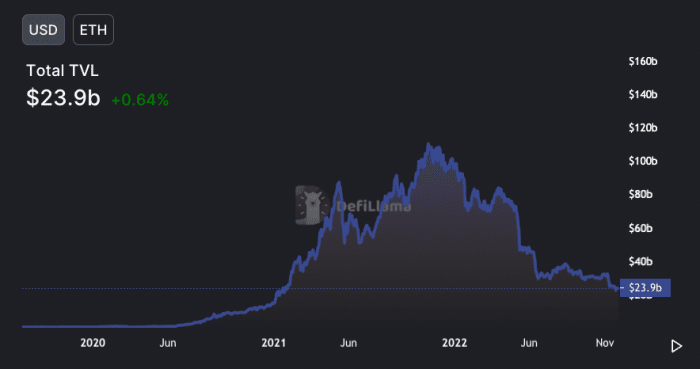

“Total value locked” in the Ethereum DeFi ecosystem passed over $100 billion in 2021 during the speculative mania, and is now only $23.9 billion today. This leverage-driven mania in the crypto-ecosystem fueled the growth of the “yield” products offered by the market, most of which have collapsed now that the figurative tide has receded.

This dynamic led to the emergence of bitcoin and cryptocurrency return-generating products, from Celsius to BlockFi to FTX and many more. Funds and traders capture a juicy spread while returning some of the profits to the retail users who hold their coins on exchanges for a small amount of interest and returns. Retail users know little about where the returns come from or the risks involved. Now it seems that all the short-term opportunities in the market have disappeared.

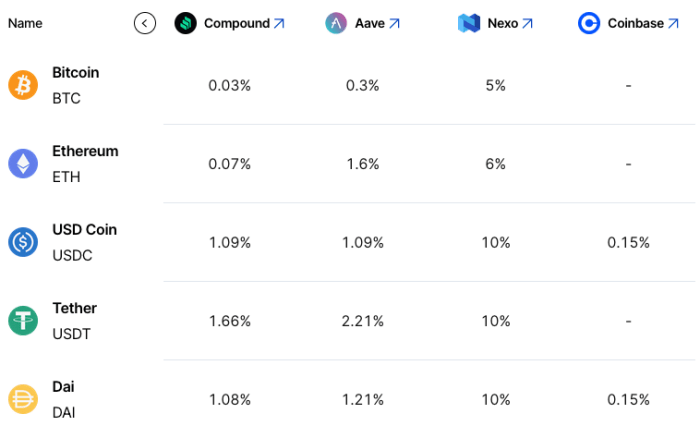

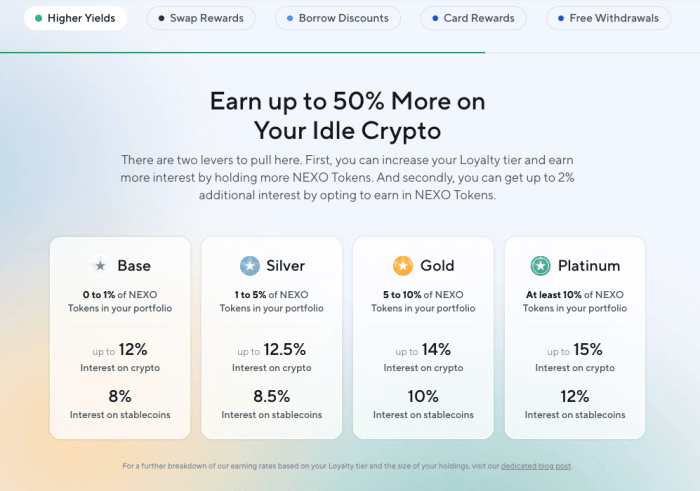

With all the speculative trades and returns gone, how can companies still offer such high-yielding prices that are well above traditional “risk-free” prices in the market? Where does the dividend come from? Not to single out or R&D any specific companies, but take Nexo for example. Prices for USDC and USDT are still at 10% versus 1% on other DeFi platforms. The same goes for bitcoin and ethereum rates, 5% and 6% respectively, while other rates are mostly non-existent elsewhere.

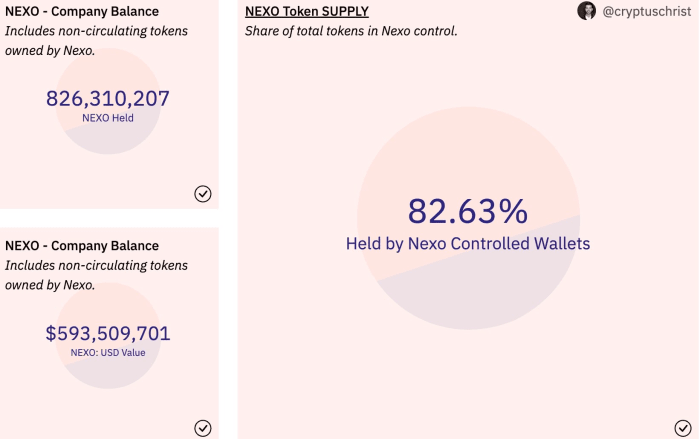

These high lending rates are secured with bitcoin and ether offering a 50% LTV (loan-to-value), while a number of other speculative tokens can be used as collateral also at a much lower LTV. Nexo shared a detailed thread on their business operations and model. As we’ve found time and time again, we can never know for sure which institutions to trust or not to trust as this industry’s deleveraging continues. However, the most important questions to ask are:

- Will loan demand at 13.9% be a sustainable business model going forward in this bear market? Shouldn’t the prices go down further?

- Regardless of Nexo’s risk management practices, are there currently increased counterparty risks for holding client balances on a variety of exchanges and DeFi protocols?

Here’s what we know:

The crypto-native credit impulse – a metric that is not perfectly quantifiable but imperfectly observable via a variety of data sets and market metrics – has plummeted from its euphoric highs in 2021 and now appears to be extremely negative. This means that any remaining product that offers you crypto-native “returns” is likely to be under extreme duress, as the arbitrage strategies that fueled the explosion in yield products throughout the bull market cycle have all but disappeared.

What remains, and what will emerge from the depths of this bear market, will be the assets/projects built on the strongest foundation. In our view, it’s bitcoin and it’s everything else.

Readers should consider counterparty risk in all its forms, and steer clear of some of the residual yield products in the market.

Relevant previous articles: