Litecoin [LTC] outperformed Bitcoin [BTC] in this factor

Amidst the current bearish market condition, Litecoin which is often referred to as the silver to Bitcoin’s gold failed to bring joy to investors. The altcoin registered huge gains in the past seven days.

Here is AMBCryptos Litecoin price prediction for 2023-24

More good news came in for LTC as the coin was listed among the top cryptos in terms of Galaxy Score, which is a promising bullish signal.

Current Top 10 Coins by LunarCrush Galaxy Score™:

1️⃣ $collie

2️⃣ $flux

3️⃣ #amplifi

4️⃣ $neb

5️⃣ $clo

6️⃣ $ltc

7️⃣ $wtk

8️⃣ $ocb

9️⃣ $sm

🔟 $amb— JU’MetaAsset (@Jeedjameel) 26 October 2022

In addition, Litecoin was also listed on Blockbank, a CeFi and DeFi platform. This new listing will not only help LTC increase its reach, but will also allow new investors to enter the Litecoin ecosystem.

NEW LISTING: @Blockbankapp crypto users can now buy and trade #Litecoin⚡

— Litecoin (@litecoin) 26 October 2022

Now you might ask if LTC’s pump was due to its ecosystem-centric development, or if it was just a consequence of Bitcoin’s price rise. Well, a look at the calculations will reveal the answer. But one point to note here is that aAs of press time, LTC was trading at $56.52, up nearly 10% from last week, which was higher than Bitcoin’s 7-day value.

Not everyone was in favor

LTC‘s on-chain calculations provided some clarity on the matter, as a few of them supported the increase, while the others indicated a trend reversal.

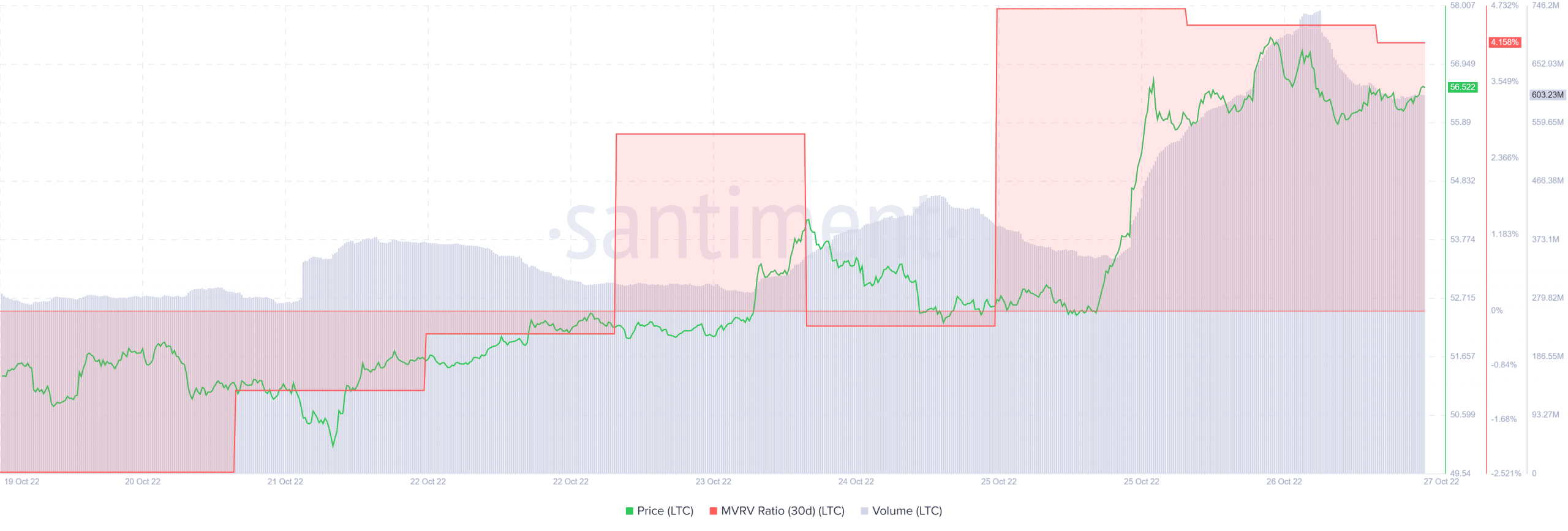

LTC’s MVRV ratio went up significantly in the last week, which is a bullish sign. Moreover, the coin’s volume was also supported as it increased along with the MVRV ratio.

Source: Sentiment

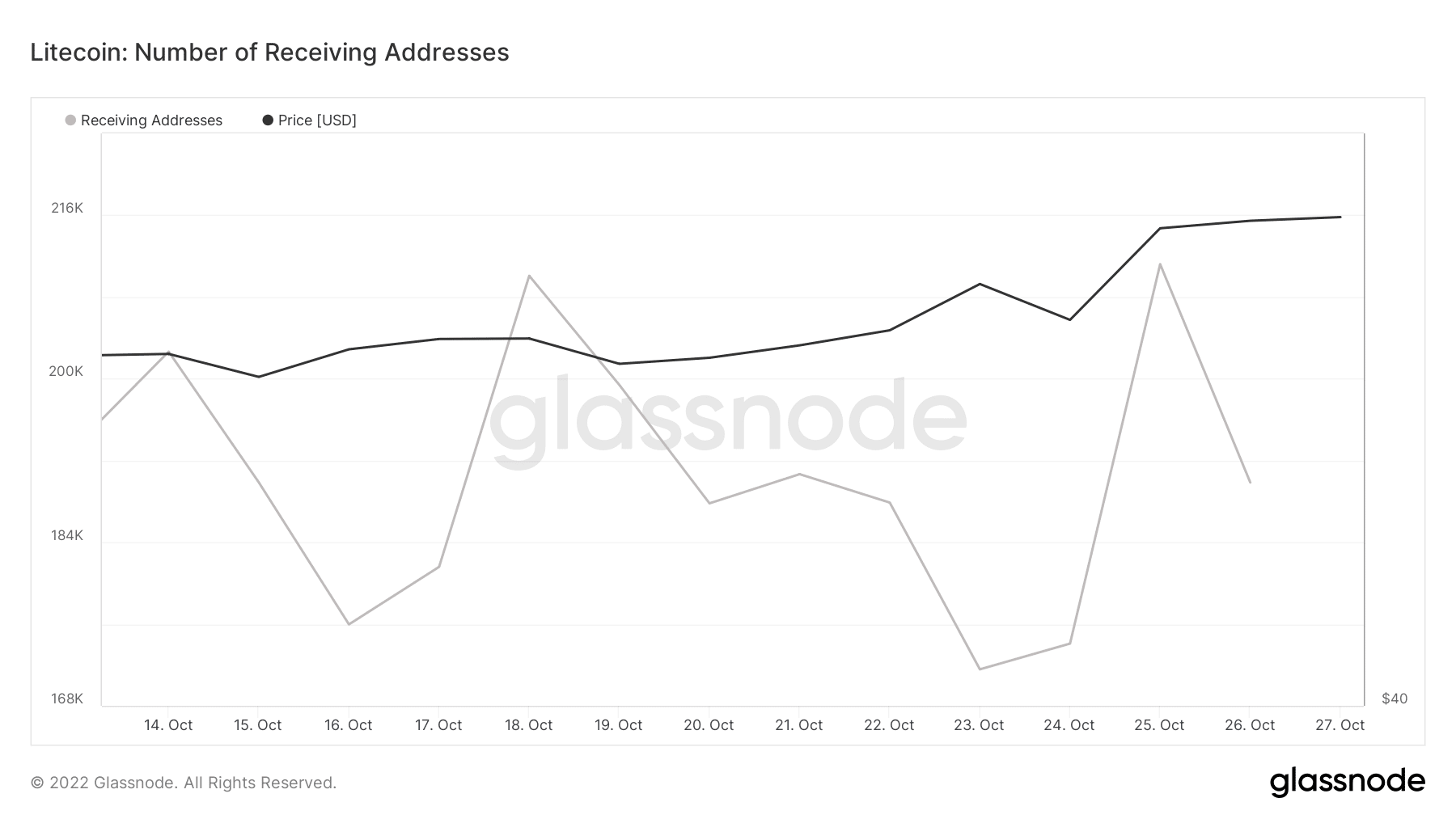

Nonetheless, Glassnode’s data revealed a different story for Litecoin. LTC’s number of receiving addresses registered a decline in the last few days, which is a negative signal.

Not only this, but Litecoin’s reserve risk has increased recently, indicating low investor confidence.

Source: Glassnode

No! LTC’s pump is real

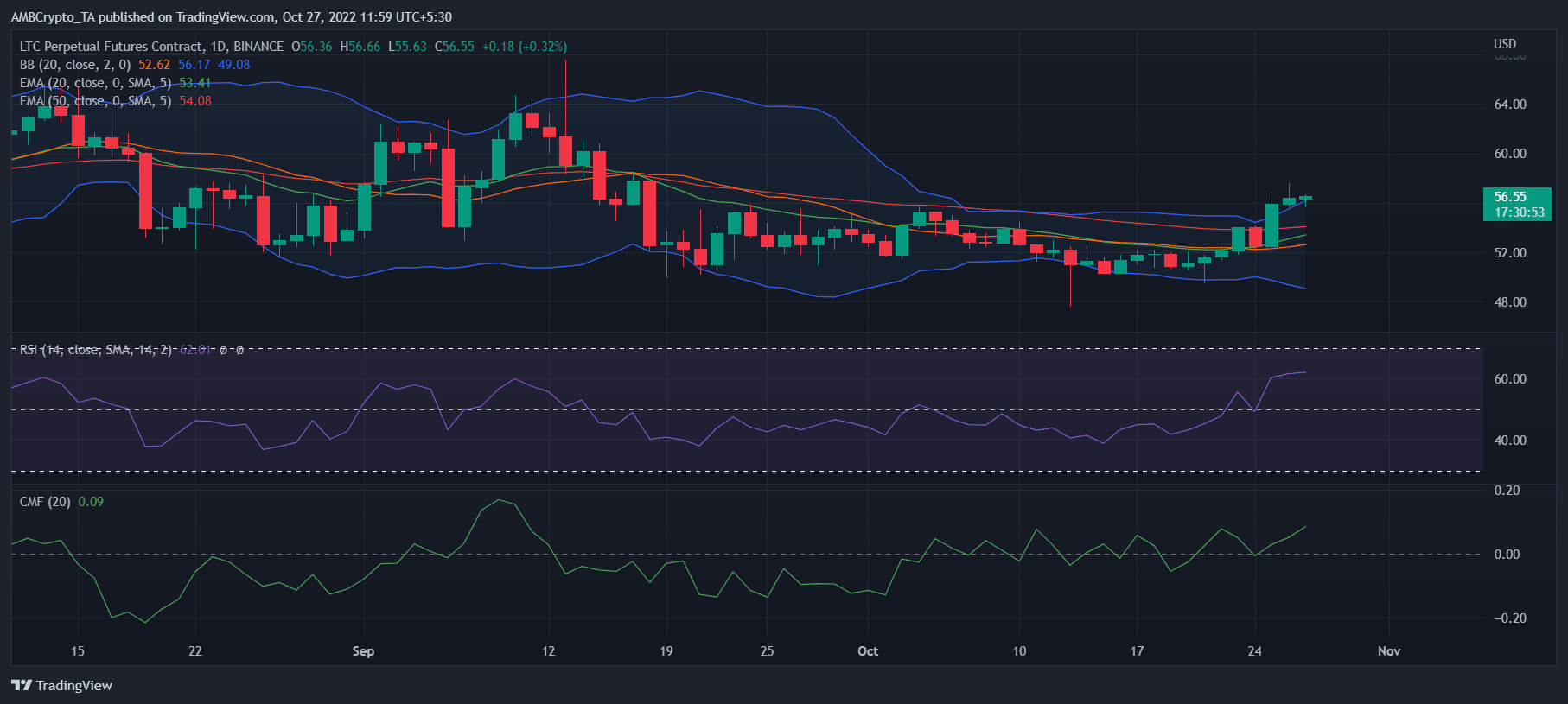

Investors can be happy as LTC‘s daily chart suggested that the pump was not simply a consequence of the bullish market as several market indicators had a further northward move.

Both Relative Strength Index (RSI) and Chaikin Money Flow (FLOW) hovered above the neutral position, which is a bullish signal.

In addition to that, the 20-day exponential moving average (EMA) (green) was rapidly approaching the 50-day EMA (red), increasing the chances of a bullish crossover in the coming days.

Bollinger Bands revealed it LTC’The price was about to enter a high volatility zone. Combining all the market indicators, a continued price rise was likely, which should please investors.

Source: TradingView