Bitcoin Rebound in Doubt Amid Crypto Market Trouble as APAC Markets Eye Risk-On Session

Bitcoin, BTC/USD, China, India, Market Sentiment, Technical Outlook – Talking Points

- Asia-Pacific markets look poised for a rally on Friday after market sentiment rose overnight

- India to release industrial and manufacturing production data as APAC traders digest US CPI

- BTC/USD is facing a recently broken support zone after recovering from multi-year lows

Friday’s Asia-Pacific Outlook

Asia-Pacific markets are eyeing a risk-on session after the US dollar fell along with government yields after US inflation eased in October, according to the consumer price index (CPI). Traders trimmed Fed rates on rate hikes, pulling the implied key rate for 2023 below the 5% mark. The easing in Fed funds futures led to the US Dollar DXY index posting its biggest daily decline since 2009.

Bitcoin prices climbed over 10%, but that wasn’t enough to pare the weekly loss of around 16%. FTX faces a liquidity gap of nearly $8 billion. The founder of the crypto exchange is striving to raise funds, but investor confidence in the crypto space has been seriously damaged. The fallout is likely to weigh on crypto sentiment for months or even years. The US SEC has opened an investigation, and more regulatory scrutiny is likely to follow.

Trade smarter – Sign up for the DailyFX newsletter

Receive timely and compelling market commentary from the DailyFX team

subscribe to newsletter

China continues to struggle with rising Covid cases. Several major cities, including Guangzhou, remain under varying degrees of restrictions, which are likely to affect economic output, although it is uncertain to what extent. If the yuan manages to extend its current run of strength against the US dollar, Chinese policymakers will have more room to ease policy and boost credit growth without worrying about triggering capital outflows. China’s lending in October fell to 615 billion Yuan, according to yesterday’s data. That was down sharply from 2.4 trillion yuan in September.

New Zealand’s BusinessNZ manufacturing PMI fell to 49.3 in October from 52 the previous month. Japan will release factory gate prices for October, which are expected to ease from a year ago. Later today, India’s industrial and manufacturing production figures for September will be released. Outside of grain, most commodities rallied. WTI crude oil prices were up around 0.5%, gold and silver were up nearly 3%, and platinum was up nearly 5%.

Bitcoin Technical Outlook

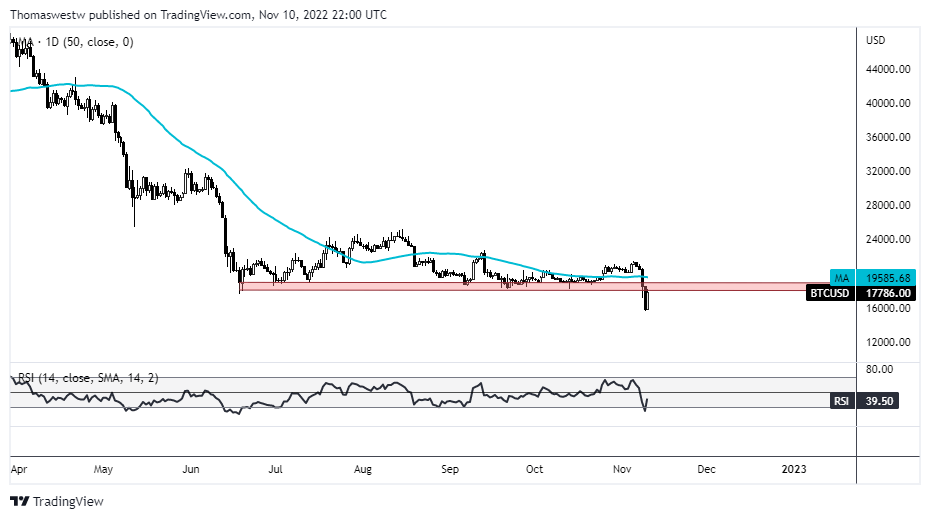

A sharp reversal sent BTC up 12%, but prices remain below the 50-day Simple Moving Average (SMA) and a zone of recently broken support underpinning a period of consolidation stretching back to June. If prices close a weekly candlestick below the previous support zone, more downside could occur.

BTC/USD Daily Chart

Chart created with TradingView

Discover what kind of currency trader you are

— Posted by Thomas Westwater, Analyst for DailyFX.com

To contact Thomas, use the comment box below or @FxWestwater on Twitter