Macro guru Raoul Pal examines current bear market, predicts when Bitcoin (BTC) will explode exponentially

Former Goldman Sachs CEO Raoul Pal says a Bitcoin (BTC) bull run will happen when macroeconomic conditions improve enough to produce a wave of liquidity.

The Macro Guru says his 990,400 Twitter followers that Bitcoin’s market will explode exponentially as investors return to the digital asset space.

“When liquidity returns (the biggest driver of institutional allocations), the value of the network should rise, which then brings in more investors (or vice versa – the number of investors rising will bring in more investors) creating a multiplier effect, which gives exponential returns.”

Pal says Bitcoin is set for an explosive rally with the number of active users on the network.

“In bear markets, the values traded go down, but the number of active users is still higher (ongoing use). As adoption rises (users) x value rises (user), prices become exponential due to the mathematical multiplier.”

Pal says his Bitcoin model based on Metcalfe’s Law, which states that a network grows in value as the number of users on the network increases, shows that network users have not fallen as sharply as in previous downturns.

“Network activity peaked in 2020 and again in 2021 and has been declining. The slow trajectory of decline in network activity is why this liquidity cycle correction has so far been smaller than previous examples so far.”

He says the number of active users on the network has remained relatively flat, but the decline in today’s bear market is less than the fallout of active users in the bear market of 2019, showing wider adoption.

“For the network value to increase from here, we need to see the total value as transactions increase or the number of active users increases…

The number of active users is fairly flat on average. Note how large the number of active users was in 2018 and the number who quit in 2019.

This bear market is very different as users have remained largely stable as deeper adoption takes hold versus pure speculation.”

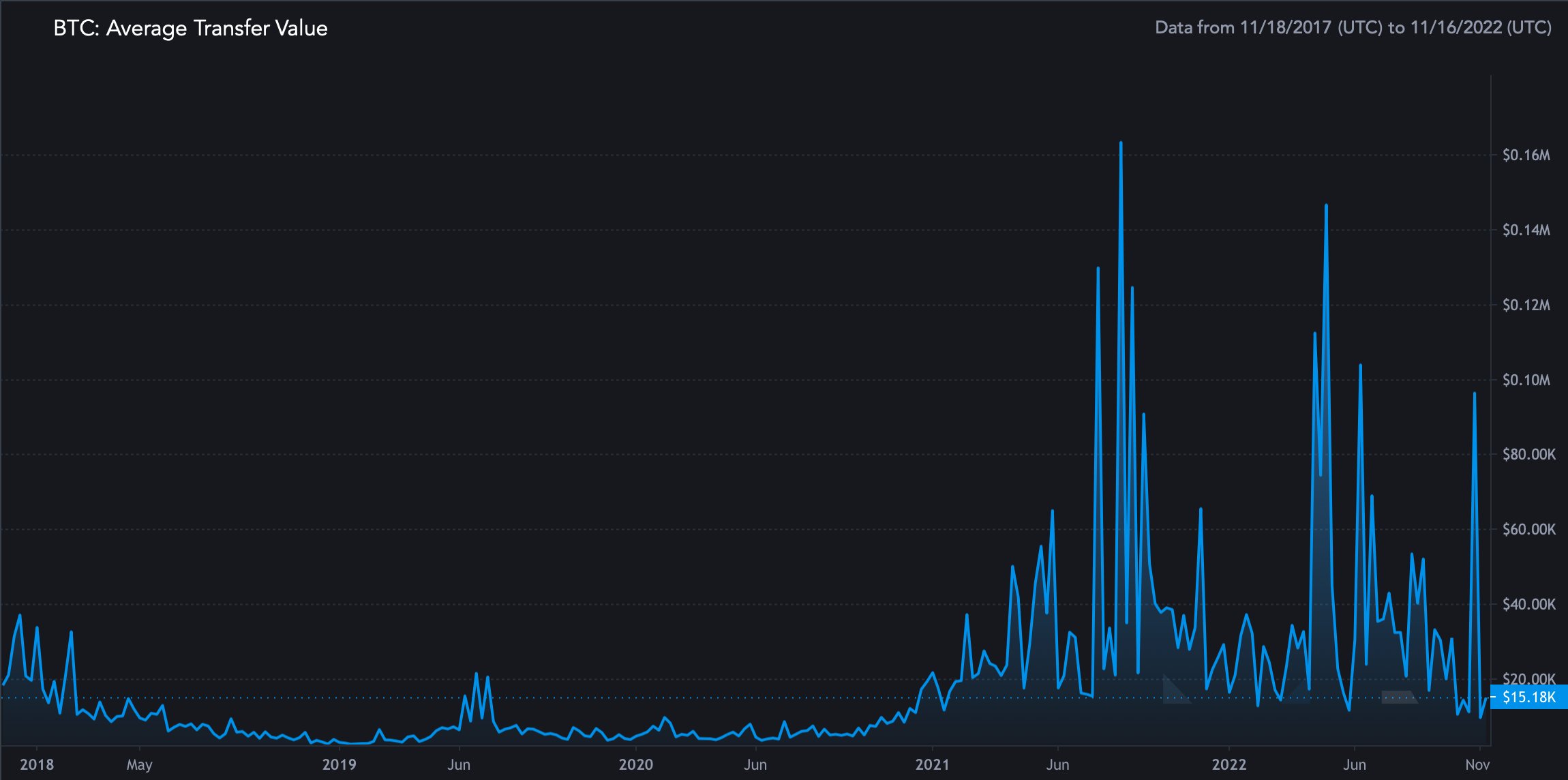

He too says the transfer of value on the Bitcoin network tells a similar story of wider adoption than in previous years.

“Total transaction value is down as larger institutional players remain on the sidelines, but on average has remained around the 2018 peak.

2018 was a retail boom, but 2020 and beyond was retail plus institutions, suggesting deeper adoption.”

Don’t Miss a Beat – Subscribe to get crypto email alerts delivered straight to your inbox

Check price action

Follow us on TwitterFacebook and Telegram

Surf The Daily Hodl Mix

Disclaimer: Opinions expressed at The Daily Hodl are not investment advice. Investors should do their due diligence before making high-risk investments in Bitcoin, cryptocurrency or digital assets. Please note that your transfers and trades are at your own risk and any losses you incur are your responsibility. The Daily Hodl does not recommend the purchase or sale of cryptocurrencies or digital assets, nor is The Daily Hodl an investment advisor. Please note that The Daily Hodl participates in affiliate marketing.

Featured image: Shutterstock/mbezvodinskikh/Jorm S