Breathe SOL, Magic Eden can bring something positive to the network

- Magic Eden continued to show dominance among NFT marketplaces

- Solana is showing positive signs as the price shows a 10% recovery

Solana [SOL] had been mired in a number of controversies in recent weeks, including FTXcollapses and token unlock news. All this news could thus have contributed to the decline of SUN token.

Still, new data from Messari suggested that the Solana Non-Fungible Token (NFT) space may have been able to weather the storm. This despite all the simmering worries.

Magic Eden leads the pack

According to a tweet by Messari on November 13, Magical Eden had been the dominant NFT marketplace in the Solana chain. This was because it controlled over 75% of the trading volume in the last month. A few other related marketplaces also experienced some growth in terms of volume.

.@MagicEden still dominates @Solana NFT trading volume, increasing near ~78% market share.@hadeswap has climbed to third place of the “best of the rest” Solana marketplaces, signaling that binding curve pricing marketplaces may be suitable for low-fee chains. pic.twitter.com/cPM12GrQC2

— Messari (@MessariCrypto) 13 November 2022

DappRadar data knew that Magic Eden’s market dominance went far beyond the Solana ecosystem. The Solana NFT marketplace was second in the ranking of markets in terms of transaction volume in the seven-day interval, only behind Open sea.

Analyzes the same data over a 30-day period knew that Magic Eden was still behind Opensea in total trading volume. Although OpenSea still has a larger daily trading volume of millions of dollars, this statistic can be considered as a testimony to the continued rise of Magic Eden.

Although Solana as a whole seems to be receiving unfavorable press at the moment, Magic Eden’s success could provide the network with some much-needed relief. A plausible explanation for the Solana NFT marketplace’s predominance could be that the platform opted for optional royalties.

This action was taken in response to the royalty dispute sweeping the NFT industry, where certain platforms enforced royalties and others left this decision up to the user. Magical Eden was among the last.

Also, the platform was built on Solana, which meant that the fees for minting NFTs were going to be lower than they were on OpenSea, which is based on Ethereum. In addition, the speed of the network makes the platform a favorite among NFT developers and traders. But how does this reflect the overall Solana NFT calculations?

Is the magic spreading to Solana?

Considering the total NFT trading volume of Solana on Santiment, the network witnessed a respectable volume. A closer check of the data showed that the volume had decreased. However, the multi-million dollar sales of the past few days still gave the ecosystem some status. There was a noticeable increase on the September 28 graph of $5.6 million.

More FTX drama, but SOL moves on

It appeared that the FTX scandal was still weighing on Solana even as the company attempted to recover. Recently released information indicated that the FTX breach had also affected Serum, a liquidity hub in Solana. According to a statement created by Magic Eden, the company temporarily suspended SFT listings and trading on the platform for security reasons.

🧵/ Due to reports of FTX’s compromised security, we did an audit to see how we could protect our users

– Your NFTs are safe and secure

– @ProjectSerum, a program we use for SFT trading, may have been affected. To be safe, we have temporarily disabled SFT listings and sales on @MagicEden— Magic Eden 🪄 (@MagicEden) 13 November 2022

So does Solana’s co-founder Anatoly Yakovenko updated community, saying that the developers who relied on serum faked the application.

Exactly, the developers who depend on serum discard the program because the upgrade key of the current one is compromised. This has nothing to do with SRM or Jump. Lots of protocols depend on serum markets for liquidity and settlement.

— toly 🇺🇸 (@aeyakovenko) 12 November 2022

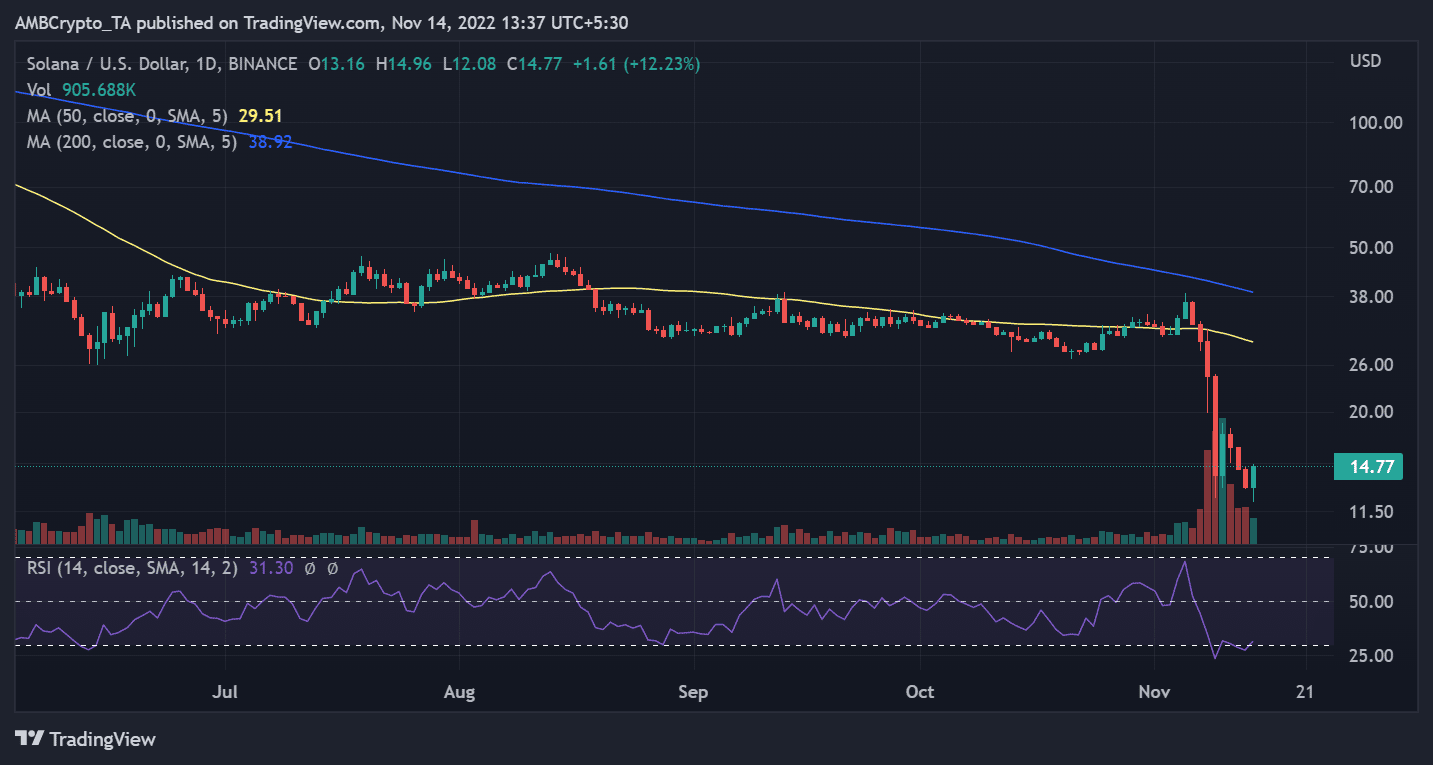

According to TradingView, SOL was trading just above $14 at the time of writing on a daily time frame. In particular, the price of SOL had increased by over 10% during the last 24-hour period.

Source: TradingView