Will aggregator marketplaces become the best places to buy NFTs?

Although there are several NFT marketplaces to choose from when purchasing your digital assets, it is inefficient to constantly switch between them when trading. Another problem in the fragmented market is having to pay gas taxes more than once when buying from different marketplaces.

NFT aggregators allow people to buy multiple NFTs from different platforms in bulk, thus saving on gas fees and being efficient. Beyond that, aggregators are also experimenting with new models for NFT trading, namely AMM marketplace, pledging and NFT tokenization.

Will they become the best places to buy NFTs?

Early NFT Marketplaces

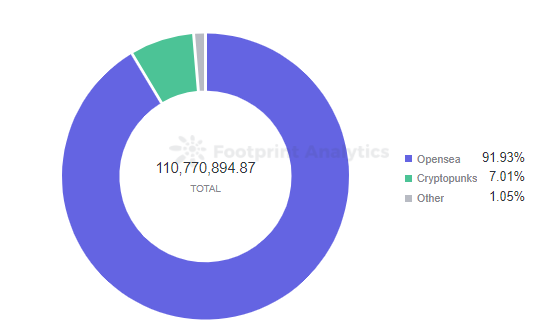

From 2016 to 2018, the first NFT trading marketplaces – OpenSea, MakersPlace and SuperRare – appeared. Since then, OpenSea has occupied more than 90% of the market share, despite its unstable trading system, hacking attacks and even scandals such as the theft of user NFT resources.

Footprint Analytics – Trading volume by marketplace – 2021

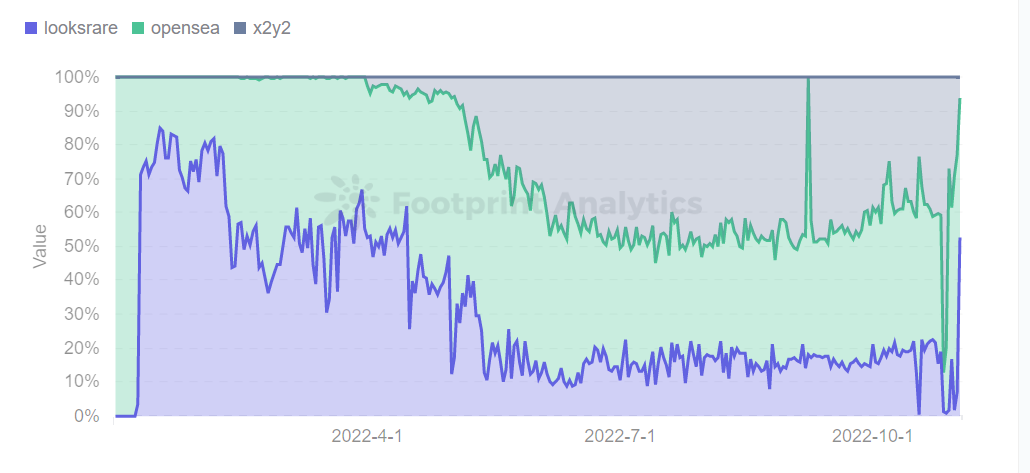

In early 2022, X2Y2 and LooksRare both began challenging OpenSea with decentralization, lower fees, and platform revenue sharing. This began to split the NFT market.

Footprint Analytics – Market share of OpenSea & LooksRare & X2Y2 Volume

However, these platforms were slow to solve batch buying issues and that is where the NFT aggregation platforms gained a foothold.

Footprint Analytics – NFT Aggregator list based on 90 days

What problems does aggregation solve?

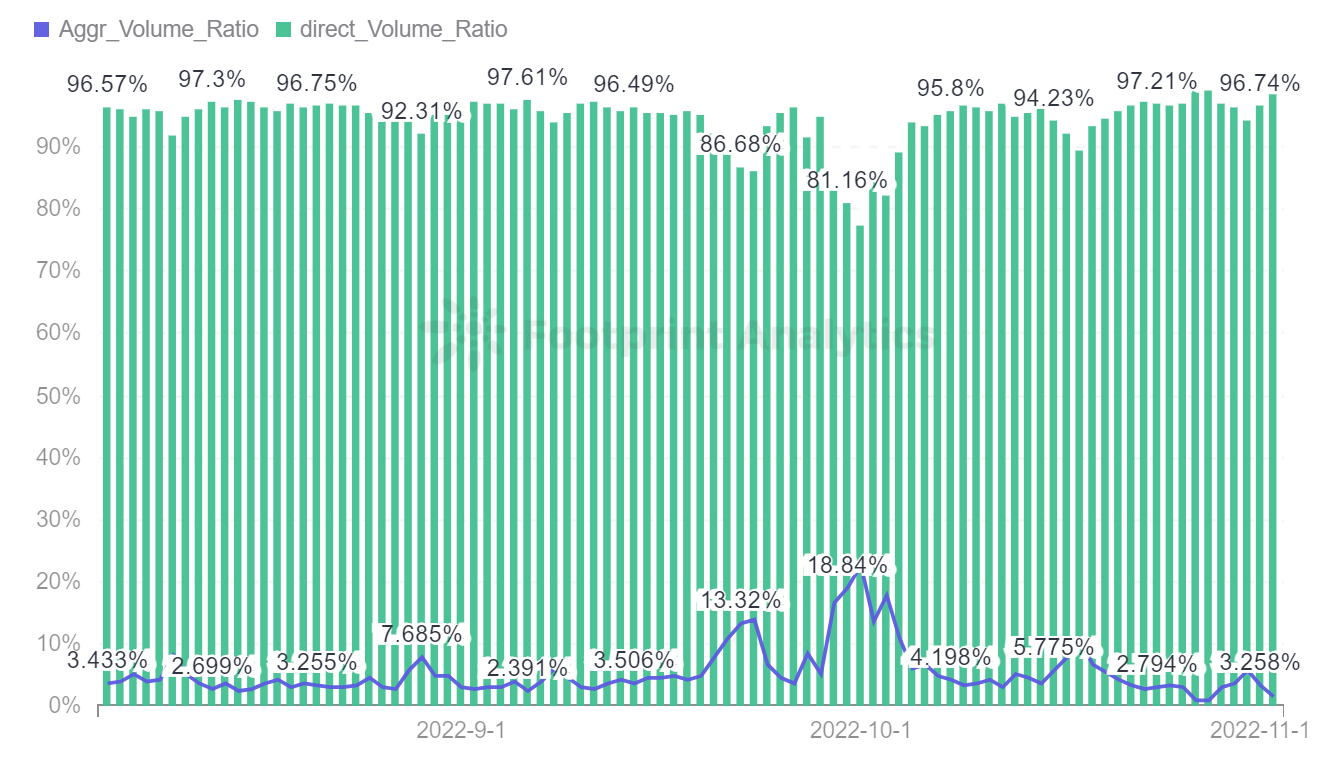

According to Footprint Analytics, the proportion of transactions on Ethereum-based aggregate trading platforms (13 platforms) gradually increased from August to October, reaching a maximum of more than 18%, and then resumed normal transactions. This indicates a trend where the NFT market is gradually moving into aggregated transactions.

Footprint Analytics – Aggregator daily relationship

However, many developers are beginning to seek valuable innovation, chasing benefits such as greater convenience and faster efficiency. There are clear boundaries between existing markets and the types of services users need that are created.

In turn, OpenSea has upgraded its product and acquired competitors.

- In April, OpenSea acquired the NFT aggregation protocol GEM.

- In May, OpenSea allowed users to trade NFTs using non-cryptocurrency means of payment.

- In October, it was announced that bulk order and purchase functionality was officially supported, and users can now list and purchase up to 30 items in a single transaction on the platform.

It is the promise of a comprehensive marketplace improvement through various features, low fees and time costs to search for NFTs. For example, Element aggregates setups from all the most popular blockchains (Ethereum, BNB Chain, Polygon, Avalanche, and Solana) to enable cross-chain transactions and expand its user base.

The emergence and development of various aggregate trading markets, for users to reduce the tedious operation of a transaction, so that users can batch list and purchase operations, reduce transaction costs and the time costs of searching in NFT.

Summary

OpenSea has had a near monopoly on NFT trading for several years. Although other marketplaces were launched with competitive features, it has been the platform for buying and selling NFTs. However, NFT aggregators have emerged with unique models and solutions to problems in the industry.

This piece is contributed by Footprint Analytics society.

Footprint Community is a place where data and crypto enthusiasts around the world help each other to understand and gain insights about Web3, the metaverse, DeFi, GameFi or any other area of the new world of blockchain. Here you will find active, diverse voices that support each other and drive society forward.

Footprint website:

Disagreement:

Disclaimer: Views and opinions expressed by the author should not be considered financial advice. We do not provide advice on financial products.