BITO and Bitcoin: History does not repeat itself, but it rhymes

Vertigo3d

Summary of the assignment

The thesis for this is simple – almost everything points to this being a major capitulation event, the first we’ve really seen since 2018 when Bitcoin (BTC-USD) fell over 30% in just two weeks.

One could argue that there was another such event in 2020, during the liquidity crisis, but this was a broad market event that affected more than just cryptocurrencies, and therefore I would argue that it was not quite the same type of capitulation.

During these capitulation events, all the same headlines and perma-bears come out of the woodwork – cursing Bitcoin going down to <$3000 or even going to $1 or $0 as it is fundamentally worthless in their minds. The same question about the legitimacy and security of cryptocurrencies and Bitcoin is raised – despite the fact that the security of the chain is not affected at all, and the reality that this is just price action, not a security threat or vulnerability.

With Bitcoin trading at a 2-year low, back to the price it was right when the inflation narrative took off in 2020, the pot odds down here are fantastic – almost nothing needs to go right for cryptocurrency to rebound.

It is my belief that the best way to play this is to go long via the ProShares Bitcoin Strategy ETF (NYSEARCA:BITO) due to the lack of currency risk combined with the availability of options, since it is not spot bitcoin, but rather a futures derivative that has no custody risk.

Similarities are everywhere

For people who have not been through these events before, they can be unnerving, especially if you are heavily invested in cryptocurrencies as everything is called into question during these events. The fabric of the space itself often appears to be crumbling, with exchanges collapsing or at risk of collapsing, user funds potentially being unsafe or stolen, government regulations or bans being rumoured, etc.

Going back in time to the November 2018 crash, which was the final capitulation of the 2017-2020 bear market where the real bottom in sentiment, interest and weekly price was reached, there are many similarities to today.

It’s almost uncanny how many similarities there are, with both of these events taking place around the same time as the US mid-term elections – both in November.

Coinmarketcap BTC Chart (2018)

Another similarity is the volatility; both periods had the previous months filled with apparent disinterest, nothing happening and extremely low volatility compared to the past.

Coinmarketcap BTC Chart (2022)

But the similarities hardly stop there, with Google’s trend charts showing an almost identical picture over the time period as well, with a slow decline in search interest in the preceding months before the price collapse.

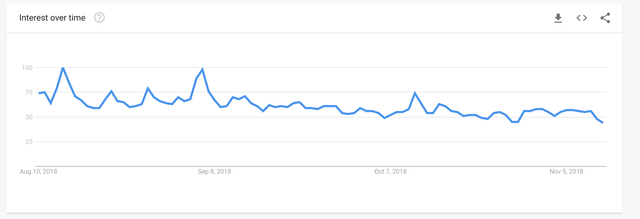

Google Search Trends Data (2018)

Google searches related to “Bitcoin” globally fell from around 75~ in mid-August 2018 to around 45~ just as the bottom fell out of the market and the crash began. This represented around a 40% drop in relative searches globally in the 90 days before the crash.

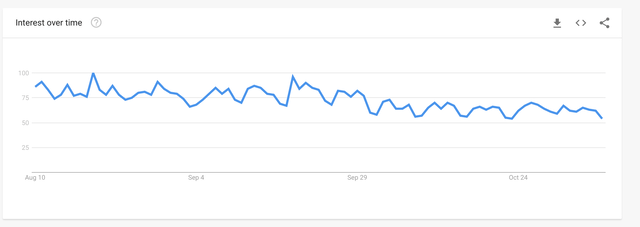

Google Search Trends Data (2022)

Similarly, in 2022 Google’s trending data for the keyword “Bitcoin” globally dropped from around 85 down to 55, representing a 38% decline in relative search interest globally in the last 90 days prior to this decline.

I can go on with chart after chart, similarity after similarity, but the reality is that the situation in 2018 was very different from today – there were no liquidity crises among the largest crypto exchanges. There was also no real risk of a cascade collapse of other platforms/exchanges.

History does not repeat itself, but it rhymes

The situation today is different than in 2018, the macro environment has evolved, the risks plaguing the markets have changed, and a lot has changed – yet there are many similarities between this capitulation event and the 2018 capitulation event.

I would suggest that this capitulation event is NOT caused by SBF and the potential collapse of FTX (FTT-USD), but this is just why we have collectively decided to panic.

No one has been interested in crypto for months, interest has continued to drop to almost nothing – down almost 40% in the last 3 months alone. Volatility has eased as no one dares to bet on the upside, nor has the downside as Bitcoin sat in a zone most thought was reasonable but uncertain – with no catalyst to move it up or down.

People mostly didn’t jump in and walk for a long time since inflation didn’t seem to expand, hawkish monetary policy and a potential economic crisis on the horizon, there was a lot of uncertainty, but with Bitcoin down so much, why would you sell after eating the majority of the loss?

That’s what people thought – until they woke up to see Bitcoin and Ethereum (ETH-USD) which have been mostly stable for many months now, in an “accumulation zone” falling 25% -> 30% in a matter of days with absolutely no certainty that a bottom will be set – all facades of stability are gone.

New York Times (

They woke up to this reality after checking their portfolio, or seeing headlines like the one above, with a taste of blood in their mouths, feeling sick that they just lost another 1/4 of their investment.

What if Bitcoin goes to $3000? What if this stupid internet money has no value? What if the US bans and regulates everything into oblivion over this? What if FTX has strengthened the price of Bitcoin? Oh god what about Tether (USDT-USD), is this the time they get regulated and proven to be a Ponzi?

Cold chills rush over them, they log on, and they spew it—selling at any price they can as the fear sets in that they might lose it all—while doubt creeps in that the bears are right.

This changed everyone’s mindset from “a bottom is in, we’re rallying into the next rally” to “why do I own this junk?” when they awoke from their complacency. SBF and FTX could be bailed out and this awakening will not go away, it was simply the excuse, the event, that caused everyone to panic.

Neck-deep in terror

Currently, Bitcoin is about $1000 off its overnight low, up to about $16,500~ and I can’t find a single soul willing to buy. Not one.

With that strong buy rating, you might think I’m going to say it’s only up and away from here – and everyone is wrongly scared. Unfortunately, I can’t say that – everything just gets worse and worse.

Binance Official Twitter

Previously it all looked like it was going to be swept under the rug and Binance (BNB-USD) was going to absorb FTX and solve this – but when they withdraw from any business or association with FTX, that possibility is gone.

There is no rescue. There is no rescue operation. There is no help.

Currently, there is no real material data on how problematic this situation is, how much customer funds are missing, missing or lost, or the current balance of FTX.

The deafening silence returns

To make matters worse, until this morning FTX and SBF had gone radio silent since November 8th, something that has only been done by companies that are on their own, headed straight for Chapter 11 bankruptcy and investigation.

The eerie similarity to Celsius Network (CEL-USD) and other crypto lending platforms, which also chose this route, is striking to me – and screams that the likely outcome of this situation will not only not be soft, but will be far far worse than people expects.

There is no rescue. There is no rescue operation. There is no help.

Remove

God help us all – the bottom has fallen out and I can’t see the ground under my feet – all I hear is screaming.

This is exactly how it sounded and felt in the November 2018 crash and the 2020 COVID-19 crash, so I’m staying long, reluctantly adding to these levels with a sick feeling in my chest as I’m forced to fund and exchange money from other investments to support my cryptocurrency portfolio.

The bottom should be in, or close to it – and in time, we bulls will probably be called lucky bottom fishermen when the crypto market returns to normal or starts to rally from these lows in the near future.

Actionable takeaways

I like to give actionable takeaways, trading ideas for people in my articles, but I can’t really give one in this case – every trade will be based on speculation and opinion and with extreme risk.

With one exception.

If you want to go long in the asset class (or I guess short), you should consider buying medium-long dated spreads, an example is buying 20 January 2023 7 puts and selling the 12 puts with the same expiry date – which gives a breakeven at mid-price (market) with a limited upside of $253 and a limited downside of $247.

This will limit the downside risk in either direction depending on whether you did the above (going long BITO/Bitcoin) or the opposite of that (going short BITO/Bitcoin) and provide a way for an investor to gain exposure without taking on the extreme risk actually holds the asset at the moment.

Risks to consider

If you haven’t gotten the hint, bulls like me are on the verge of being flayed alive from the market. In a few days, if the true impact of this ordeal turns out to be catastrophic, we can all join in the screaming with everyone else – falling rapidly into the abyss without seeing the bottom.

Those who do not have a risk tolerance capable of withstanding a complete loss of capital should probably avoid all cryptocurrency products until this whole situation has played out.