Be careful to catch the falling knife

A falling knife is a sign of an asset’s rapid decline in value. Catching a falling knife is a dangerous trading method where a trader attempts to buy near the bottom of such a drop.

What is a falling knife?

Catching a “falling knife” means buying into an asset that has extreme downward momentum and has not shown any bullish reversal signs.

Simply put, the benefits of the tactic is that if the timing is perfect, a trader can buy the exact bottom and book a significant profit when the price of the asset recovers.

The downside, however, is that the price may continue to fall to no avail. The use of leverage exacerbates this disadvantage. This is because the continuation of the decline could quickly lead to liquidations.

Why should you avoid falling knives?

The main reason to avoid a falling knife is that there is no place to place a stop loss. Therefore, the losses can be unlimited. This can be illustrated by the Bitcoin (BTC) price movement in March 2020, during the “Coronavirus Crash”.

Between March 10 and 12, the BTC price fell by 52%, leading to a low of $3,782.

The decline accelerated when the BTC price broke down from the horizontal support area of $7,300, which was also the support level of the 0.618 Fib retracement.

A potential method to catch this “falling knife” would be to buy near the 0.786 Fib retracement support level at $5.495. However, the Bitcoin price dropped to $3,782 the next day.

If a trader were to try to catch a falling knife in the spot market, he/she would still be in profit when the market eventually turned. However, he/she would most likely be liquidated if high leverage was used.

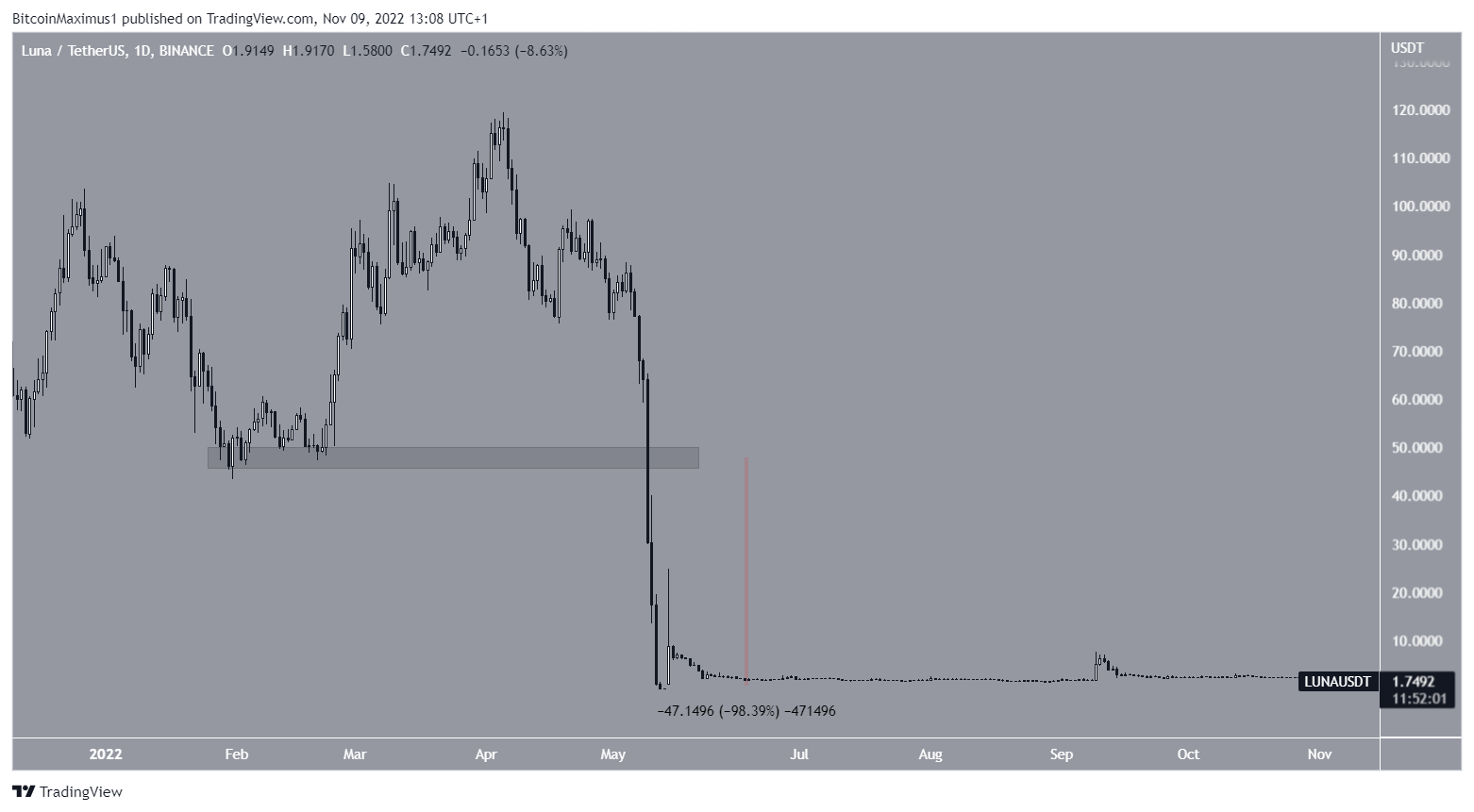

A scenario that would end badly even in the spot markets comes from Terra (LUNA). A sharp downward movement began on May 9, and the logical place to catch the “falling knife” would have been at the $50 support area.

However, the area was unsuccessful in initiating a reversal. LUNA price fell another 98% after breaking down from the support area and has not recovered.

LUNA/USDT chart by TradingView

How to catch falling knives

If you are stuck trying to catch a falling knife, the right way to do it would be dollar cost averaging in the stop market. Going back to the BTC example, it would be possible to place six equal buy orders (green lines) at $500 intervals from $5,600 to $3,100. This would have caught the bounce at the 0.786 Fib retracement support level and divergence below it.

The disadvantage is that the profit would be lower in the event of a reversal, since not all the orders would have been triggered. However, if the trade goes bad, the average purchase price will be $4,350, reducing losses significantly.

Cryptocurrency Market – Collapse or Reversal?

The cryptocurrency market capitalization is at a very crucial support level of $860 billion. This is both the 0.382 Fib retracement support level and a horizontal support area. The support has been in place since June. So the next bailout will be $585 billion if a crash occurs. The 0.5 Fib retracement support level creates that.

The crypto market cap is currently breaking down from this range, although it has yet to reach a weekly close below it. In addition, the weekly RSI may be about to generate bullish divergence (green line). This is also yet to be validated since the resumption of the downward movement would invalidate the divergence.

Therefore, whether the cryptocurrency market cap breaks down or bounces at the $860 billion support area will determine the future long-term trend.

For BeInCrypto’s latest Bitcoin (BTC) analysis, click here.

Disclaimer: BeInCrypto strives to provide accurate and up-to-date information, but it will not be responsible for missing facts or inaccurate information. You comply and understand that you should use all such information at your own risk. Cryptocurrencies are highly volatile financial assets, so do your research and make your own financial decisions.

Disclaimer

All information on our website is published in good faith and for general information purposes only. Any action the reader takes on the information contained on our website is strictly at their own risk.