Tags in this story

36.84 trillion, All time high, Bitcoin, Bitcoin (BTC), Bitcoin Miners, Bitcoin mining, BTC Mining, BTC Prices, crypto mining, Foundry, Foundry USA, Hashpower, Hashrate, hashrate ATH, hashrate shift, total hashrate

all about cryptop referances

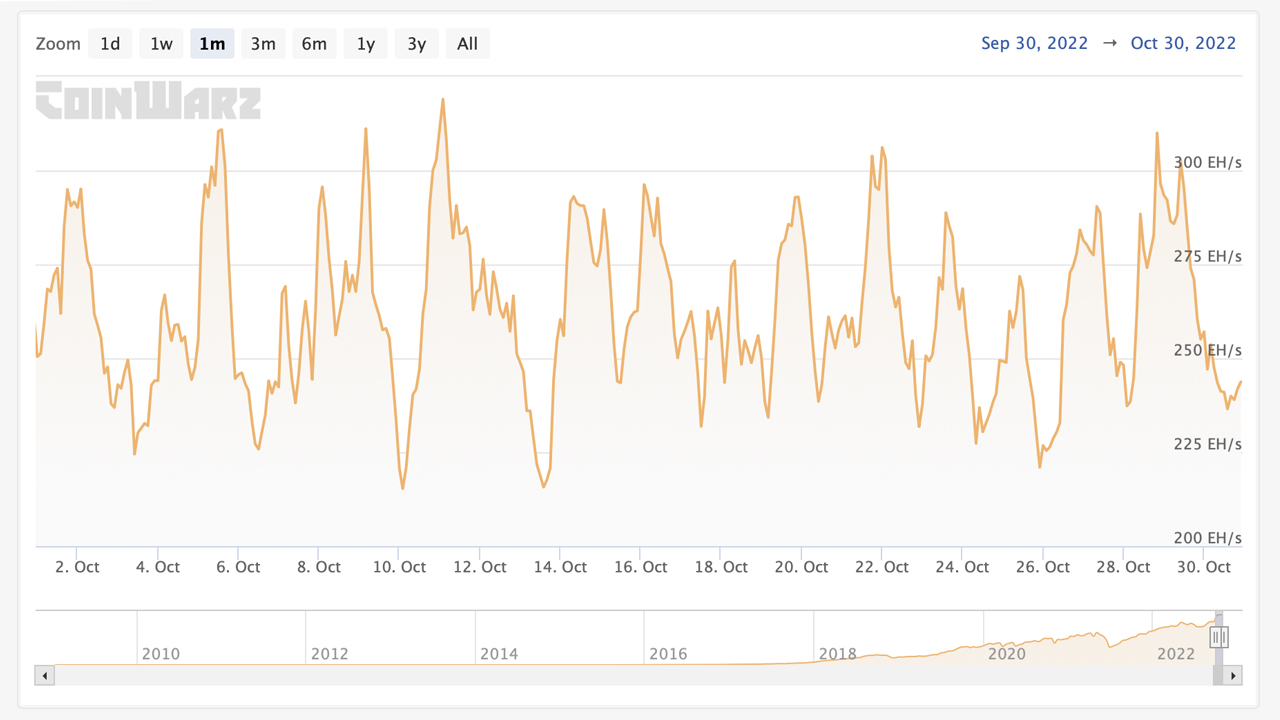

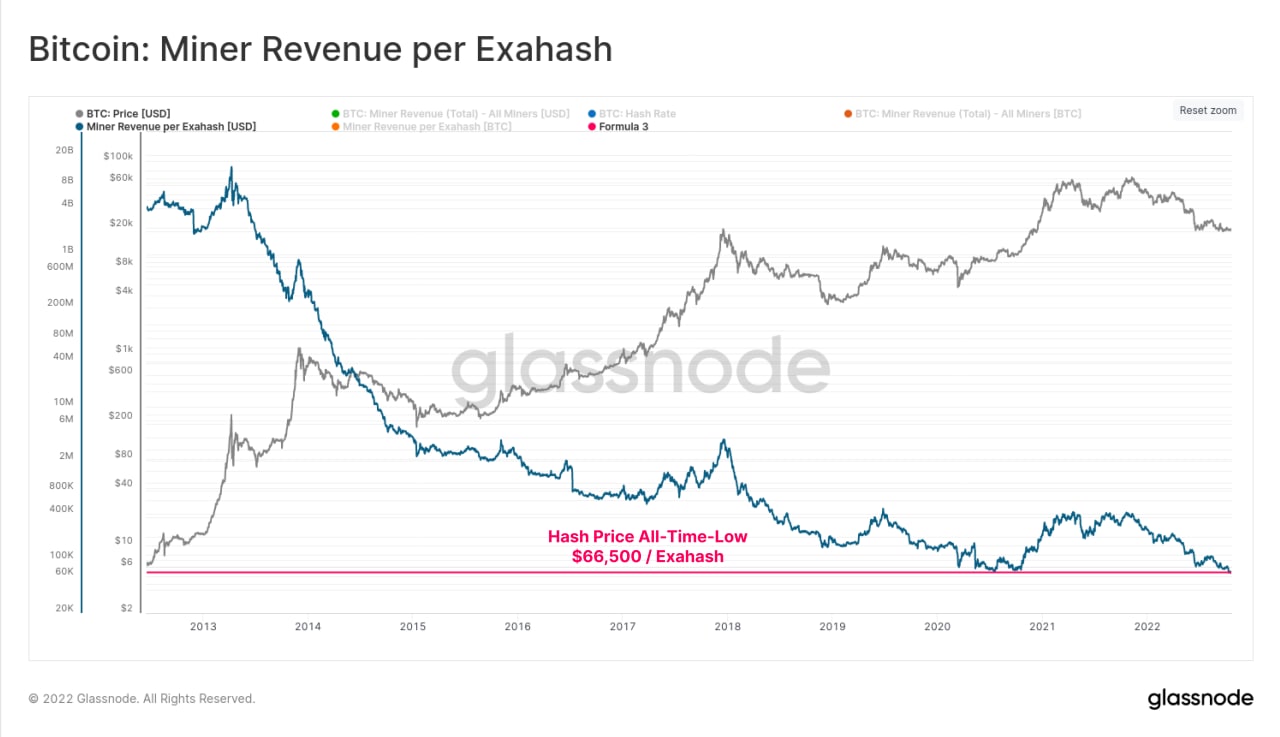

This month’s bitcoin hash price hit a record low of $66,500 per exahash on October 25, according to statistics from onchain market intelligence firm Glassnode. Alongside this, the network’s mining difficulty reached a lifetime high of 36.84 trillion on October 23rd. Despite the high mining difficulty and lower prices, Bitcoin’s total hash rate reached a record high of 325.11 exahash per second (EH/s) as 4,578 blocks were generated in the last 30 days.

While the month of October saw an “uptober” in terms of 30-day percentage gains, the month also saw a few mining records. Most notably, the all-time hashrate high was recorded at block height 758,138, when Bitcoin’s (BTC) total hashrate reached 325.11 EH/s.

Bitcoin’s hash rate has stayed above the 200 EH/s mark all month, but hit a low of 215 EH/s on October 10. The hashrate average over the last 2016 blocks (about two weeks) was around 259.8 EH/s.

Bitcoin’s record high hashrate has meant that the network has experienced two difficulty levels this month that have increased. The first difficulty adjustment change was the biggest difficulty retarget of 2022, jumping 13.55% at block height 758,016 on October 10th.

The second retarget in October took place on 23 October, when the shift increased upwards again by 3.44%. Both of these upward shifts combined brought the network’s difficulty to a lifetime of 36.84 trillion.

The next difficulty change won’t come until next month on November 6th, and it’s expected to be reduced by 1.51%. Price-wise, while the crypto winter has been tough for bitcoin miners, October was the best month of the last three months for BTC prices.

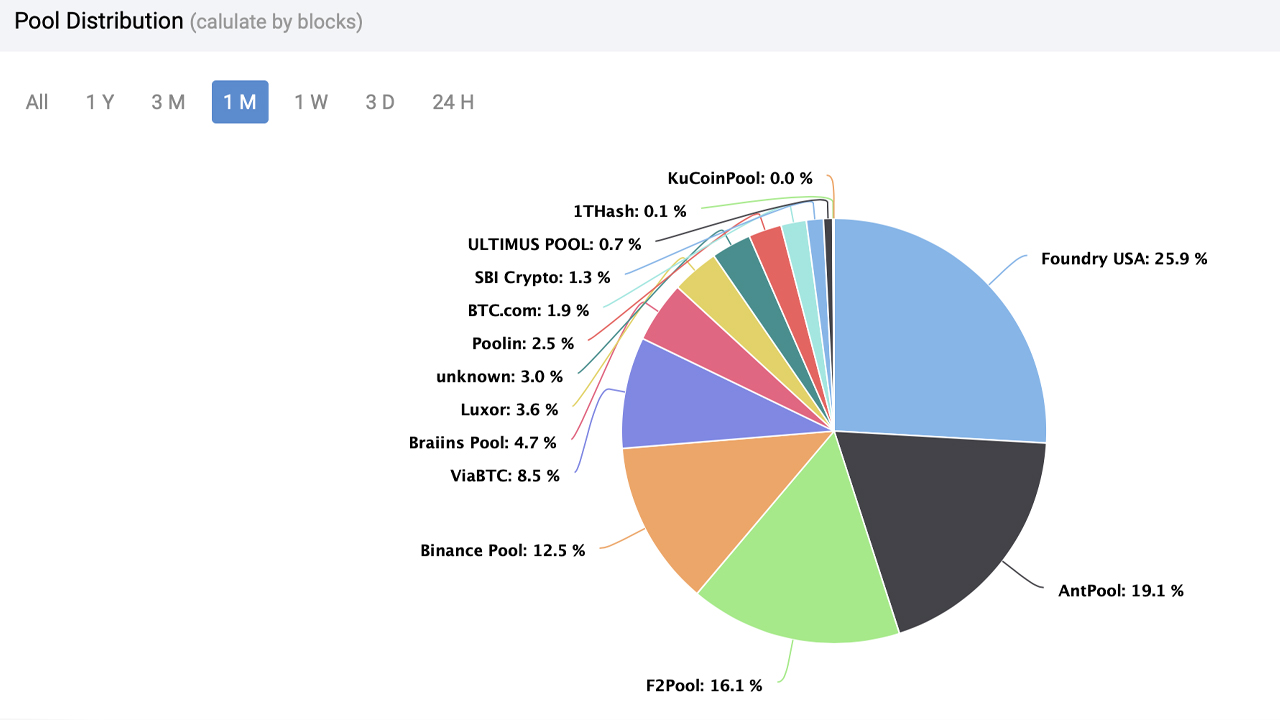

Bitcoin gained more than 5% against the US dollar in 30 days. In the last 30 days, bitcoin miners discovered 4,578 blocks that produced 28,612.50 newly minted bitcoins. Of the 4,578 blocks, the top mining pool, Foundry USA, discovered 1,186 blocks.

Over the past 30 days, Foundry’s total hashrate was 25.91% of the global hashrate. Over the past month, bitcoin miners have pulled off a feat of pushing hash rate and mining difficulty to record highs, while bitcoin’s hash price has been at its lowest in nearly 14 years.

With all these factors, it will be interesting to see what happens to the hashrate and difficulty metrics when bitcoin’s hash price reaches higher prices, rather than the record lows recorded this month.

What do you think about the state of bitcoin mining during the month of October? Let us know what you think about this topic in the comments section below.

Image credit: Shutterstock, Pixabay, Wiki Commons

Disclaimer: This article is for informational purposes only. It is not a direct offer or solicitation of an offer to buy or sell, or an endorsement or recommendation of products, services or companies. Bitcoin.com does not provide investment, tax, legal or accounting advice. Neither the company nor the author is responsible, directly or indirectly, for any damage or loss caused or alleged to be caused by or in connection with the use of or reliance on content, goods or services mentioned in this article.