Argo Blockchain: The Next Miner Squeeze Casualty (NASDAQ:ARBK)

gesrey/iStock via Getty Images

Yesterday, both the cryptocurrency community and the traditional stock investment world learned that the leading Bitcoin (BTC-USD) miner by monthly output is facing insolvency. While each company has its own struggles, it’s hard not to see on what just happened with Core Scientific (CORZ) and wondering who is next. The majority of the macro headwinds that Core Scientific has dealt with are challenges that all other Bitcoin miners share. Specifically, with increases in hashrate and block reward difficulty, miners have experienced a nasty margin squeeze for most of 2022:

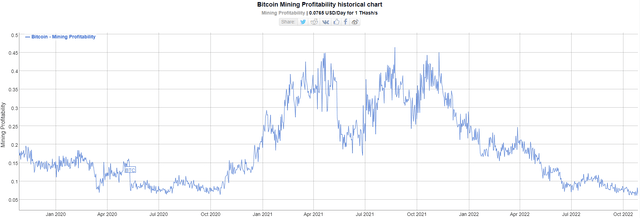

Mining Profitability (BitInfoCharts)

Mining profitability hit an all-time low just a few days ago, and in light of the CORZ news, it’s reasonable to start wondering if there will be another crash from the margin squeeze.

Argos’ underperformance

One of the listed Bitcoin miners that I’ve been telling BlockChain Reaction subscribers to avoid for weeks is Argo Blockchain (NASDAQ:ARBK) (ARBKL).

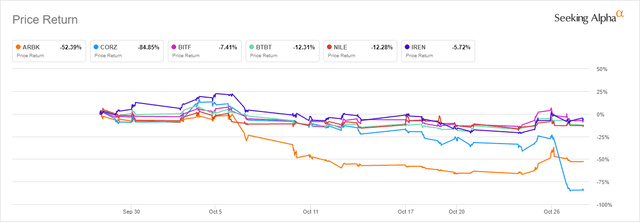

1 month return (seeking alpha)

You can see in the chart above that Argo had already been the weakest listed miner in the last month before yesterday when CORZ collapsed by around 75%. This weakness was likely a response to Argo’s announcement that it sold 3,400 mining machines earlier this month. The liquidation was an attempt to raise $6.8 million in cash. From the company’s PR:

As previously reported on September 9, 2022, the company has seen headwinds from both natural gas and electricity prices caused by the geopolitical situation in Europe and low levels of natural gas storage in the United States. These factors, combined with the decline in the price of Bitcoin since March 2022 and increased mining difficulty, have reduced the company’s profitability and free cash flow generation.

High energy prices have plagued many of the listed miners, but Argo stands out in a bad way due to its high debt load compared to other similarly large miners.

Balance

By looking at the balance sheet, it is easy to see why the company needs cash. There is a high debt burden compared to peers and not much left to pay the bills.

| CORZ | BITF | THE IRISH | CLSK | BTBT | ARBK | |

| Market value | 360.87 million | 222.25 million | 198.21 million | 174.25 million | 92.37 million | 94.03 million |

| Group value | 1.38B | 296.03 million | 196.53 million | 190.94 million | 57.12 million | 219.94 million |

| Total cash | 128.54 million | 45.98 million | 109.97 million | 3.48 million | 44.30M | 11.21 million |

| Total debt | 1.15B | 123.64 million | 108.29M | 20.16M | 0 | 143.63 million |

| Net debt | 1.02B | 77.65 million | -1.68 million | 16.68 million | -44.30 million | 132.42 million |

| Total debt to equity | 275.77% | 36.89% | 24.76% | 5.35% | 1.71% | 71.44% |

Source: Seeking Alpha

Like Core Scientific, Argo Blockchain has a debt to equity position significantly higher than most peers. At the end of Q2, Argo had $53.4 million in short-term loans, $15.3 million in accounts payable, $14.9 million in combined cash and receivables, and just $14.4 million in revenue for the quarter.

Similarities to Core Scientific

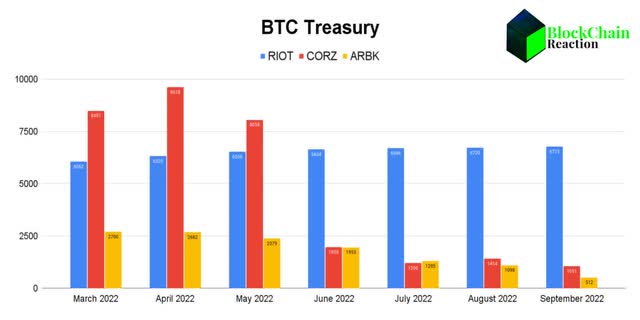

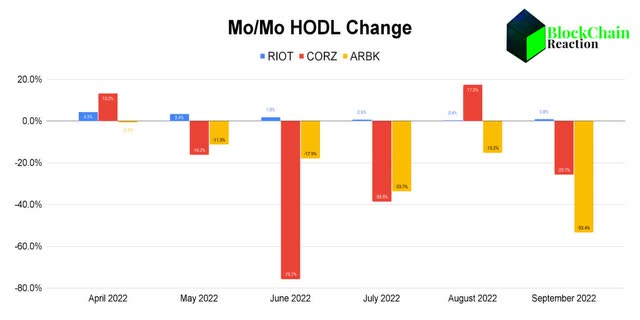

There were tea leaves to read before Core revealed that it cannot service its equipment commitments next month. A big indication that Core was in trouble was the aggressive selling of Treasuries from May to June. Core sold roughly 75% of its BTC stack during that time period, but the peak in the company’s treasury actually occurred in April. We can see some similarities in Argo. I’ve added another Bitcoin miner Riot Blockchain (RIOT) as a barometer to show that not all miners have sold off their Treasuries this year:

BTC holdings (company releases)

Argo had 2,700 BTC in March and only 512 BTC at the end of September. While Argos BTC sales started a bit earlier than Core, we see Argos BTC sales becoming more aggressive in recent months:

Monthly HODL change (company releases)

Argo sold down by 34% in July and by 53% in September. While Argo’s withdrawals have been slower than Core Scientific’s for the past 6 months, the company is running out of BTC to sell to raise funds.

Baby bonds collapse

But it’s not just the decline in the company’s Bitcoin coffers or machine sales that I think are the most worrying indicators for Argo. If the market expected Argo to survive the crypto winter, I don’t think the ARBKL baby bond shares would be trading at 51 cents on the dollar:

1 year ARBKL share return (Seeking Alpha)

The 90% reduction in the price of ordinary shares is bad. But the collapse of ARBKL shares is worse from an optical perspective in my view. These shares have a value of $25 and yield 8.75% at par. At a current share price of $12.75, ARBKL trades at a 49% discount to par and offers a yield of 17.15%. This is either a big opportunity or a clear sign that the market doesn’t think Argo can pay its bills. I’m guessing it’s the latter.

Risks of going short

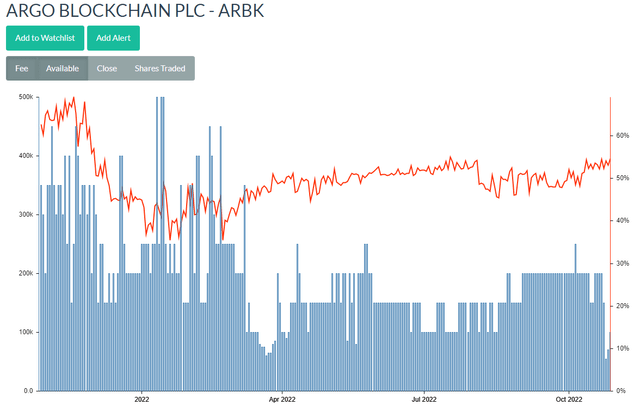

Although I think Argo Blockchain is in a race against time, I would only be short of a 90% sale if you are a very experienced trader. Argo’s success is still tied to Bitcoin at the end of the day. According to iBorrowDesk, available stocks have also decreased in recent days and borrowing costs have increased:

ARBK (iBorrowDesk)

While the fundamentals look dire for Argo, sentiment could change if Bitcoin starts to rise and profitability in the sector picks up. I am of the opinion that there are more miners who will do better if BTC really turns it around, but a short position in ARBK can be wiped out very quickly if BTC has a sustained bear market rally and there are reasons to suggest a move that is possible. If you go short ARBK you may want to go long one of the better positioned miners as a hedge.

Summary

The biggest problem for every Bitcoin miner at the moment is the margin squeeze from low BTC prices. If you are of the opinion that Bitcoin is going lower, then I think Argo Blockchain is very likely the next listed miner to take a dive. The company has a high debt load, high costs, is selling assets for cash, has very little BTC left to sell, and has baby bonds priced at 50% of face. Even if Bitcoin rises, there is a chance that ARBK shares will still go down through dilution if the company decides to raise capital through an IPO. If you are long, I would sell and move on. If you want to shorten it, I’d wait for a price markup and pounce.