Miners are the biggest risk to Bitcoin price – Bitcoin Magazine

Below is an excerpt from a recent issue of Bitcoin Magazine Pro, Bitcoin Magazine premium market’s newsletter. To be among the first to receive this insight and other market analysis on the bitcoin chain straight to your inbox, Subscribe now.

As hash rates rise, parallels to 2018 emerge

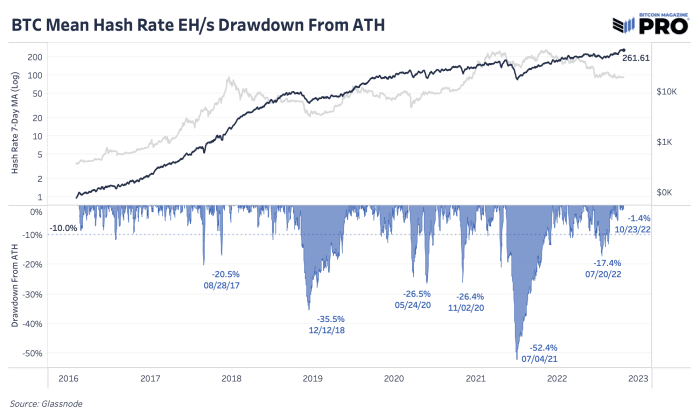

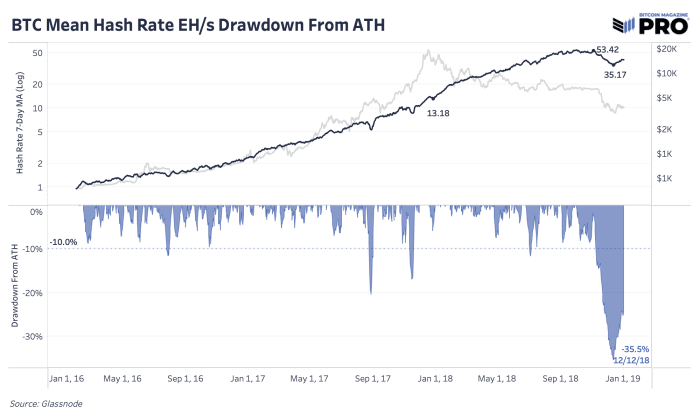

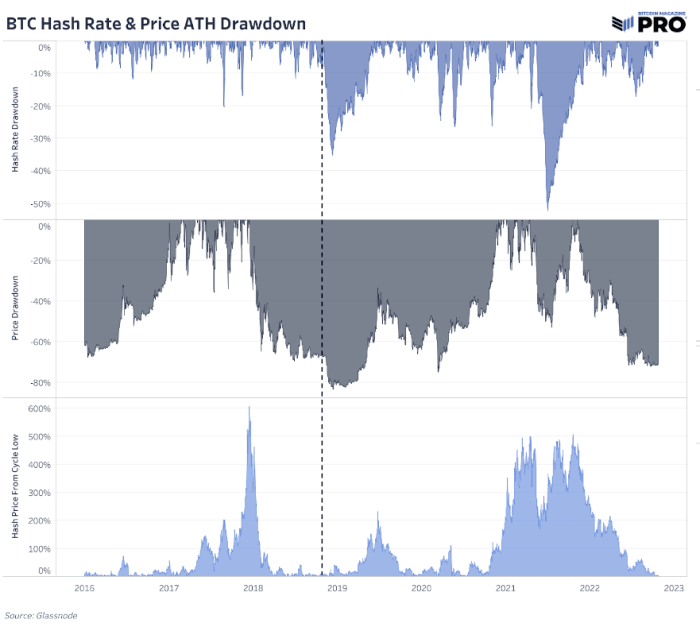

On October 23, bitcoin mining difficulty saw an upward adjustment of 3.44% (after the previous adjustment of 13.55%), pushing mining difficulty to another record high as the hash rate continues to rise. With the price of bitcoin stagnant at $20,000 give or take for the past few months, we’ve noticed some parallels between the 2018 market cycle and the one ahead of us today.

Meme source: Brain’s Mining

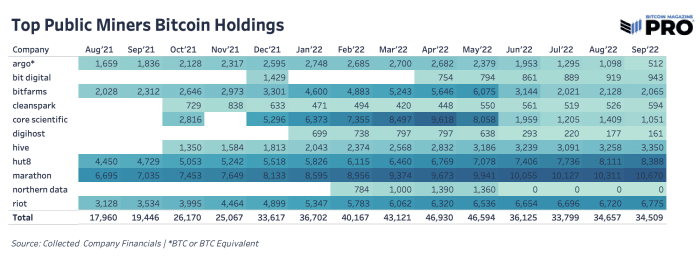

The rising hash rate dynamics seen through 2022 while the bitcoin price has fallen has put a lot of pressure on both public and private mining. Throughout the year, we’ve seen public miners surrender their bitcoin holdings as declining revenues and treasury values put increasing pressure on their balance sheets.

At its peak, public miners’ bitcoin holdings reached over 46,000 BTC, but have since fallen 26% as bitcoin treasure holdings were sold out of necessity to access more capital, pay down debt, and fund operations and expansion plans. Although estimated and rough numbers, the top public miners account for over 20% of all Bitcoin’s hash rate for the network. Moves by public miners to not only sell bitcoin holdings, but also to expand and withdraw their hash rate are having a significant impact on the market.

As the hash price continues to trend to all-time lows, the likelihood of a miner capitulation/liquidation event increases to a drop in hash rate, as certain entities stop mining and liquidate their assets (both in terms of bitcoin and ASIC).

Apart from the mining ban in China during 2021, the largest top-to-bottom drop in hashrate (7d MA) in the history of bitcoin was about 35%. In our opinion, this bear market cycle will not end until a flush of the weakest mining participants has taken place, which will be observed by a temporary but meaningful drop in the hash rate and subsequently reduce mining difficulties, easing conditions for the surviving participants.

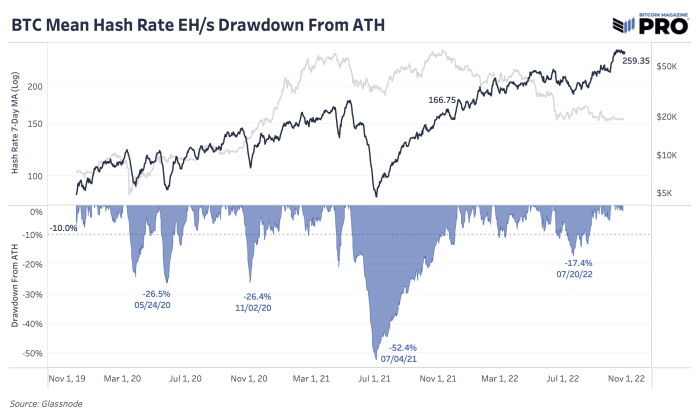

Although it was already a “capitulation” itself earlier this summer during the initial cryptocurrency market payoff in June, the hash rate has since gone vertical, with new fleets of the latest Bitmain Antminer S19 XP, an industry-leading miner, which just now has been distributed a lot by the biggest miners.

Given the current state of hashrate and difficulty, we believe that pressure is indeed building, but the figurative breakout has yet to occur.

The mechanics of a race to the bottom

We could easily see a scenario where further pressure on bitcoin prices and mining industry revenues force more of what was holding bitcoin back into the market along with a significant drop in hash rate. The charts below show the comparison of hash rate, price trajectory and percentage drawdown from 2018 and today.

If there’s a case for the final leg lower, this is it, and our data-driven approach has us leaning towards this having a decent likelihood of playing out. In the chart below, you can observe what happened to the bitcoin market the last time there was a price stagnation after a reduction of this caliber as the hash rate rose to daily new highs (hint: the dashed line).

While history doesn’t repeat itself, it often rhymes, and our data-driven approach means our team is increasingly alert to the pressures this mining industry and subsequently the bitcoin market will face in the near term.

While we are by no means saying this is happening for sure, the higher the hash rate goes while bitcoin the asset itself trades with increasingly subdued volatility levels -71% from the previous all-time high (around when some of the biggest CapEx investments made into mining infrastructure took place), then a final miner-induced capitulation event is increasingly likely to occur. This is not a prediction, but rather an observation based on the data before us.

Relevant previous articles: