Price Analysis of Bitcoin, Ethereum and Solana – The Cryptonomist

Bitcoin Analysis

Bitcoin’s price made its lowest daily candle close since December 31, 2020 on Wednesday, and as traders settled for the daily session, BTC’s price was -$2,636.1. At the close of trading on Wednesday, BTC’s price was -$4,696.6 over the previous 48 hours of trading.

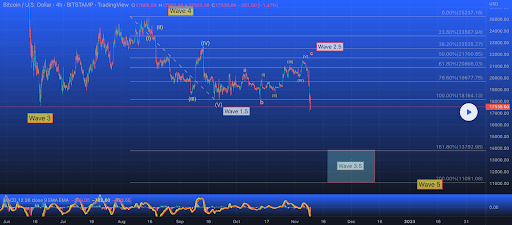

We start our price analyzes for this Thursday with BTC/USD 4HR Chart below of Shop_your_way. BTC’s price trades between 161.80% fibonacci level [$13,792.98] and 100.00% fib level [$18,164.13]at the time of writing.

Bullish market participants has lost a number of key levels over the past 3 days, but none as critical as BTC’s 2017 all-time high at $19,891. Targets overhead for bulls on the way to reclaim this level are 100.00% fib level and 78.60% fib level [$19,677.76]. Above this level, the targets for traders expecting a reversal are 61.80% [$20,866.03]50.00% [$21,700.65]and 38.20% [$21,700.65].

Bearish traders which has clearly been controlling BTC’s price action this week wants to go down and test the 161.80% fib level. If they succeed there, their secondary target becomes the focus of bears at the 200.00% fibonacci level [$11,091.08].

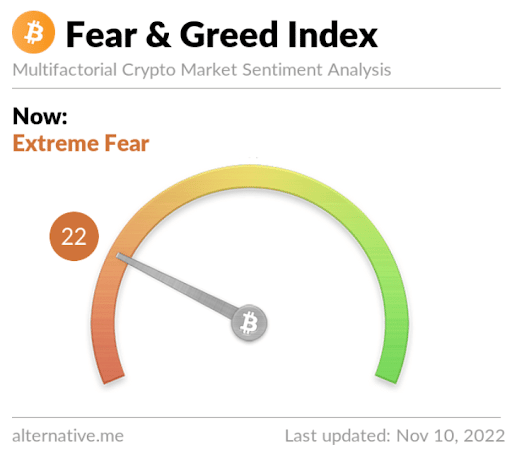

The fear and greed index is 22 Extreme fear and is -7 from Wednesday’s reading of 29 Fear.

Bitcoin’s Moving Average: 5-day [$19,694.87]20 days [$19,789.38]50 days [$19,719.86]100 days [$20,779.95]200 days [$28,818.01]Year to date [$30,048.21].

BTC’s 24-hour price range is $15,588-$18,645.9 and its 7-day price range is $15,588-$21,417.69. Bitcoin’s 52-week price range is $17,611-$69,044.

The price of Bitcoin on this date last year was $64,920.

The average price of BTC for the last 30 days is $19,748.7 and its -11.4% over the same interval.

Bitcoin’s price [-14.23%] closed its daily candle on Wednesday with double-digit percentage losses for a second straight session. The world’s leading digital asset ended the day worth $15,892.2 and in the red for the fourth day in a row.

Ethereum analysis

Ether price ended more than 17% lower than where it began Wednesday’s trading session, and at the time of writing, ETH’s price was -$234.55.

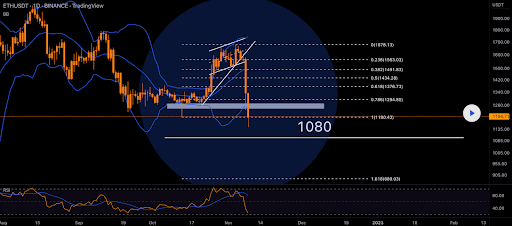

The ETH/USD 1D Chart below of MonoCoinSignal is the second chart we look at this Thursday. ETH’s price is trading between the 1.618 fib level [$889.03] and 1 fib level [$1,190.43]at the time of writing.

Ether’s price is also trading below the 2018 cycle peak [at the time of writing] and has lost integrated bending levels for bullish market participants. To recapture ETH’s 2018 ATH, bullish Ether traders need to overcome 0.786 [$1,294.8]0.618 [$1,376.73]0.5 [$1,434.28] and finally 0.382 [$1,491.83].

Ether’s Moving Average: 5-day [$1,466.95]20 days [$1,428.67]50 days [$1,434.29]100 days [$1,463.27]200 days [$2,006.29]Year to date [$2,11.89].

ETH’s 24-hour price range is $1,073.53-$1,337.16 and its 7-day price range is $1,073.53-$1,659.61. Ether’s 52-week price range is $883.62-$4,878.

The price of ETH on this date in 2021 was $4,633.95.

The average price of ETH for the last 30 days is $1,412.61 and its -12.57% in the same period.

Ether price [-17.57%] closed its daily candle on Wednesday worth $1,100.68 in negative numbers for a fifth consecutive frame.

Solana Analysis

Solana’s price has been one of the worst performers this week and arguably the closest victim to the FTX and Alameda Research contagion that has swept the entire cryptocurrency sector. The ties that FTX and Alameda have to Solana’s protocol haven’t done long-SOL market participants any favors, and as Wednesday’s trading session closed, SOL was -$10.3.

The SOL crypto token has been so negatively impacted this week that SOL’s price at times dropped more than 60% within 24 hours.

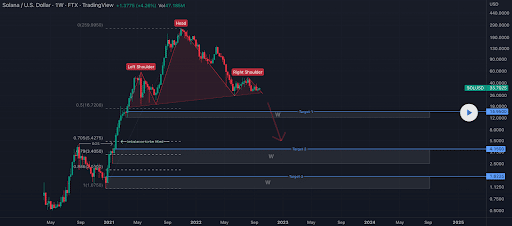

The SOL/USD 1W chart below from MichaelL200 will conclude this week’s price analyses. SOL’s price trades between the 0.705 Fibonacci level [$5.42] and the 0.5 fib level [$16.72]at the time of writing.

Those who believe the Solana platform will survive and SOL’s price will jump have targets above the weekly time frame of the 0.5 fib level followed by a secondary target of a full retracement on this daily chart at 0 [$259.99].

In contrast, traders who believe further downside is imminent have targets of 0.705, 0.79 [$3.4]0.886 [$2.01]and the 1 fib level [$1.07].

SOL’s moving average: 5-day [$26.69]20 days [$29.55]50 days [$31.57]100 days [$34.94]200 days [$57.91]Year to date [$65.11].

Solana’s 24-hour price range is $12.37-$23.97 and its 7-day price range is $12.37-$38.03. SOL’s 52-week price range is $12.37-$246.4.

Solana’s price on this date last year was $233.64.

The average price of SOL in the last 30 days is $30.28 and its -58.97% over the same time frame.

The pain may not be over yet for Solana market participants, as approximately 50 million SOL tokens are set to be unstaked at the close of a new earning period on Thursday. The exact total cannot be determined since several validators have chosen during the last 24 hours to withdraw SOL.

Solana’s price [-42.30%] ended its daily session on Wednesday at $14.05 and in the red for a fourth consecutive day.