Pantera Capital Reveals $149,000 Bitcoin Price Target – Here’s the Timeline

Crypto fund Pantera Capital says the next halving event for Bitcoin (BTC) will trigger a bull rally beginning in early 2024.

Pantera Capital CEO Dan Morehead and other executives are telling investors that the price of Bitcoin is likely to bottom out throughout November and pick up speed ahead of the next halving.

A Bitcoin halving event is when miners’ block rewards are halved, and as a result the supply is reduced. In the past, Bitcoin’s price has risen before and after the halving events. The next one is expected in the spring.

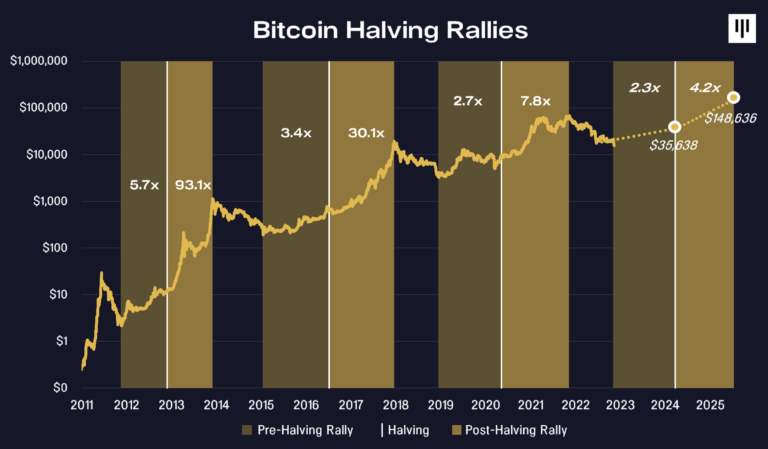

“Bitcoin has historically bottomed 477 days before the halving, climbed into it, and then exploded to the upside afterward. Post-halving rallies have averaged 480 days—from the halving to the top of the next bull cycle. If history were to repeat itself, the price would on Bitcoin going down on November 30, 2022. We will then see a rally into early 2024 and then a strong rally after the actual halving. The following chart shows what could happen if Bitcoin repeats its performance around previous halvings.”

Pantera predicts Bitcoin’s price will rise to $36,000 ahead of the next halving expected in March 2024, and then continue its bull run to an all-time high of $149,000.

“The 2020 halving reduced the supply of new Bitcoins by 43% compared to the previous halving. It had a 23% equal impact on price. The next halving is expected to occur on March 22, 2024. Since most Bitcoins are now in circulation, each halving will be almost exactly half the reduction in new supply. If history were to repeat itself, the next halving would see Bitcoin rise to $36,000 before the halving and $149,000 after.”

At the time of writing, Bitcoin is trading hands at $16,887.

Don’t Miss a Beat – Subscribe to get crypto email alerts delivered straight to your inbox

Check price action

Follow us on TwitterFacebook and Telegram

Surf The Daily Hodl Mix

Disclaimer: Opinions expressed at The Daily Hodl are not investment advice. Investors should do their due diligence before making high-risk investments in Bitcoin, cryptocurrency or digital assets. Please note that your transfers and trades are at your own risk and any losses you incur are your responsibility. The Daily Hodl does not recommend the purchase or sale of cryptocurrencies or digital assets, nor is The Daily Hodl an investment advisor. Please note that The Daily Hodl participates in affiliate marketing.

Featured image: Shutterstock/issaro prakalung