How the Government Can Come for Your Bitcoin – Bitcoin Magazine

This is an opinion piece by Robert Hall, a content creator and small business owner.

Link to embedded video.

The popular thought among bitcoiners is that bitcoin adoption will be a seamless transition to a bitcoin standard. As much as I wish this were the case, governments will not give up their power to print money and control the economic conditions of what they consider their slaves without a fight.

Bitcoin as a monetary network is growing by leaps and bounds every year. An estimated 106 million people worldwide own Bitcoin, and users make around 300,000-500,000 transactions today. Adoption numbers will continue to grow as bitcoin matures and solidifies in the market of ideas.

I can assure you that the authorities are also following this development closely. As bitcoin adoption grows, expect governments to use more tactics to scare you away from owning it or create tax laws designed to punish bitcoin holders. You should also expect outright confiscation and the threat of being thrown in jail.

If bitcoin has been remotely on your radar, chances are you’ve heard negative stories about bitcoin in the mainstream press. The media spreads fear, uncertainty and doubt (FUD) about Bitcoin to prevent you from being interested in learning more about it. The powers that be use sophisticated marketing techniques and narrative control to implant an idea of bitcoin in your mind before you have a chance to do your research.

Here are some examples of FUD from well-known media publications:

“Why Bitcoin Is Bad for the Environment” (Fear)

“Cryptocurrency causes growth in crime” (uncertainty)

“The Brutal Truth About Bitcoin (Doubt)”

All it took was a quick internet search to find these stories. This is the government’s primary weapon to discourage the use of bitcoin, which probably worked for a time – but this is no longer the case. With inflation raging around the world and governments buckling under the pressure of currency depreciation and a strong dollar, people will start looking for a better way to store their wealth.

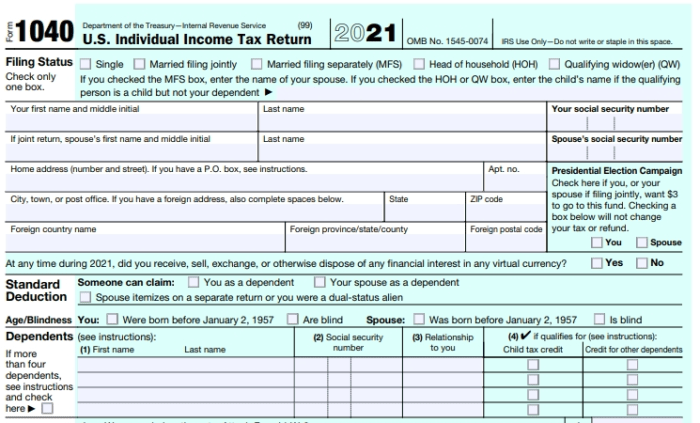

This type of economic environment is ripe for bitcoin adoption on a massive scale. This will cause governments to put further pressure on their citizens who own bitcoin. When governments understand that they cannot stop their citizens from adopting bitcoin, they will most likely try to profit from it by creating confiscatory tax laws to take advantage of bitcoin’s price gains. Don’t think it can happen? It is already a policy in India.

Stealing from the middle class

As recently as May, Democrats and the Biden administration considered a tax on unrealized gains.

“Biden’s tax on unrealized gains will affect far more taxpayers than he claims

India taxes digital assets at 30 percent.

“India’s Cryptocurrency Industry Rolls Like New Tax Hammers”

“Philippines President Marcos Jr. Pushes Tax on Digital Services”

As you can see, this global trend looks set to escalate in the coming years.

If you can’t beat it, ban it.

Bans are the latest and most heavy-handed tool governments will use to discourage the use of bitcoin. This is when you can tell they are petrified of bitcoin. They will pass laws banning the ownership of bitcoin and criminalizing its possession. Numerous countries around the world have followed this path, especially China.

China has been the most aggressive and has a long history of banning bitcoin and other cryptocurrencies.

Nigeria is another example of how governments will attack Bitcoin. They can tell financial institutions to block all transactions related to bitcoin. This may disrupt bitcoin adoption for a while, but bitcoin adoption is unlikely to stop for long.

The situation that many Bitcoiners in America are concerned about is a 6102-type executive order that would ban ownership of bitcoin.

Unfortunately, there is a precedent for something like this to happen. On April 6, 1933, President Franklin D. Roosevelt signed Executive Order 6102, “prohibiting the hoarding of gold coins, gold bars, and gold certificates in the continental United States.”

This essentially banned private ownership of gold in the United States. Executive Order 6102 required all citizens to surrender their gold to the Federal Reserve by May 1, 1933. Violation of this executive order was subject to a $10,000 fine, which is $209,000 in today’s dollars, and 5-10 years in prison.

This is the one thing that should keep every Bitcoiner up at night. What is stopping them from doing something like this in the future? The precedent is set. I’m not sure they need a pretext to seize your bitcoin other than we’re going bankrupt and want to stay in power.

The government knows who owns bitcoin or can find out relatively quickly with the help of the cryptocurrency exchanges. Know Your Customer (KYC) regulations make it easy to see where you live and how much bitcoin you have.

If you are not familiar with buying non-KYC bitcoin, now is the time to learn how to do it. There are a few platforms that make it easy to buy and sell bitcoin without the authorities watching your every move.

HodlHodl and Bisq use the power of multisig storage to make this happen. You can also buy KYC-free bitcoin from ATMs as well. For an in-depth review of how to buy bitcoin from an ATM or use Bisq, check out this article by Bitcoin Magazine contributor Econoalchemist.

Bitcoin businesses must comply with KYC regulations created by the federal government. These rules affect the lives of innocent people they claim to protect. I have been personally affected by the KYC rules and regulations. I will not name the companies in question, but I have had accounts closed, or been unable to open accounts with certain companies for reasons that were never explained to me. If this can happen to me, it can surely happen to anyone.

The state’s power is real and should not be taken lightly. The Bitcoin revolution is real and happening in real time, but there are questions you need to ask yourself. My question to you is: What will you do if the government makes it illegal to own Bitcoin? Should you hand over your bitcoin to the government? Are you willing to risk going to jail for your bitcoin? Are you going to travel?

What will you do if they ban bitcoin and you need food and shelter for your family? Are you willing to work in a black market? I don’t think these are questions that the average Bitcoiner asks themselves – but they should.

The world is unstable and who knows what the future holds for any of us? It’s better to have a plan now than to be caught flat-footed.

In the meantime, continue to be humble and stack your bet.

This is a guest post by Robert Hall. Opinions expressed are entirely their own and do not necessarily reflect the opinions of BTC Inc. or Bitcoin Magazine.