Reflecting on the Satoshi White Paper – Bitcoin Magazine

This is an opinion editorial by Archie Chaudhury, a blockchain enthusiast and former top prize winner at the 2021 MIT Bitcoin Expo.

When Satoshi Nakamoto first published the Bitcoin white paper in October 2008, the world fell upon a financial crisis caused by the irresponsibility and negligence of the institutions that controlled our financial system. Hedge funds, central banks and other powerful agents had been all too happy to place over-leveraged bets on the economy, profiting from the financial losses the working class suffered when those bets collapsed.

Governments, in a desperate attempt to keep these institutions alive, spent hundreds of billions of dollars on bailouts and other cash injections instead of ensuring the well-being of the average citizen. Bitcoin was Satoshi Nakamoto’s answer to government-backed money; it was a vision for a decentralized digital currency that could provide the efficiency of online banking, the relative pseudonymity of physical cash, and the scarcity of gold.

Unlike previous attempts to create digital money, Bitcoin was not backed or controlled by a single entity or party, but rather by an anonymous developer(s?), a set of faceless forum visitors, and a small online community that believed in using cryptographic software for privacy and independence from authoritarian powers. Nakamoto’s ultimate goal was to create an asset that was autonomous, decentralized and not susceptible to the greed or will of any individual. October 31st, the day Satoshi Nakamoto formally announced his white paper to Cypherpunk’s Mailing List, has become known as “Bitcoin White Paper Day” and is celebrated as an informal declaration of independence from corrupt state-backed money, heard around the world. The purpose of this article is to reflect on how far we have come since then, and how much work remains to achieve Nakamoto’s goals.

The Bitcoin we use today is very different from the Bitcoin that Satoshi Nakamoto and his fellow contributors created in the late 2000s and early 2010s. Beyond the many technical upgrades and hard forks, the network itself has grown significantly, with more and more people taking the proverbial “orange pill” and deciding to use bitcoin in some capacity.

There is another way that Bitcoin has changed: the core network and asset (BTC) is thought of more as a store of value than a platform for micropayments. It was actually a significant cultural schism in the Bitcoin community that led to this change: the famous, and aptly titled, “Blocksize Wars” about five years ago led to this change, with forks like Bitcoin Cash and later Bitcoin SV becoming created by community members who believed in scalability above all else, and that the core of the Bitcoin chain was maintained by members who sought to preserve decentralization and to look at alternative methods such as Layer 2 payment channels to support scalability. The Lightning Network, which is the most popular payment channel, has slowly gained popularity, recently reaching a capacity of 5,000 bitcoin.

Despite these changes, the core technological principles that Nakamoto supported in 2008 (the Nakamoto Consensus with proof-of-work mining and a static maximum supply of 21 million) remain constant. This is not solely due to a technological or economic reason; in fact, it has been argued that changing Bitcoin’s underlying consensus mechanism or supply cap could lead to increased performance and adoption, respectively. Rather, Bitcoin’s consistency in these areas can be attributed to the philosophy of its underlying community, which strongly believes in scarcity, security, and decentralization above all else.

Meanwhile, bitcoin is being used by people all over the world to stave off unruly financial conditions. Bitcoin’s natural scarcity makes it attractive to citizens where corruption has led to unlimited inflation. This adoption has even led some governments, such as El Salvador, to declare bitcoin a national currency, a move that would have been unfathomable to Nakamoto and Bitcoin’s original contributors.

Perhaps the most interesting takeaway from Bitcoin’s rise over the past couple of years is that it has happened without a central leader: unlike alternative assets more akin to decentralized software platforms, bitcoin functions purely as money, with key “political” decisions made by a community. There is no Bitcoin organization or representative solely responsible for promoting adoption, nor is there any central “Chief Scientist” who has a significant impact on key decisions at the protocol level. While there are certainly major societal impacts, the protocol as a whole does not have an organizational structure to guide either adoption or development. In fact, Bitcoin’s lack of hierarchy should be a measure for other distributed ledger projects that, while perhaps decentralized to some degree, are still largely influenced by a single entity or individual.

While Bitcoin has certainly grown from its humble beginnings as a white paper and a few hundred lines of scrap code, it still has a long way to go if it is to reach the ambitious goals discussed by Nakamoto and other early adopters in their email chains and forum posts. From a technical standpoint, the Bitcoin community must continue to build technology that not only enables further scalability and security, but perhaps more importantly, also helps make the network more decentralized. One of the most faithful mottos that Bitcoin community members have adopted is the term “Don’t trust, verify.” This is of course in reference to running a full Bitcoin node and not relying on data from external third parties, such as node providers. Network optimization, rollups, and other scalability research have been proposed by various individuals in the Bitcoin community as a way for the network to simultaneously scale while reducing the cost of running a full node. A recent report, published by John Light through research funded by the Human Rights Foundation, Starkware and CMS Holdings, provides more details on rollup-related scalability research.

Despite its roots in technology, Bitcoin has evolved over the years to become something more: it is now a community, a network, if you will, of like-minded individuals who all have varying degrees of belief in a single idea . Bitcoin is no longer software, only allowed to developers, coders or those with a highly technical background, and this marked shift should also signal additional non-technical priorities for the Bitcoin community to address over the next decade.

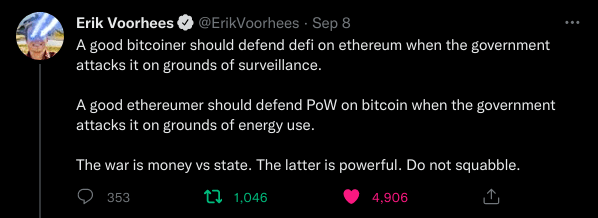

More effort needs to be put into educating the general public and making them aware of not only Bitcoin’s technology, but also the flaws of the legacy financial systems they use today. More effort needs to be put into not only presenting bitcoin’s economics and technology, but also drawing out the differences between bitcoin and other cryptocurrency platforms. Finally, more effort needs to be made among the cryptocurrency community as a whole to come together when the fundamental principles that Satoshi Nakamoto and his fellow cypherpunks believed in are threatened by authoritarian governments, regardless of the platform being attacked.

While discussions surrounding different blockchain networks have always been tribalistic to some degree, the recent trend has been to promote the success of your platform above all else, even insulting or insulting platforms facing potential regulatory scrutiny. While believing that bitcoin is the soundest digital asset in terms of economics/construction, and arguing about that belief is fine and even encouraged, celebrating when an alternative platform is threatened with regulatory action or censorship is , against what Bitcoin is basically all about.

The cypherpunks, Satoshi Nakamoto, and a majority of Bitcoin’s community all believe in the idea that there could one day be a peer-to-peer digital currency completely independent of any government, intermediary, or biased party. While we certainly have different disagreements about the pros and cons of our respective technologies, belong to different “maximalist” groups, and generally have varying beliefs, we all ultimately belong to a space that was motivated by the idea of a censorship-resistant and non-partisan digital asset/network. We would do well to remember that fundamental principle as we continue to work with Bitcoin over the next 14 years.

Tweet from Erik Vorhees about sanctioning Tornado Cash and potential BTC regulation by ESG supporters.

This is a guest post by Archie Chaudhury. Opinions expressed are entirely their own and do not necessarily reflect those of BTC Inc. or Bitcoin Magazine.