Will Chainlink Gains Be Undone As Crypto Market Collapses Amid Rumors?

- The Chainlink price climbed above $9.20 for the first time since August 13, a three-month high despite crypto volatility.

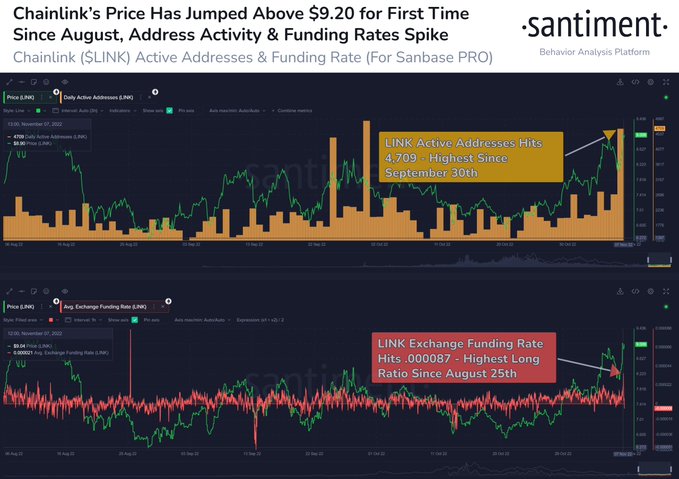

- The increase in LINK price is supported by a large amount of Chainlink address activity.

- Analysts maintain a positive view on Chainlink as the altcoin breaks past key resistance at $8.40.

Chainlink price hit a three-month high despite the ongoing uncertainty and volatility in crypto. Rumors of Samuel Bankman-Fried’s FTX exchange insolvency has increased selling pressure on cryptocurrencies in general. Still, Chainlink has defied the negative sentiment and disconnected from cryptocurrencies to break past the $8.60 level.

Also read: JUST IN: As US midterm elections approach, $3.15 billion worth of Bitcoin is flooded

Chainlink hits three-month high despite mass market volatility

Chainlink, a decentralized blockchain oracle network on Ethereum, is used to facilitate the transfer of tamper-proof data to on-chain smart contracts. Chainlink price climbed above the $9.20 level for the first time since August 13th. LINK hit three-month high despite crypto market volatility.

The rise in the altcoin’s price has been supported by an increase in active address activity over the past five weeks.

Chainlink address activity

The current volatility in the crypto market and the bearish sentiment among the owners comes from rumors that Samuel Bankman-Fried’s stock exchange FTX is experiencing a bank run. Crypto influencers and critics claim that FTX has been pushed to the brink of a debt crisis. The exchange has witnessed outflows of 1 billion dollars in recent days.

SBF’s comments on how DeFi needs regulation and his blueprint for regulators has sparked the ire of the wider crypto community. When the draft The Senate Agriculture Committee’s Digital Commodities Consumer Protection Act (DCCPA) bill was leaked online, SBF’s position on the matter became clear. The SBF pointed regulators towards DeFi devices and platforms, deflecting their interest in regulating centralized crypto exchanges.

What more, Alameda, a leading general trading firm, owned by Bankman-Fried and managed by Caroline Ellison, witnessed a 47% drop in its chain balance in the past month. Most of the funds of SBF-owned Alameda were deposited with FTX exchange and Genesis, a major crypto lender.

Jack Niewold, founder of Crypto Pragmatist believes the FTX exchange is insolvent, with massive outflows and increased selling pressure on FTT, the original token. Binance and major wallet investors unload their FTT in favor of USDT, USD or BUSD as the crypto community unites to protect DeFi from regulatory guidelines.

Sam Bankman-Fried was once admired as the king of crypto.

Now Alameda and FTX are rumored to be on the brink of insolvency.

: This is how things went wrong for SBF and FTX.

— Miles Deutscher (@milesdeutscher) 7 November 2022

Changpeng Zhao, CEO of Binance told its Twitter followers that the sale of $584 million in FTT is a risk management measure. CZ claimed that Binance wants to avoid an implosion like that of Terra’s LUNC (formerly LUNA) and UST.

Liquidating our FTT is just risk management after exit, and learning from LUNA. We were supportive before, but we won’t pretend to love after divorce. We are not against anyone. But we will not support people who lobby against other industry players behind their backs. And further.

— CZ Binance (@cz_binance) 6 November 2022

The FTT price fell 23% overnight and the FTX exchange is drowning in billions of withdrawals in recent days. This uncertainty has pushed crypto prices lower and Chainlink broke away from cryptocurrencies to lead the pack with 23% gains in two weeks.

Analysts are positive on Chainlink, predicting continuation of the uptrend

Sheldon Sniper, a crypto trader and technical analyst believes Chainlink price has bullish potential. The expert noted that the Chainlink price broke an 18-month weekly trend and is poised to target the $12.60 and $16 levels.

LINKUSDT price chart

The $8.40 level is the key resistance for Chainlink, and a break past this level would confirm a bullish breakout. If the Chainlink price does not hold above the $8.40 level, it will invalidate the bullish thesis and the asset will continue its decline along the 18-month trend line.