HIVE Blockchain: Potentially Negative Margin Mining (NASDAQ:HIVE)

luza studios

A few months ago I wrote a cautionary article about HIVE Blockchain Technologies Ltd. (NASDAQ:HIVE), highlighting some red flags in the company’s Q4 2022 earnings report. In particular, I was concerned that HIVE Ethereum (ETH-USD) mining equipment may become obsolete with a pending transition to a “Proof-of-Stake” (“POS”) system. I was also concerned about HIVE’s mining margins, as HIVE had been running negative gross margins in Q4/2022. Since my article, HIVE has dropped over 30%.

After reviewing the latest figures from HIVE’s monthly production reports and cryptocurrency prices, I continue to advise investors to stay away. With today’s crypto prices, HIVE appears to be operating with negative gross margins, i.e. not even covering the cost of electricity. The loss of Ethereum mining has dealt a severe blow to HIVE’s business. Combined with increased Bitcoin (BTC-USD) mining difficulty, HIVE’s monthly production of BTC has fallen 40% from August to October despite adding 7% in ASICs.

Ethereum merged and its impact on HIVE

When I wrote my first article, there was still some doubt about the pending Ethereum conversion to POS. In fact, HIVE itself had downplayed the timeline and impact, and the company mocked the long-delayed transition in its Q3/F22 presentation (Figure 1).

Figure 1 – HIVE Down-Priority Ethereum Merger (HIVE Q3/F22 presentation)

Unfortunately for HIVE and other Ethereum miners who were deriving income from Proof-of-Work on the Ethereum network, the Ethereum network merged into a POS system on September 15, 2022. The merger made Ethereum mining equipment obsolete, with many GPUs which is now sold below. MSRP and list prices.

As a reminder, HIVE had 6.49 Terahash of Ethereum mining capacity at the end of August, which produced 3,010 ETH (equivalent to 228.4 BTC, according to HIVE). HIVE also mined 290.4 BTC in August using their dedicated ASIC miners, so in total the company produced 518.8 BTC equivalents.

In response to the Ethereum merger, HIVE commented that the company would pivot its operations to focus on Bitcoin, including the digital treasuries (ie it would no longer HODL ETH). Since the merge, HIVE revenue from GPU mining dramatically decreased, from ~7 BTC/d to 1.6 BTC/d, as the GPUs were converted to mine altcoins.

In September, the transition month, HIVE mined 268.9 BTC from ASIC mining, 1,394 ETH (equivalent to 111.6 BTC) and 15.8 BTC from GPU mining of altcoins for a total of 396.3 BTC.

In October, the first month of BTC-only mining, HIVE mined 262 BTC from ASIC mining and 45 BTC from GPU mining for a total of 307 BTC.

So as a result of the Ethereum merger, HIVE’s BTC equivalent mining output dropped by over 40%, from 519 BTC in August to 307 BTC in October.

Bitcoin Difficulties Continue to Climb; HIVE running on a treadmill

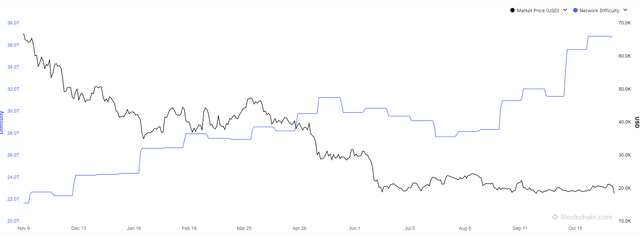

Further exacerbating HIVE’s Ethereum problem was the fact that the difficulty of mining Bitcoin continued to rise, recently pushing new records despite falling Bitcoin prices (Figure 2).

Figure 2 – Bitcoin difficulty vs. price (blockchain.com)

So while HIVE continued to add ASIC mining rigs, with its ASIC hashrate increasing 7% from 2.23 Exahash in August to 2.38 Exahash in October, the number of BTC it mined from ASIC mining actually dropped 10% from 290 BTC in August to 262 in October.

What is HIVE’s margin now?

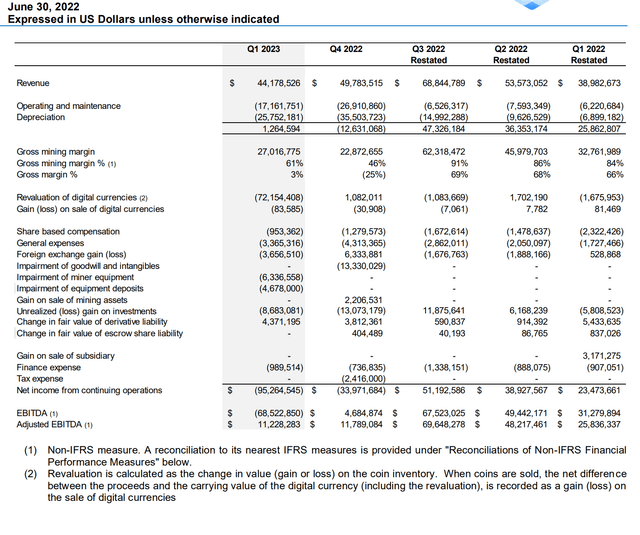

Looking back on my concern about HIVE’s margin profile, I was admittedly too bearish in my previous article when I pointed out that HIVE was operating at a negative gross margin in Q4/F22, as a number of one-offs had increased O&M expenses. In first quarter results reported in August, gross margin QoQ increased to 61%, as O&M costs normalized somewhat to $17.2 million. However, I was directionally correct as HIVE’s gross margin, which included depreciation on mining equipment, was only 3% in Q1/F23 (Figure 3).

Figure 3 – HIVE operational summary (HIVE Q1/F23 MD&A)

Are gross mining margins now zero?

Looking ahead, we are at an interesting time. On November 9, Bitcoin crashed to ~$17,000 as one of the seemingly “untouchables” in the industry, FTX, was forced to seek a bailout from its main rival, Binance.

What’s interesting is that if we assume HIVE’s Q1/F23 O&M costs are the norm, that would add up to a daily mining cost of ~$190k ($17.2M over 91 days). From the production update from October we also know that:

As of November 2, HIVE produces an average of over 9.5 Bitcoins per day from ASIC and GPU production, consisting of over 8 Bitcoins per day from our ASIC fleet and over 1 Bitcoin per day from our GPU fleet.

Even if we are generous and assume that HIVE produces 10 BTC per day, at current bitcoin prices, HIVE only generates $170,000 / day (10 BTC times $17,000 / BTC) in revenue.

Therefore, it is very possible that HIVE is currently mining at one negative gross margin. This will mean that the mining revenues cannot even cover the electricity costs.

Risks of Bearish View

Obviously, the biggest risk to my bearish view is going to be cryptocurrency prices. In August, following my last article, HIVE briefly topped $7/share as risk assets enjoyed a summer rally. However, in the long term, I believe that HIVE cannot escape the reality that with current crypto prices, the mining equipment may initially be burning energy and money as it mines with negative gross margins.

Summary

In summary, I continue to be wary of HIVE. With today’s crypto prices, HIVE appears to be operating with negative gross margins. The loss of Ethereum mining has dealt a severe blow to HIVE’s business. Combined with increased BTC difficulty, HIVE’s monthly production of BTC has dropped 40% from August to October despite adding 7% in ASICs.

![From ad overload to sustainability, blockchain is changing the marketing game [Podcast] From ad overload to sustainability, blockchain is changing the marketing game [Podcast]](https://technode.global/wp-content/uploads/2021/11/Tiahui.png)