October 2022 NFT report – Coin stud

October was a relatively sleepy month for blockchain, with no huge market swings, project launches or funding rounds. The NFT market continues to stagnate since late summer as macro conditions remain tough.

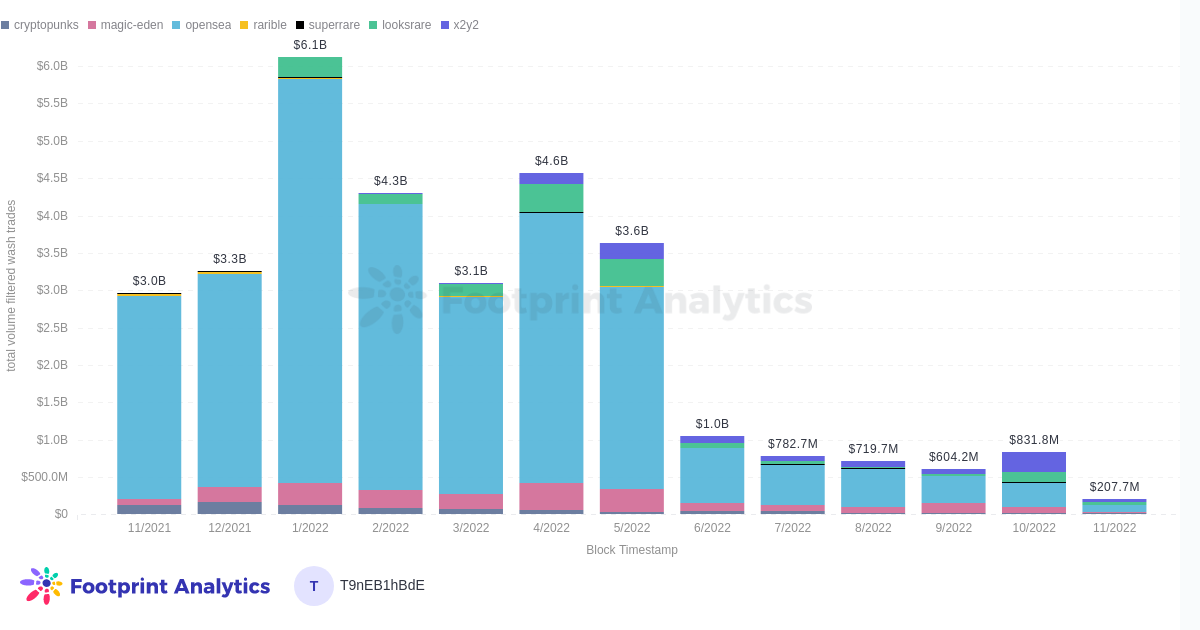

From last month’s report, Footprint Analytics has begun to incorporate and refine its filters and analyzes for laundry trade. As the market has cooled, there has been significantly less wash trading than at the height of the market, but it remains a problem to accurately assess the industry.

The total market

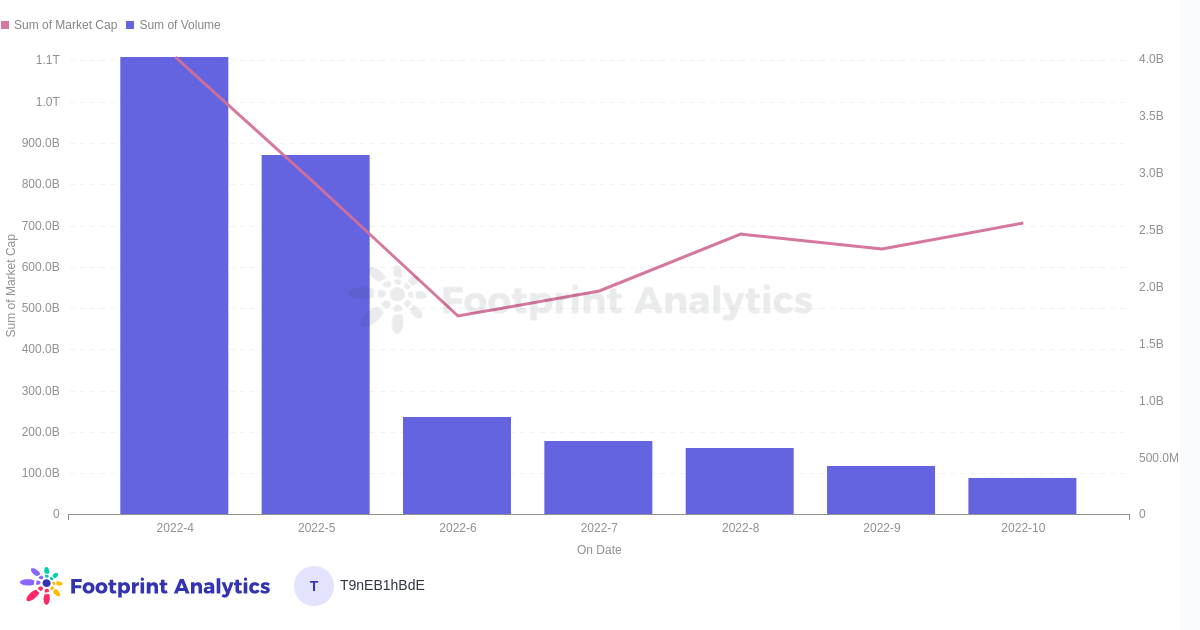

- The total market capitalization of the NFT sector increased by 9.7% from $643 billion to $706 billion.

- However, the total number of NFT transactions saw a sharp decline from 5.3 million to 3.7 million.

- The total number of NFT holders increased from 17.2 million to 19.2 million in October.

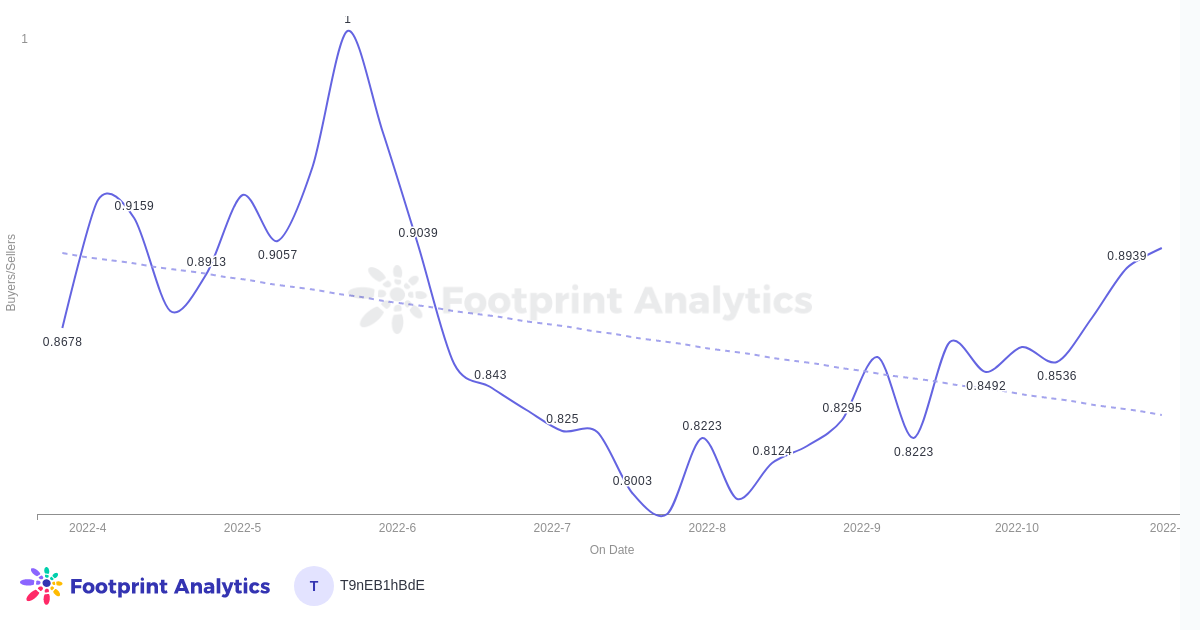

- The buyer-to-seller ratio increased in October, reaching 0.89 (89 buyers for every 100 sellers).

- The last time there were more buyers than sellers was in May, when there were 545,531 buyers and 514,442 sellers.

- Volume across NFT marketplaces fell 24.9% MoM.

Financing and investment

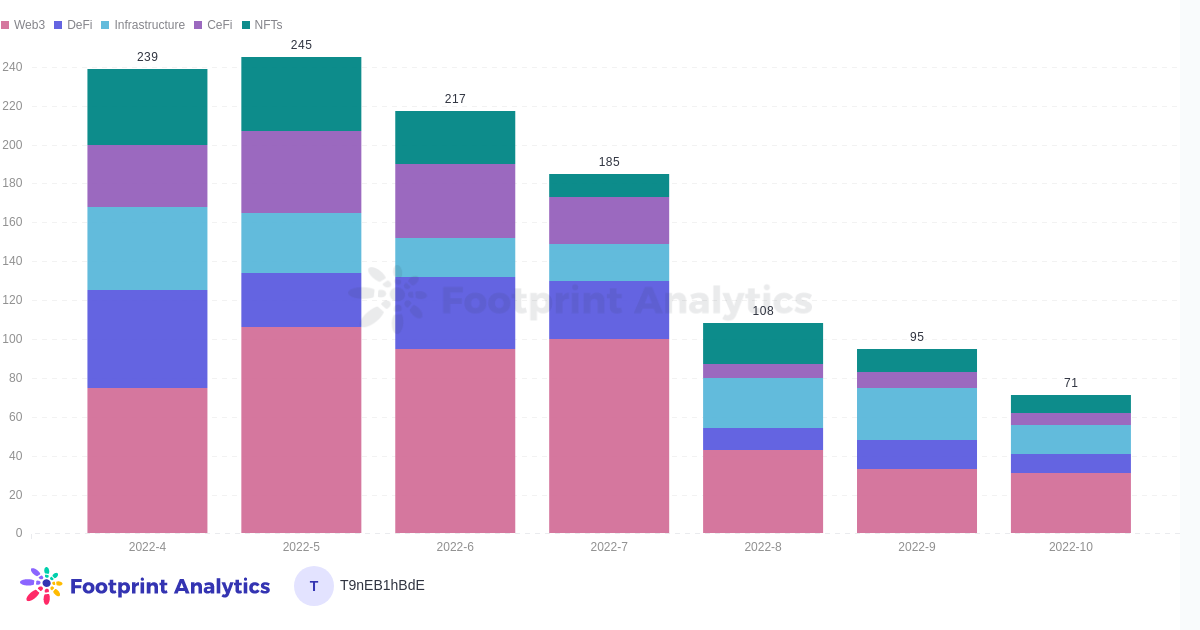

- The number of funding rounds in the NFT space decreased from 12 to 9, while the number of rounds in the blockchain space overall decreased by 25% MoM (from 95 to 71)

- The majority of funding rounds were seed rounds.

- It is becoming increasingly difficult to separate NFT projects from others and analyze the category in a pure vacuum, as Web3, GameFi and infrastructure increasingly converge with NFTs. For example, the top project by funding, Stardust, can be classified as both an NFT and a gaming project.

Marketplaces and chains

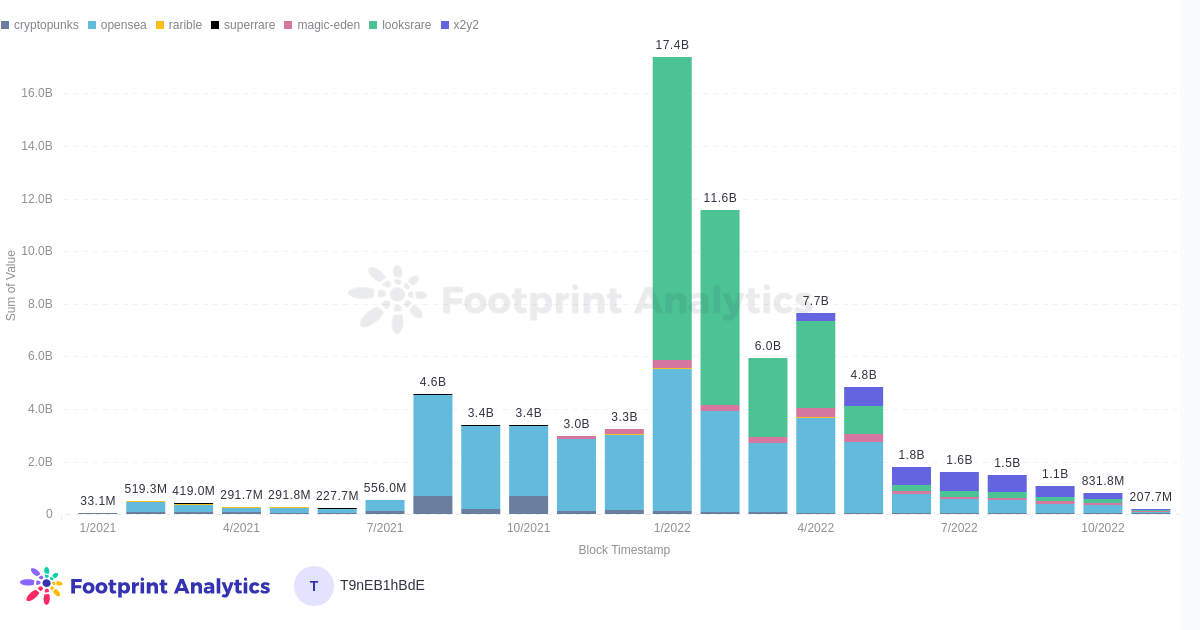

- Washing trade continues to be an obstacle in the assessment of the NFT market. However, it is significantly lower than what it was at the height of the market in January to April.

- Ethereum still accounts for the majority of NFT trading volume, but the total number of transactions is split almost evenly with Solana.

Collections Overview

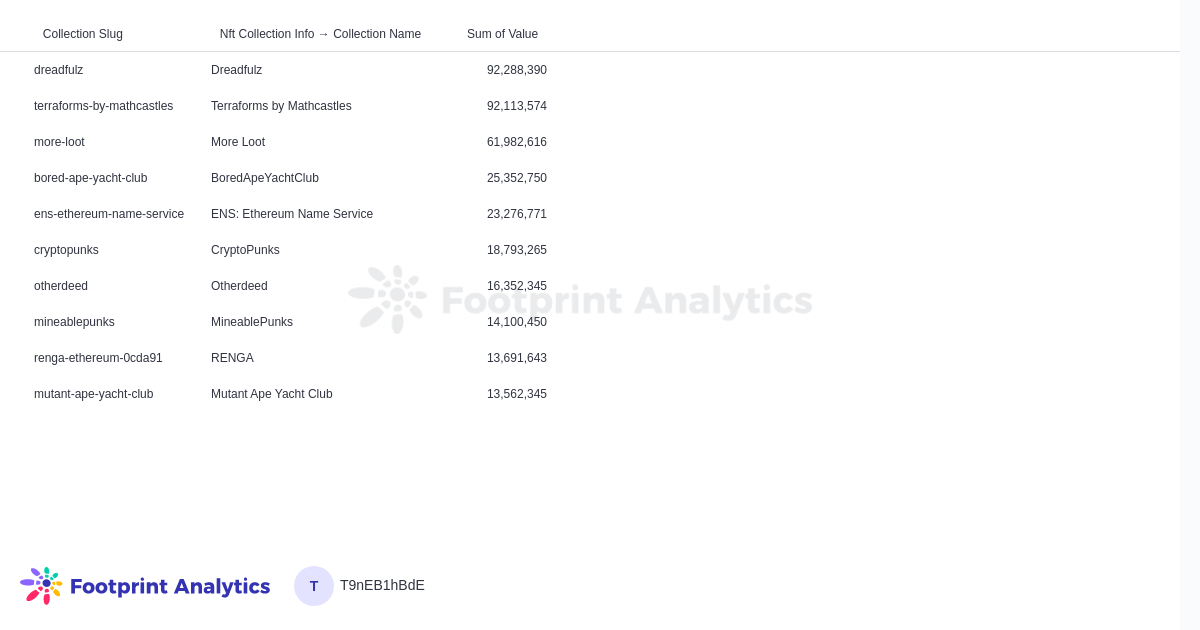

- Meebits, Terraforms by Mathcastles and Dreadfulz were the top three selling collections by volume in October. Their suspected turnover of washing amounts was 94%, 98% and 89% respectively. Note: These are percentages of total trading volume, not total trades.

- Blue Chip NFT pools BAYC and CyptoPunks saw almost no change in the amount of trading volume from September to October.

NFT Market Overview

In October, the volume in the NFT sector fell along with transactions, while the overall market value increased.

NFT market value and volume (October report)

The relationship between buyers and sellers continues to shift upwards. In the summer, the ratio strongly favored buyers, driving down the prices of NFTs, but this started to balance out again in September and continued up into October.

Buyers/sellers ratio October report

Investment and collection

The number of fundraising rounds in the blockchain industry converged across all categories, with the number of NFT funding rounds now in the single digits.

Investment by category (NFT report in October)

Marketplaces and chains

At the start of 2022, laundry trade was a large proportion of total NFT trade. It has since declined. Chains other than Ethereum still face an uphill battle to gain NFT projects and communities.

NFT volume by platform

NFT volume by platform (with wash trade filtered)

Collections

The top 3 collections by volume in October were Dreadfulz, Terraforms by Mathcastles and More Loot. The percentage of laundry trade for each collection was 90%, 92% and 93% respectively.

Top 10 collections by volume (October report)

Wash trade statistics for selected collections (preview)

Blue chip collections tend to be a good watch for the NFT market as they do not experience wash trading. There has been very little change from September to October for either CryptoPunks or BAYC.

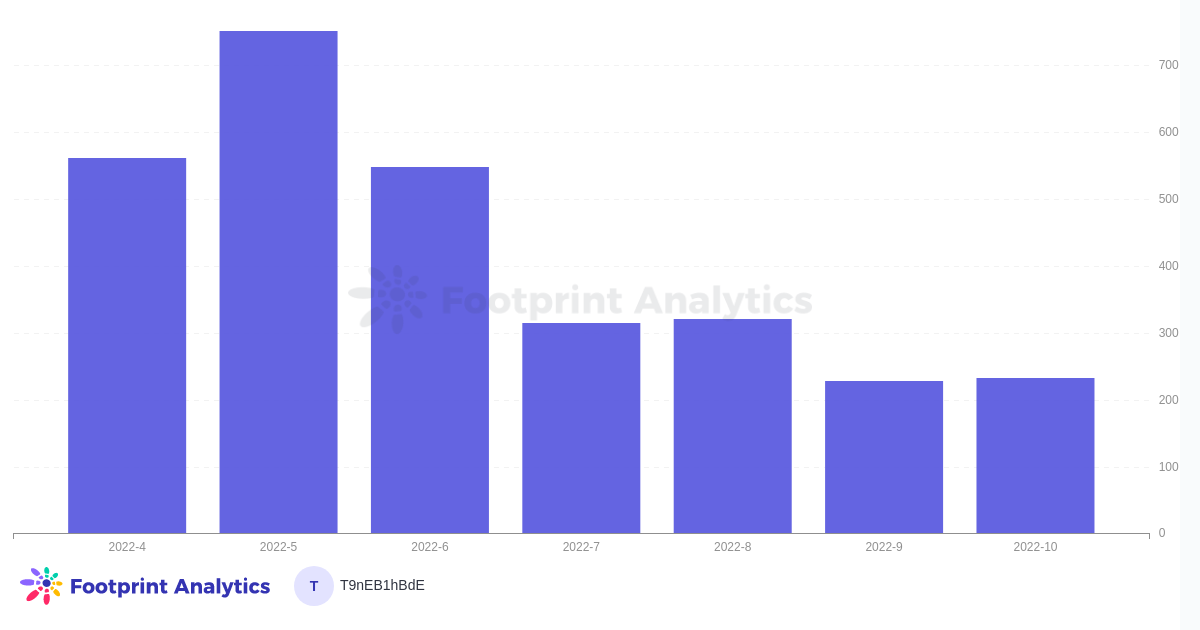

BAYC: NFT transactions

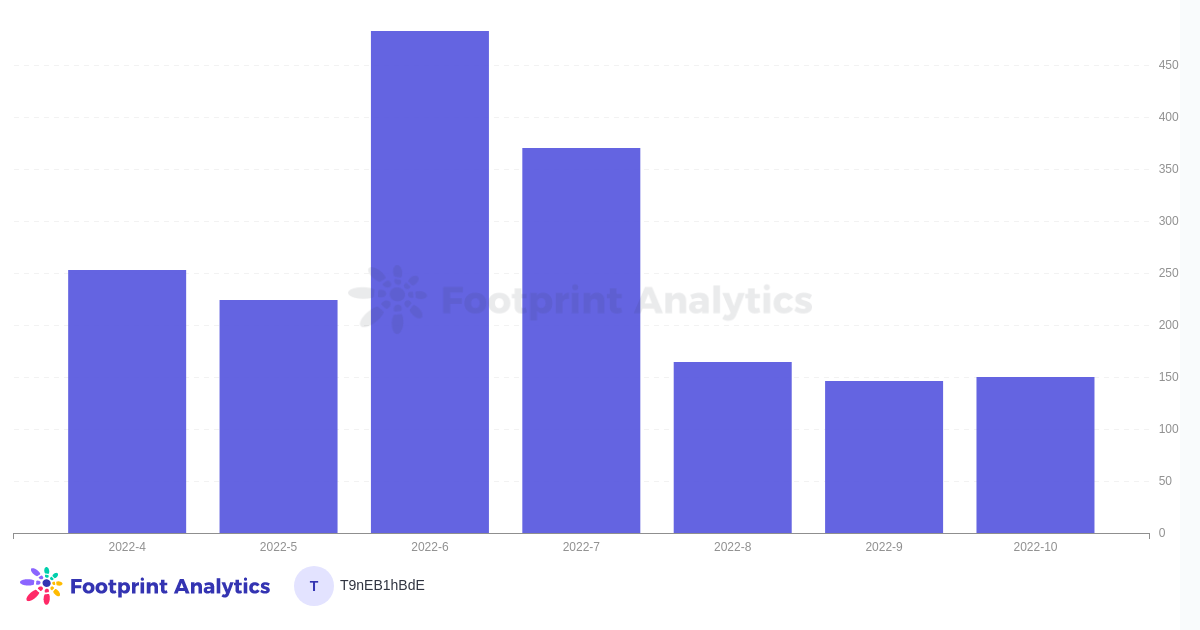

CryptoPunks: NFT Transactions

This piece is contributed by Footprint Analytics society.

Footprint Community is a place where data and crypto enthusiasts around the world help each other to understand and gain insights about Web3, the metaverse, DeFi, GameFi or any other area of the new world of blockchain. Here you will find active, diverse voices that support each other and drive society forward.

Footprint website:

Disagreement:

Disclaimer: Views and opinions expressed by the author should not be considered financial advice. We do not provide advice on financial products.