Crypto traders face nightmares as each coin consolidates

The global crypto market has shown signs of weakness as most crypto traders are knee-deep in losses. As the once-volatile market yearns for some action, traders are pulling back.

Low trading volumes and unstable macroeconomic conditions have dragged down volatility in the crypto market, as prices of top digital assets move into range. Bitcoin (BTC), Ethereum (ETH) and altcoins were traders’ favorites due to their volatile price action, but these assets are now seeing no small gains or losses.

Crypto market: Risky assets low due to volatility

Cryptocurrencies have often been referred to as risky assets due to their high volatility, but recently Bitcoin, Ethereum and the global crypto market cap have shown signs of stagnation.

The Bitcoin (BTC) price has been trading in a tight price range between $18,800 and $21,500 for over two months now. The top altcoin by market capitalization, Ethereum (ETH), has been trading between a tight range of $1,280 and $1,350.

Both BTC and ETH prices have given almost no room to either bulls or bears as price action maintains a consolidating stance.

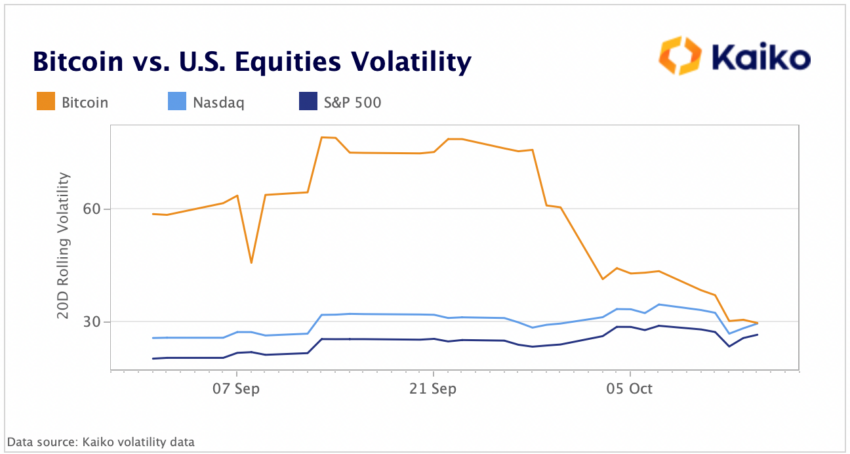

The consolidation is so deep that Bitcoin price action has also become less volatile than traditional stock indices. The S&P Volatility Index, which measures stock volatility, hit a new all-time high while Bitcoin’s volatility neared its lowest level.

Data from Kaiko Research showed that Bitcoin’s 20-day realized volatility was lower than Nasdaq’s for the first time since 2020.

The gap between BTC and stocks’ 30-day and 90-day volatility has been narrowing since the second half of September despite BTC’s higher sensitivity to macroeconomic data.

Retail for crypto traders missing in action

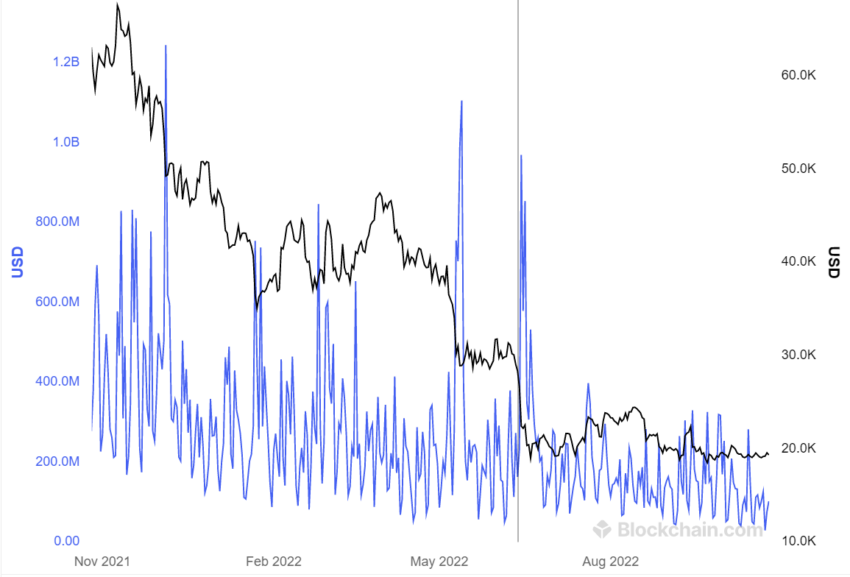

With volatility approaching low levels, retail traders have maintained a quiet stance. Data from Blockchain.com highlighted that total USD trading volume on major Bitcoin exchanges had fallen to a monthly average low of just over $28 million. This is the lowest level since November 2020.

With buyers and sellers in no mood to take risks, trading volumes on centralized exchanges have remained low.

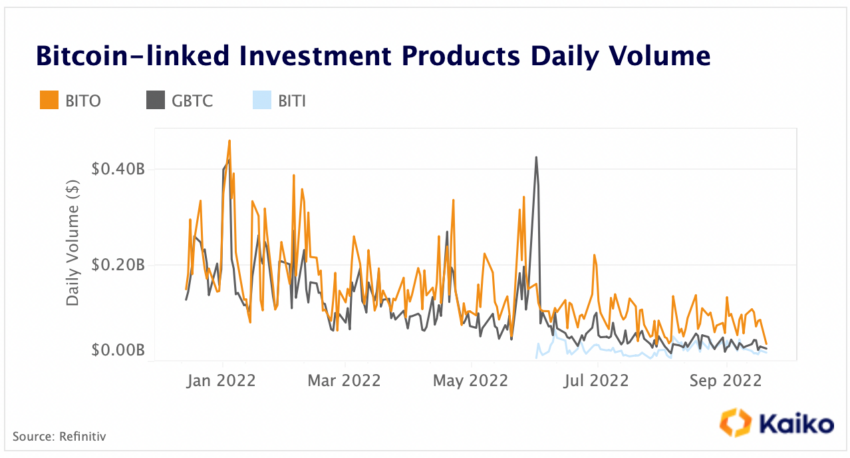

Traders seemed missing in action, but also institutions were not positive on the crypto market. In October, average daily volumes for BTC-linked investment products fell to historically low levels as institutional demand saw a drop.

Grayscale Bitcoin Trust (GBTC) saw the sharpest decline in trading volume, from $400 million in January to $30 million last week.

As the crypto market maintained its eerily calm trajectory, traders were still waiting for a move – positive or negative.

Disclaimer: BeInCrypto strives to provide accurate and up-to-date information, but it will not be responsible for missing facts or inaccurate information. You comply and understand that you should use this information at your own risk. Cryptocurrencies are highly volatile financial assets, so do your research and make your own financial decisions.

Disclaimer

All information on our website is published in good faith and for general information purposes only. Any action the reader takes on the information contained on our website is strictly at their own risk.