8 events this week could trigger volatility in the crypto markets

This week could prove bumpy for crypto markets which will face macroeconomic headwinds from key US and European economic indicators amid looming US mid-term elections.

The US and the Eurozone will reveal key macroeconomic numbers this week that have historically been linked to volatility in the crypto markets.

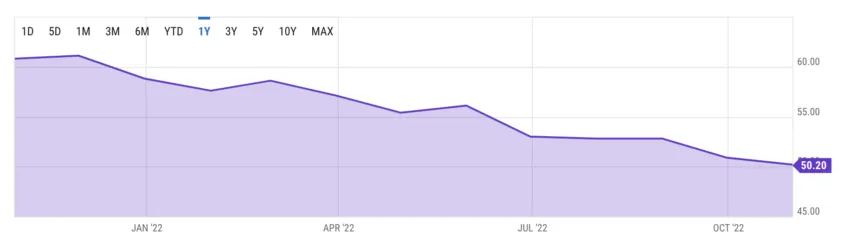

November 1: US manufacturing PMI

Those who bet against the prices of cryptocurrencies (short sellers) may face the prospect of liquidations as the week unfolds. They may also see a more significant correlation between the stock market and crypto.

The first port of call is the US ISM Manufacturing Purchasing Managers Index, due to be published on November 1, 2022. It comes from a monthly survey of purchasing managers who can access early information about company performance.

A PMI above 50 means the manufacturing sector is booming, boosting investor confidence and causing a boom in the stock market. A PMI of 50 means no change, while a PMI below 50 means that the industry has stagnated.

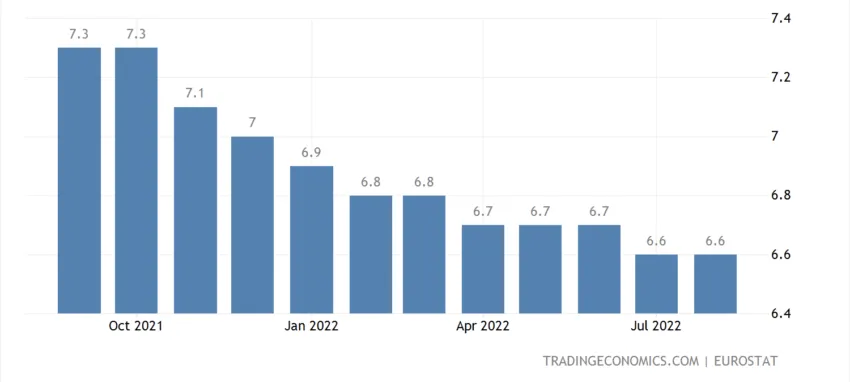

November 2: Eurozone manufacturing PMI and federal funds rate

A similar calculation in the eurozone, the manufacturing PMI, is due on November 2, 2022. It shows the health of the manufacturing sector in the eurozone.

ISM PMI for October 2022 is down at 50.2, beating analysts’ expectations of 50 after reaching 50.9 last month. Historically, fiat currencies such as the US dollar have strengthened, with a PMI above 50.

On the other hand, a PMI below 50 for two consecutive months indicates that the economy is in a recession.

A lower PMI of 50.2 indicates that the economy has slowed slightly, possibly due to recent Fed rate hikes. At press time, the crypto market is largely stable, with five of the top ten cryptos by market cap in green and five in red.

3 November: Unemployment in the Eurozone in September

The US Department of Labor is also set to release the unemployment rate for October 2022. Falling unemployment numbers usually mean a strong labor market fueled by economic prosperity. The Eurozone will publish its employment rate for September 2022 on 3 November 2022.

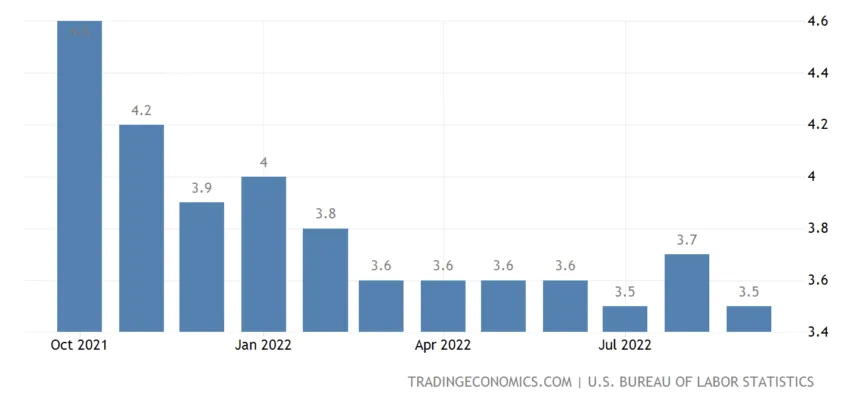

November 4: Unemployment in the US in October

Analysts expect the US unemployment rate to rise to 3.6% from 3.5% in September 2022.

If this turns out to be true, it could encourage the Federal Reserve to cautiously slow its rate hikes. This decline could be bullish for crypto markets, meaning the economy is less likely to fall into a recession.

So far, analysts have predicted that the Fed will raise the funds rate by 75 basis points to 4% on November 2, 2022.

Following the release of September 2022 unemployment, which showed a lower figure than August 2022, Bitcoin liquidations reached $12 million as the price fell 2%.

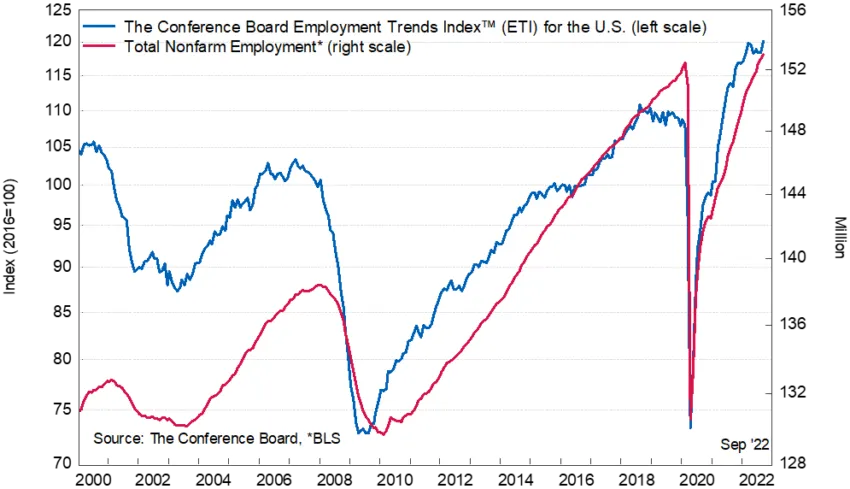

Nov 7: US index of employment trends

The Employment Trends Index is another significant number that shows where the job market is likely to go in the coming months. A higher number means jobs are likely to increase soon. A lower number means that jobs are likely to be reduced in the short term.

If the Fed continues to raise interest rates to cool the labor market, this could reduce hiring in the coming months. As the rate of inflation falls towards the Fed target, the central bank may slow the pace of interest rate increases.

This could be positive for Bitcoin as a risky asset, as investors are likely to pile into the cryptocurrency as threats of a recession fade.

8 November: retail sales in the eurozone

September 2022 eurozone retail sales, scheduled for a November 8 release, could indicate the region is about to slip into recession. In August 2022, retail sales, a proxy for consumer demand, fell 0.3% compared to July 2022.

The area has been hit hard by rising energy prices caused by the war in Ukraine. If demand continues to fall, cryptocurrencies will likely be affected, as consumers will have less disposable income to spend on risky assets.

Nevertheless, the picture may become more nuanced if European governments introduce measures to reduce taxes or give discounts for energy costs.

November 8: US midterm elections

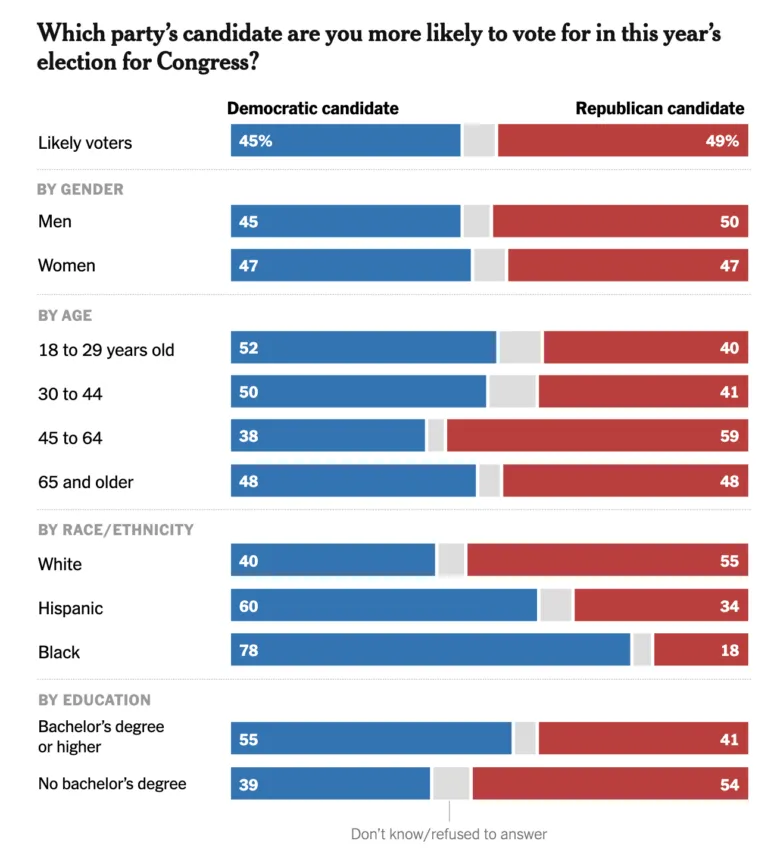

With the US mid-term elections around the corner, the future of crypto markets in the US is becoming less clear.

There are 435 seats in the House of Representatives contested and 35 seats in the Senate. While Republicans have generally been more pro-crypto than their Democratic counterparts, a Republican victory may not necessarily result in pro-crypto legislation.

President Joe Biden’s Crypto Framework further complicates matters, likely resulting in a enactment as various bills make their way through Congress.

November 10: CPI in the US in October and real income dynamics

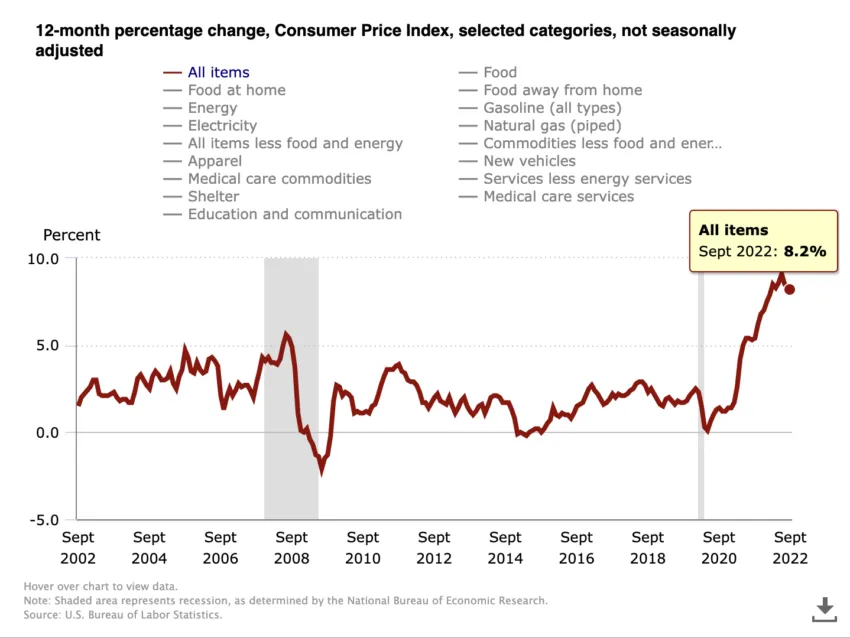

The Consumer Price Index (CPI) for October 2022 is scheduled to be released on 10 November 2022 at 8:30 a.m. Eastern Time. The CPI rate for September came in at 8.2%, down just 0.1% from August’s 8.3%.

The crypto markets did not react much to the September rate. But they are likely to react to the release of the Oct. 2022 rate if it turns out to be higher than the previous month. In the past, a higher monthly CPI has sent crypto markets soaring as inflation ran red hot. If the Oct rate is higher than last month, it could result in a sharp drop in the price of Bitcoin and liquidation of leveraged positions. However, from the chart it appears that the CPI rates have formed a peak.

How is the crypto market preparing for these macroeconomic events?

Among all the macroeconomic factors listed above, Bitcoin is fighting the resistance of the descending triangle trendline on a weekly time frame as the market approaches FED rate hikes.

Descending triangles are generally considered a bearish chart pattern. Not only that, Bitcoin is also testing the 20-week Simple Moving Average (SMA) for the first time in seven months.

These strong resistances could send the price back to the support of the $18,000 level. The BTC price has held on to the $18,000 support for nearly five months. Breach of this support level will be a breakdown of the descending triangle pattern. It can result in extreme volatility in the crypto market.

Still, if the FED rate hike comes in at 50 BPS, Bitcoin could provide a weekly close above the trend line. Then the bearish pattern will become invalid.

For BeInCrypto’s latest Bitcoin (BTC) analysis, click here.

Disclaimer

All information on our website is published in good faith and for general information purposes only. Any action the reader takes on the information contained on our website is strictly at their own risk.