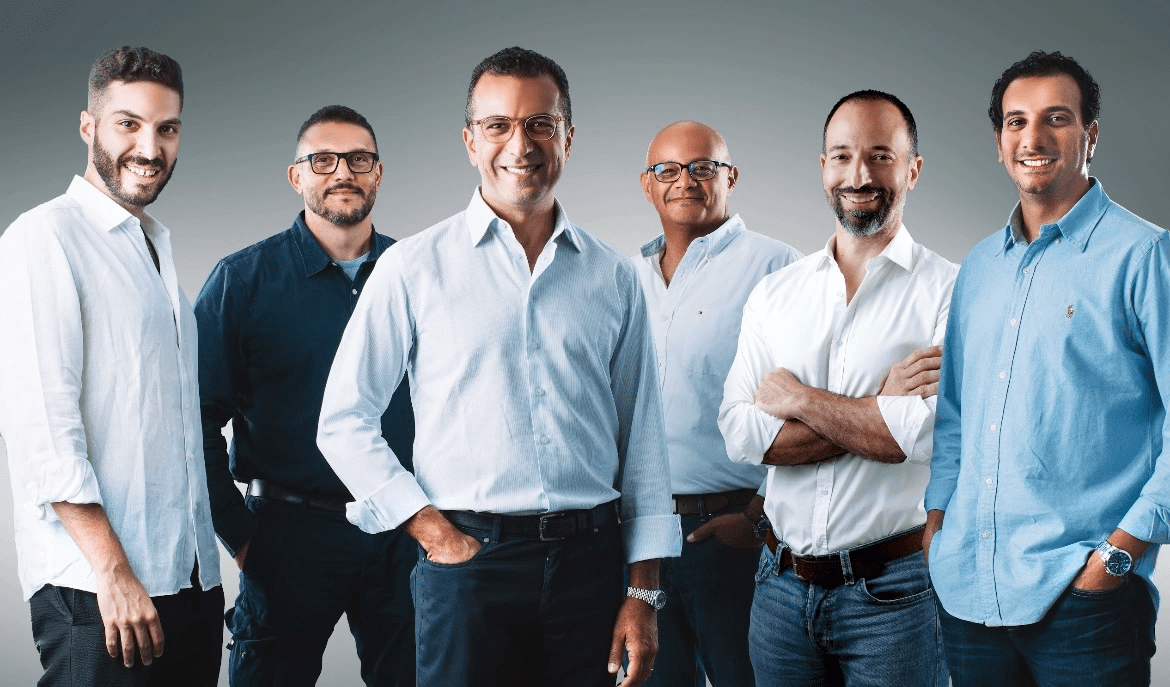

Egyptian fintech startup, Blnk raises $32 million in debt and equity funding

Blnk, an Egyptian fintech offering instant consumer credit, has announced that it has raised $32 million in debt and equity funding to “accelerate financial inclusion in underserved communities across the country” and support its “AI-powered” lending infrastructure.

The fintech disclosed that the $32 million raise is spread across various funding types and stages, including $12.5 million in pre-seed and seed equity rounds led by Sawari Ventures and other Abu Dhabi investors, as well as $11.2 million in debt financing and $8.3 million. when issuing securitized bonds.

When we talk about the investment, Joseph Iskanderinvestment manager at lead investor EIIC, expressed his commitment to work with Blnk to drive financial inclusion in the country, and other value-creating businesses to grow the Egyptian market.

He said:

“We are convinced that the Egyptian market and its startup ecosystem present a compelling opportunity for regional and international investors, and we are committed to identifying and investing in value-added businesses. We are pleased to partner with Blnk to drive financial inclusion and economic development in Egypt and we look forward to working with the team to achieve their goals.”

Joseph Iskander, investment manager at lead investor EIIC

So far, Blnk claims to have disbursed over $20 million in loans via a network of more than 300 merchants (half of which are active) to over 60,000 customers paying an average of 2.6% monthly interest.

Also read: Elon Musk sells Tesla shares for around $4 billion days after the Twitter takeover

About Blnk

Blnk claims that less than 4% of Egyptians have access to credit cards and can only afford to buy products/services with cash that they have saved or are forced to borrow from hard money lenders at high interest rates.

In addition, just over 4 million credit cards are used in Egypt, a country with a population of over 100 million. Because there are so few other options available in the market, citizens of the country have little or no access to credit.

It is on this basis that Blnk, a fintech business launched last October, developed its goal of enabling inclusion through point-of-sale financing. All consumers of the company’s services can now get instant credit from their preferred dealers within minutes.

According to the company, customers using Blnk at the point of sale need a national ID to start with, after which they can get financing in three minutes, “It’s a very fast service,” said Amr Sultanco-founder and CEO, in an interview with TechCrunch.

“And by being there at the point of sale, we’re helping to increase conversion rates and offer affordable products to significantly underserved populations. We’re very focused on financial inclusion, especially how to underwrite people who don’t have a credit history.”

Consumer loans are one of the various options examined by Blnk. The digital lending platform works with Egyptian retailers to enable them to screen customers at the point of sale and offer them financing for the purchase of goods including electronics, furniture and car services over a period of six to thirty-six months.

Sultan, who started the company with Tarek Elsheikh, said Blnk does this via its proprietary credit guarantee system and risk scoring model that assesses customers’ risk and ability to service their debt.

Other fintech companies offering loans and other financial services in Egypt include MNT-Halan, MoneyFellows and Khazna.

Also read: Kuda expands to the UK with the launch of new services