Fintech partner banks are bucking industry deposit trends

Introduction

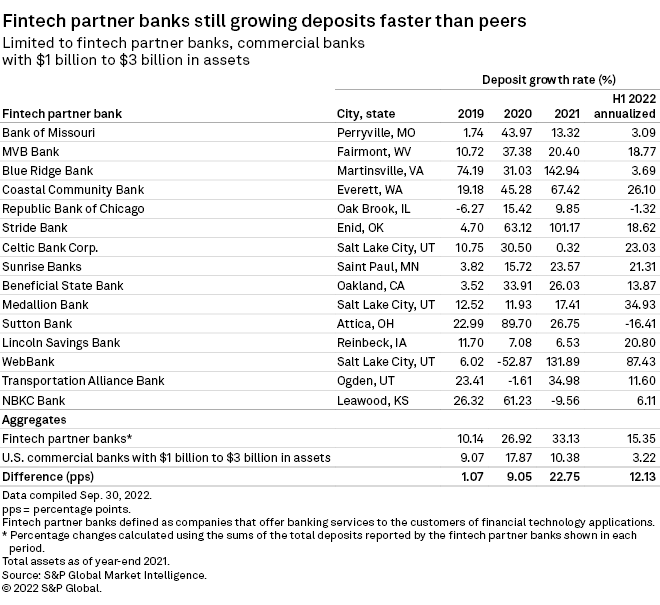

Financial technology companies are still a source of deposits for the banks that work with them. Of a group of 15 U.S. partner banks in assets ranging from $1 billion to $3 billion, about 10 are on track for double-digit increases in total deposits in 2022, far outperforming similarly sized U.S. commercial banks.

We define a “partner bank” to be an FDIC member bank that provides services, such as credit and debit cards or personal loans, to customers of financial technology applications. Users interact with the fintech app on the front end, but their accounts are with the partner bank on the back end. This is often referred to as banking-as-a-service.

Banking-as-a-service has offered a robust source of deposit growth in a more challenging macro environment. But banks looking to enter the banking-as-a-service arena may find that account sizes are relatively small and deposit levels tend to have more volatility. The technical requirements of fintech partners can also be an obstacle, but even small community banks have been able to meet these requirements.

This analysis is limited to banks that had $1 billion to $3 billion in total assets at the end of 2021, but there are banks outside of this range that also operate banking-as-a-service. First Electronic Bank, for example, counted less than $80 million in assets at the end of 2021, while Fifth Third Bank NA had more than $200 billion. However, of all the partner banks we were able to identify, the median asset size was $1.56 billion, hence the $1 to $3 billion range used in this analysis.

Community banks saw an influx of deposits amid the pandemic, but growth will be harder to come by this year and next, according to S&P Global Market Intelligence’s US Community Bank Projections. The latest forecast shows deposits falling by 1.8% in 2022 and 0.5% in 2023.

The partner banks appear to be an exception to this general trend. WebBank, for one, is on pace to grow deposits by 87% in 2022, based on its first-half annualized rate. In Q2 2022, WebBank launched US credit card buy-now-pay-later provider Klarna Holding AB (publ) and cryptocurrency exchange Gemini Trust Co. LLC that had waiting lists of more than 1 million and 500,000, respectively. PayPal Holdings Inc. also unveiled a new buy-now-pay-later product, PayPal Pay Monthly, in partnership with WebBank on June 15.

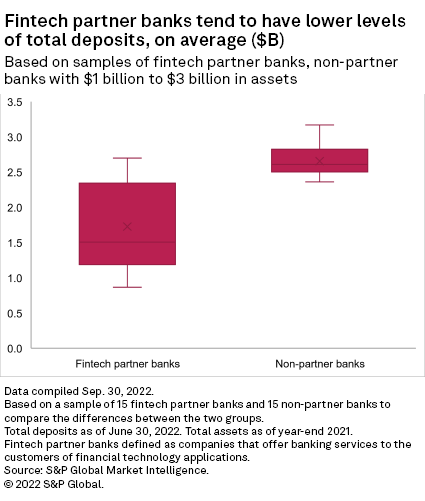

But while the partner banks are increasing deposits rapidly, they had on average lower overall deposit levels than corresponding banks as at 30 June. The partner bank group’s average deposit level was $1.73 billion, compared to an average of $2.65 billion for a group of 15 banks in the same asset area.

The difference was statistically significant as judged by a standard statistical analysis F-test and a t-test at an alpha level of 0.01. This is valuable context for the deposit growth data as it is easier to log a higher percentage from a smaller base. It can also be an indication that account sizes are smaller.

On average, the partner banks had a larger number of accounts and thus smaller average balances on these accounts. Looking at accounts of $250,000 or less, NBKC Bank had more than 990,000 as of June 30, which meant an average account size of about $450. Lincoln Savings Bank and Medallion Bank each had more than 1 million accounts, with average account sizes of approximately $830 and $1,000, respectively. But results varied, sometimes significantly. As the plot shows, partner banks have a wide range of deposit levels compared to non-partner banks. Their deposit levels also tended to be more volatile from quarter to quarter, as measured by standard deviation.

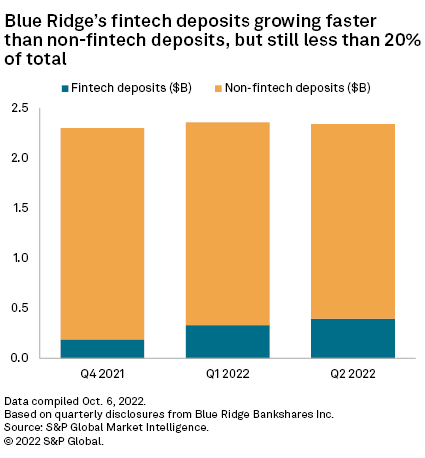

Part of the challenge in classifying partner banks is that banking-as-a-service may only be part of the bank’s business. For example, Blue Ridge Bankshares Inc. provides a breakdown in quarterly filings sent to the SEC, which showed that fintech deposits made up just 17% of total deposits as of June 30. But Blue Ridge’s results certainly underscored the trend of banking as a service being a driver of deposit growth: Fintech deposits more than doubled from Q4 2021 to Q2 2022, while non-fintech deposits fell around 8%.

Although partner banks do not focus exclusively on banking-as-a-service, they tend to have some features that set them apart from their peers. A high ratio of non-interest income to total income is a potential indicator that a bank does banking as a service, as is the aforementioned number of deposit accounts in relation to total assets. A partner bank may also have a large ratio of transaction deposits to total deposits.

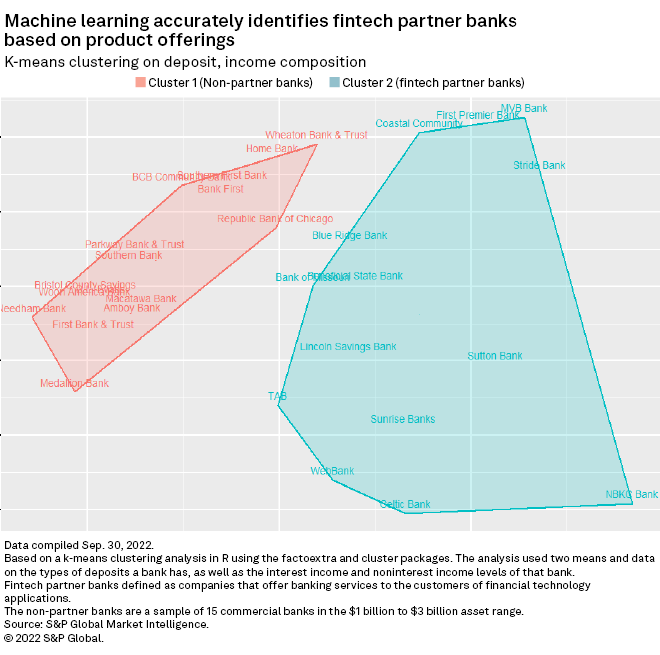

A machine can even be trained to spot the differences: A k-means classification algorithm, used in machine learning, separated the partner banks from the non-partner banks with 90% accuracy. The algorithm groups data points into clusters that have similar mean values across specified functions. For our analysis, we used two clusters and data on deposit composition and non-interest income.

However, the algorithm makes some mistakes. We will consider Republic Bank of Chicago and the aforementioned Medallion Bank as partner banks.

This article was published by S&P Global Market Intelligence and not by S&P Global Ratings, which is a separately managed division of S&P Global.