Bitcoin Price and Ethereum Prediction, Solana Pumps 4%, Can We Expect More?

Bitcoin is down nearly 20% in seven days to trade at $16,789 as a result of the FTX bankruptcy, which has caused market chaos and risk-on sentiment. Ethereum, the second most valuable cryptocurrency, on the other hand, has plunged over 20% in the past seven days to trade at $1,252.20.

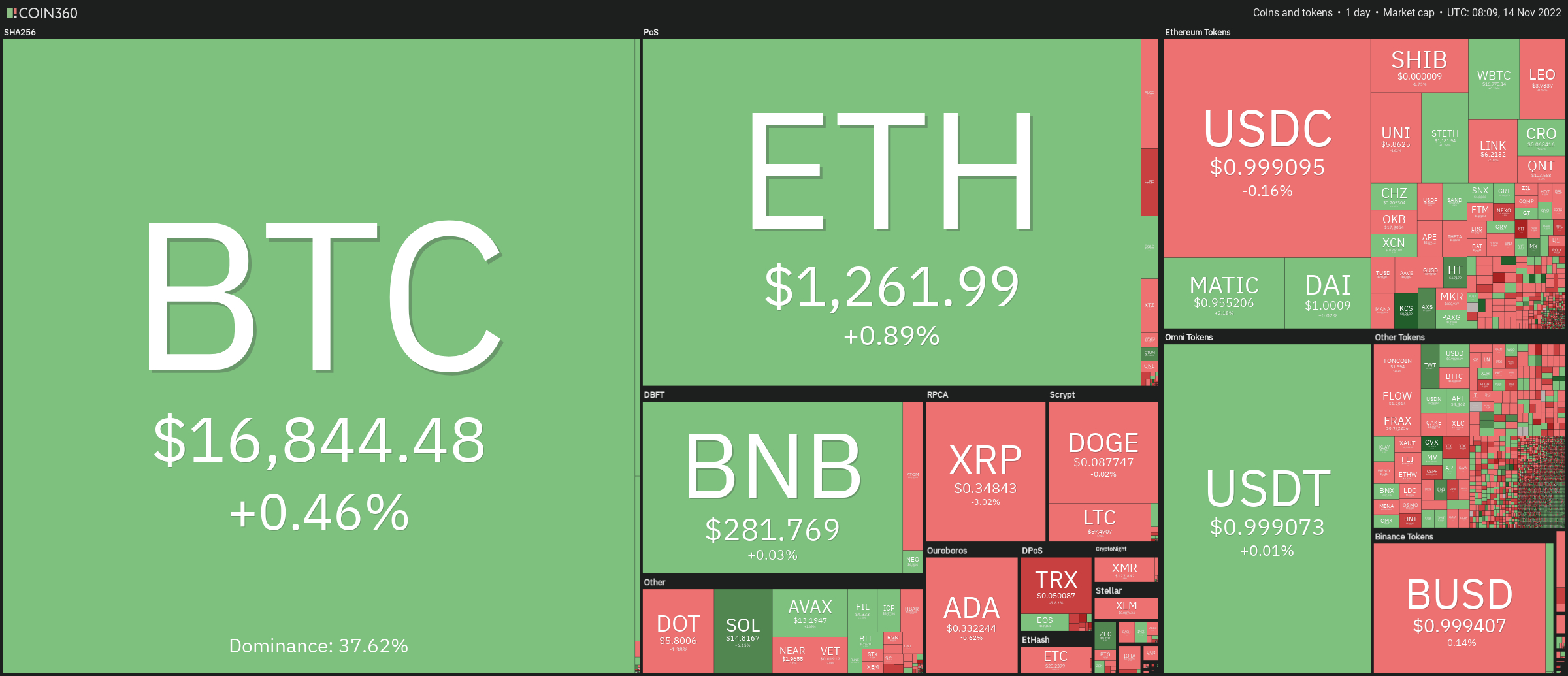

Global crypto market capitalization fell over 4% to $810.59 billion the previous day, sending major cryptocurrencies into the red early on November 14. In contrast, the total crypto market volume increased by over 12% in the last 24 hours to $60.78 billion.

Total volume in DeFi was $4.23 billion, accounting for nearly 7% of the entire 24-hour volume in the crypto market. The entire volume of stablecoins was $56.48 billion, accounting for 92% of the total 24-hour volume of the crypto market.

Let’s take a look at the top altcoin winners and losers of the past 24 hours.

Top Altcoin Winners and Losers

Trust Wallet Token (TWT), ZCash (ZEC) and GMX are three of the top 100 coins that have gained value in the last 24 hours (GMX).

TWT rose more than 19% to $2, ZEC grew more than 6% to $41.60, and GMX gained almost 3%.

FTX Token (FTT) has lost more than 18% of its value in the last 24 hours and over 90% in seven days to trade at $2.26. VIDT DAO (VIDT) has lost 90% in the last 24 hours

Exchange yields hit historic highs

Since the failure of the second largest cryptocurrency exchange last week, Bitcoin holders have increasingly turned to self-custody options. Research firm Glassnode reports a dramatic increase in transactions from exchanges to personal cold storage wallets.

Glass node tweeted on November 13 that monthly Bitcoin withdrawals from exchanges have reached near-historic levels of 106,000 BTC. Only three other times before this (April 2022, November 2020 and June/July 2022) were mentioned.

It also revealed that on November 9, there was a sharp increase to approximately 90,000 Bitcoin wallets receiving the asset from exchange addresses. An increase in BTC withdrawals from an exchange is an optimistic indicator of long-term BTC holdings.

In this case, however, it appears to have been caused by a loss of faith in centralized cryptocurrency exchanges.

According to Glassnode, “positive balance adjustments across all wallet cohorts, from shrimp to whales,” have occurred as a result of withdrawals.

Glassnode has noted an increase in the speed at which stablecoins (many of which destabilized last week) have flooded onto exchanges.

With over $1 billion in stablecoins, it was deposited into regulated markets on November 10. It also said the combined stablecoin reserves of all the exchanges it tracks hit a new record high of $41.2 billion.

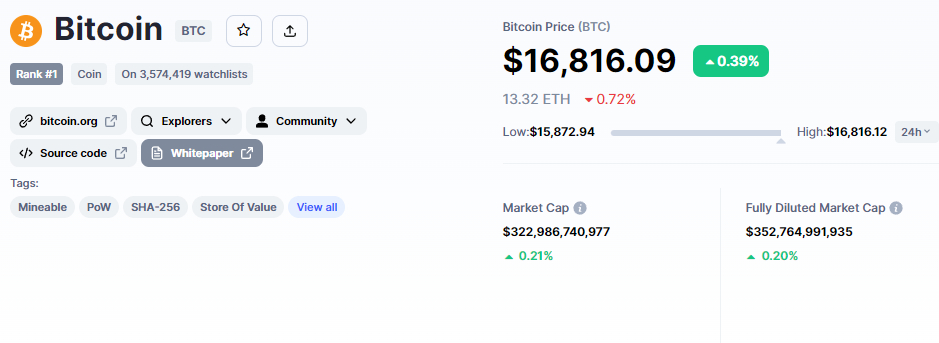

Bitcoin price

The current Bitcoin price is $16,798, and the 24-hour trading volume is $37 billion. Bitcoin has increased by 0.20% in the last 24 hours. CoinMarketCap currently ranks first, with a live market cap of $322 billion. It has a maximum supply of 21,000,000 BTC coins and a circulating supply of 19,206,950 BTC coins.

Bitcoin is consolidating in a broad trading range between $18,000 and $16,000, and a breakout will determine future price action. Bitcoin has completed a 38.2% Fibonacci retracement at the $18,100 level in the 4-hour time frame and it is now stable.

A positive crossover above $18,100. This level has the potential to expose Bitcoin price to a 61.8% Fibonacci level at $19,350. If Bitcoin fails to break through the 38.2% Fibonacci retracement level at $18,250, it could fall below $15,965.

MACD, a leading technical indicator, has entered the buy zone, but the 50-day moving average and RSI remain in the sell zone. BTC may continue to fall if the closing candles fall below $18,000, with support at $16,000 and 15,850.

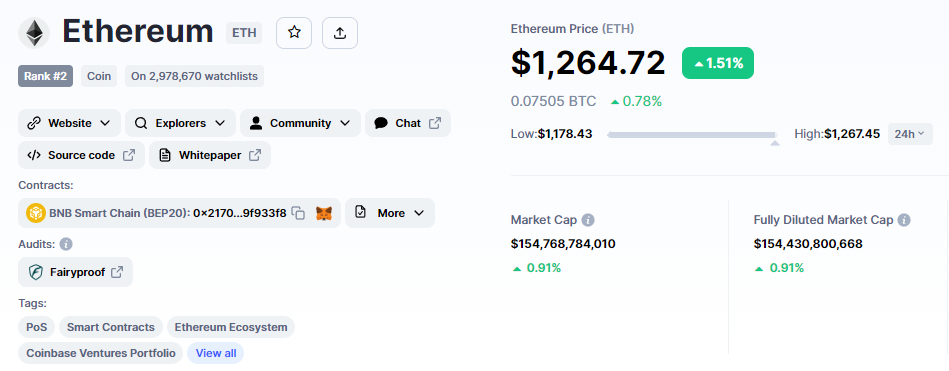

Ethereum price

The current price of Ethereum is $1,261, with a 24-hour trading volume of $13 billion. Over the past 24 hours, Ethereum has risen less than 1%. With a market capitalization of $154 billion, CoinMarketCap is currently number two. It has a circulating supply of 122,373,866 ETH coins and no maximum supply.

On Friday, the second most valuable cryptocurrency, Ethereum, gained 1% in the previous 24 hours to $1,262. On CoinMarketCap, it is now ranked number two, with a live market capitalization of $154 billion.

On the daily chart, Ethereum has regained the $1,262 level due to a bullish retracement. Ethereum’s immediate resistance level is $1,370, which is supported by a 50-day moving average. A bullish crossover above $1,370 could accelerate the recovery to $1,506 or $1,670.

Support remains near $1170 or $1095. A break below this level could expose ETH to $1,000, or $881, but this seems unlikely for now.

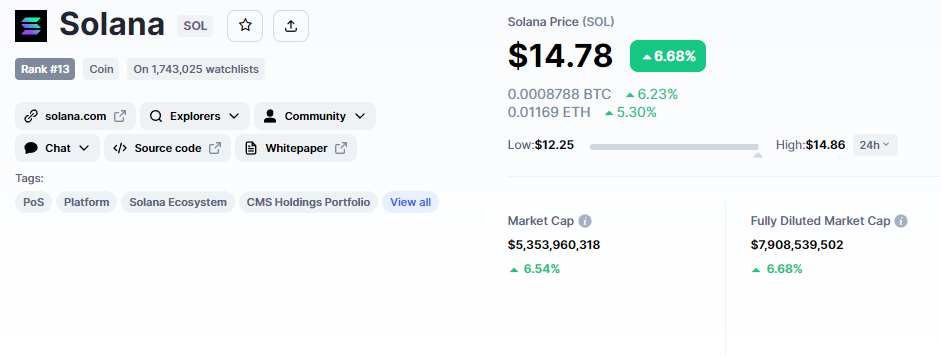

Solana Pumps 4%, can we expect more?

Solana’s current price is $14.58, with a 24-hour trading volume of $1.1 billion. Solana has increased by over 5.32% in the last 24 hours. With a market cap of $5.2 billion, CoinMarketCap is currently ranked 13th. The circulating supply is 362,273,045 SOL coins.

Solana has already completed a 38.2% Fibonacci retracement to $21.85, and closing candles below this level indicates that the bearish trend is likely to continue. The SOL/USD pair continues to trade below the 50-day moving average, raising resistance near $26.

Formation of a bearish engulfing candle below the $21.85 barrier line, indicating that the decline is likely to continue. If sellers push SOL below the immediate support at $11.50, it could collapse to $5.5. Let’s consider staying bearish below $20 today.

New crypto pre-sale with great potential

Dash 2 Trade (D2T)

Dash 2 Trade is an Ethereum-based trading intelligence platform that provides real-time analytics and social data to traders of all skill levels, enabling them to make more informed decisions.

It launched its token sale three weeks ago and has since raised more than $6.1 million, as well as confirmed its first CEX listing on LBank exchange.

The current value of 1 D2T is 0.0513 USDT, but this is expected to rise to $0.0533 in the next sale stage and $0.0662 in the final stage.

Visit Dash 2 Trade now

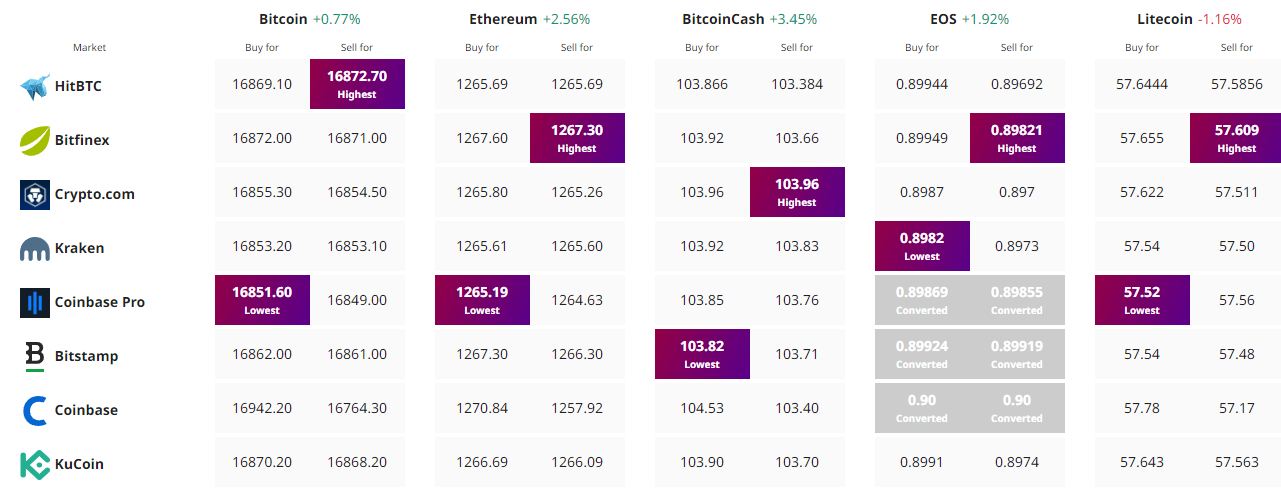

Find the best price to buy/sell cryptocurrency