Apollo’s Alpha: What Gives Crypto Assets Their Value?

David Angliss, analyst at Australia’s leading cryptocurrency investment firm, Capital of Apolloshares the Fund’s common sense of what is happening in the rapidly changing and volatile cryptocurrency space.

In this week’s Apollo’s Alpha column, we take a break from specific crypto projects as David Angliss has pointed us to some in-depth research put together by his colleague Tim Johnston. And it helps us deal with a pretty damn annoying and hard-to-answer question – what gives crypto-assets* their value?

It’s hard enough trying to explain what blockchain, Bitcoin, Ethereum and DeFi actually are in simple terms, let alone provide an intelligent answer to the crypto-value head-scratcher often posed by those outside the sector’s bubble.

But in detail, Apollo has done an incredible job with it, which we, with David’s help, will try to break down for you here.

(*Note: Apollo Capital generally prefers the term “crypto-assets” to “cryptocurrencies, mainly because it is “a broader and more accurate description”.)

Crypto asset categories

To begin answering the question we headline, Apollo first identifies the basic categories of cryptoassets as such, with Bitcoin in a class of its own entirely:

• Digital gold (Bitcoin)

• Commodity-like crypto-assets

• Equity-like crypto assets backed by cash flows

• Debt-like crypto-assets

• Currency-like crypto-assets

“To understand how cryptoassets become valuable, it may be helpful to see that many are valuable in the same way as traditional assets,” the Apollo analysis said.

And “the value in established asset classes comes from one, or a combination, of”:

• Rights linked to the asset

• Benefit the asset provides

• Believe in the value of the asset

Bitcoin’s value is a strong story

Apollo’s analysis of Bitcoin’s value, which compares the asset to gold, is particularly interesting as at first glance it sounds like the fund manager believes BTC has hardly any value at all. But that is not the case.

“Bitcoin has no rights attached to it. Bitcoin has no intrinsic value. Bitcoin has limited utility – it can be stored, sent and received,” Johnston writes.

“Yet, as we will see, Bitcoin’s value does not come from its use. Despite these limitations, at the time of writing Bitcoin has amassed a value of around $400 billion. Bitcoin is a story – an incredibly powerful story based on what it stands for and its unique characteristics.”

The analysis touches on Bitcoin’s evolution from its anonymously founded origins on the back of the 2008 global financial crisis to the point where it “can stand to accumulate vast amounts of value as a non-sovereign, apolitical form of money or store of value open to all”.

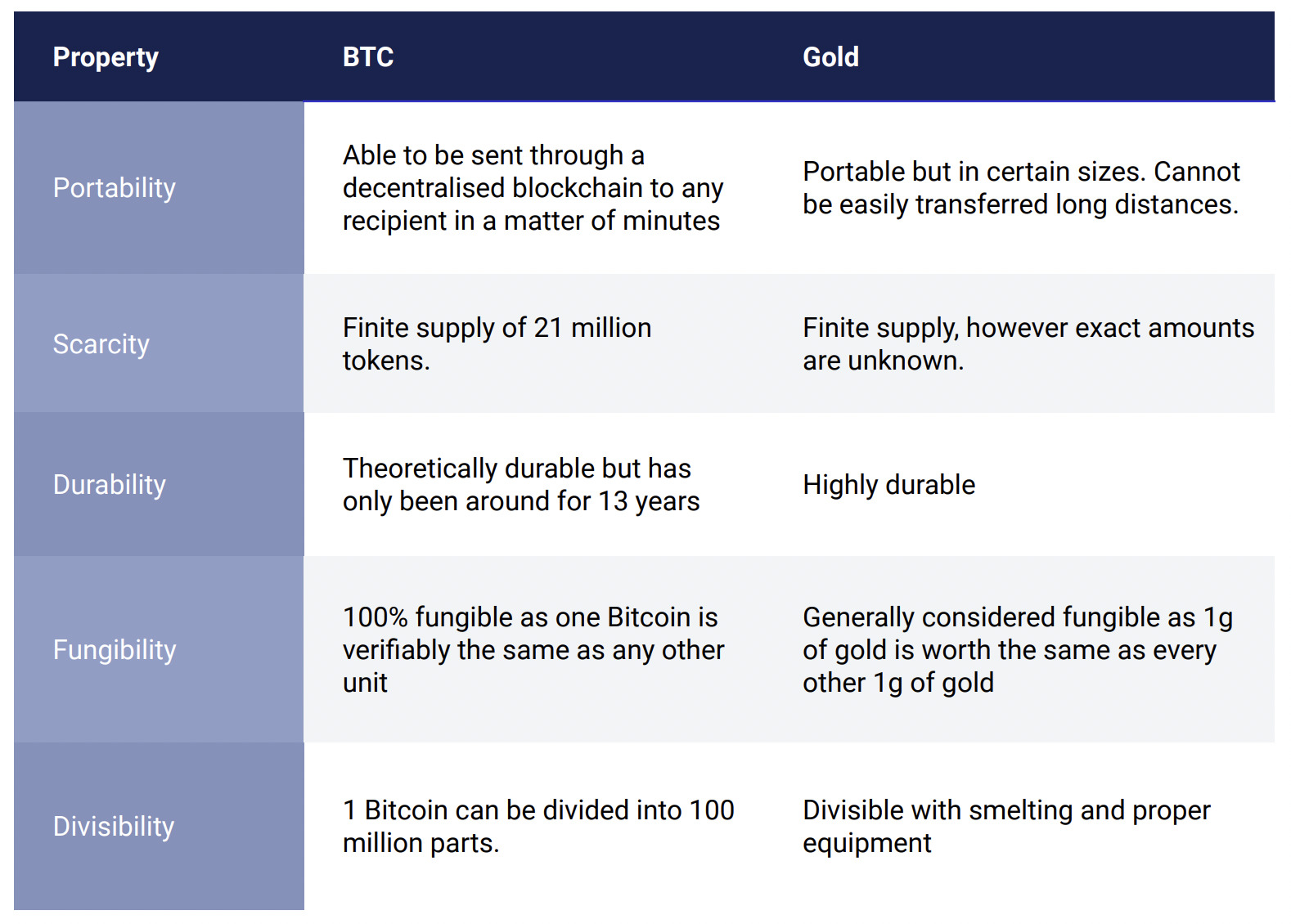

“Many countries around the world are seeking an alternative to the US dollar as the global reserve currency. It is easy to see the appeal of a state-free, independent, global reserve currency. Some might suggest that gold plays this role, but it is limited by its properties , especially its physical nature.”

Apollo compares Bitcoin’s history to the history of currency and gold. Currency also has no “intrinsic value”, says Apollo, but it is a story people believe.

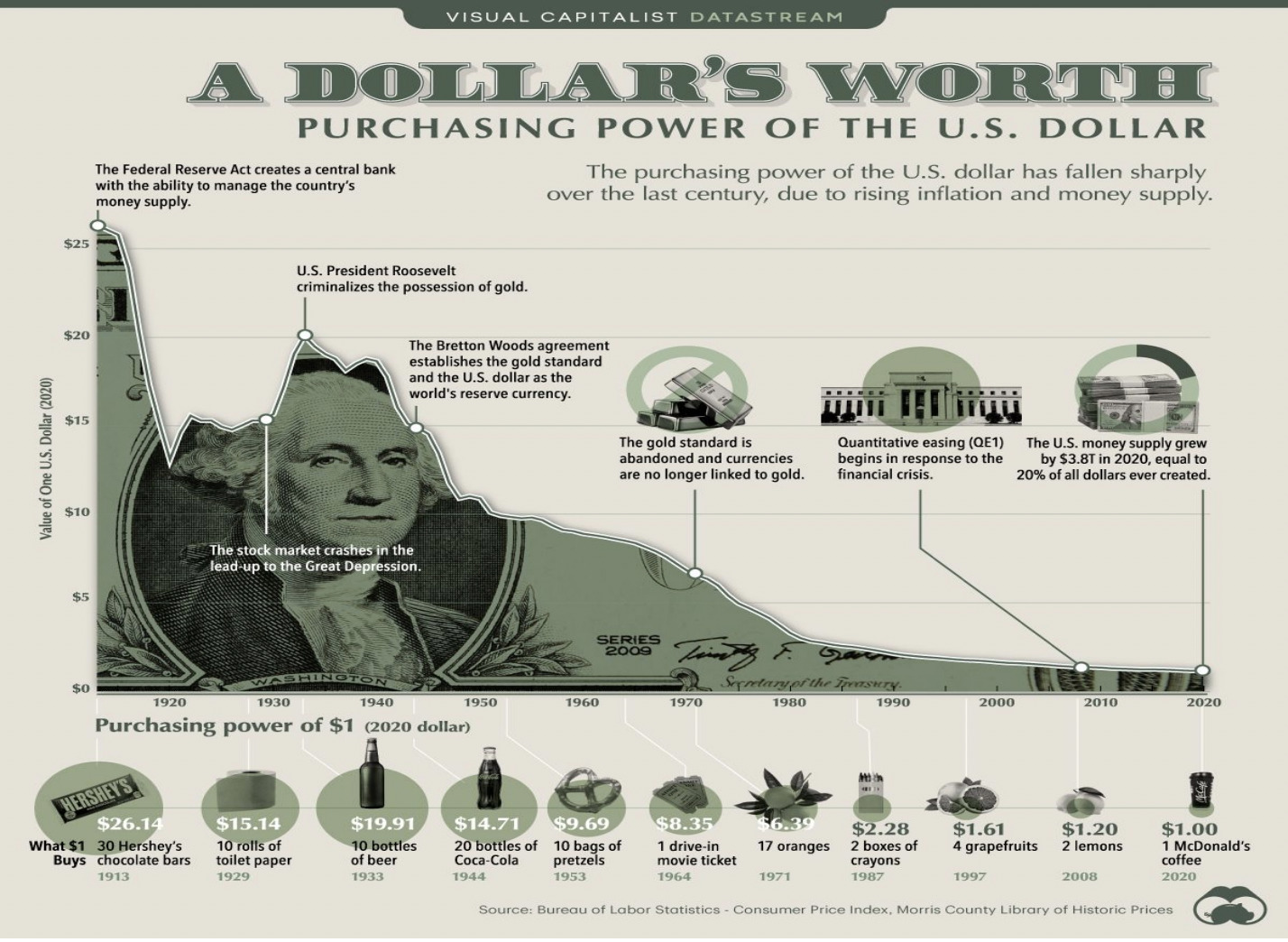

And that’s despite charts like this…

Incidentally, for the purposes of the Apollo report, “assets such as gold, Bitcoin, currencies and commodities generate no cash flows and therefore have no intrinsic value”.

And as the image above shows, the value of the US dollar has fallen dramatically over the past 100 years. “We are confident that it will continue to fall further”, says Apollo.

Gold, meanwhile, is a different story folks believe i. “Gold’s value is ultimately a social construct: it is valuable because we all agree it has been and will be in the future,” the report details.

But Apollo explains (as shown in the chart below) why it believes Bitcoin has become a superior asset by comparison, and why the asset would reach as high as $600,000 per coin if it were ever to achieve the same market value that gold currently enjoys . .

Ethereum as a commodity

Apollo identifies smart contract platforms, also known as layer 1s, as commodity-like assets, and it singles out Ethereum as the bull goose smart contract platform. And with good reason given that the asset has the overwhelming advantage of network effect compared to its growing number of competitors.

Referring to Bitcoin’s relatively limited utility, “Ethereum was developed in part because of Bitcoin’s inflexibility, writes Apollo”, adding:

“We can think of Ethereum as a more flexible, general-purpose blockchain that offers developers and users far greater utility than Bitcoin. We propose that Ethereum is a commodity-like asset whose value comes from demand based on the utility it provides.”

“We can think of Ethereum as the electricity that drives the development and operation of decentralized applications. Ultimately, the demand for both electricity and Ethereum depends on the utility. If people stop demanding electricity due to a construction slowdown, the price will drop.”

Conversely, but as long as people continue to build on and use Ethereum – e.g. for the purposes of decentralized finance, then you would think that ETH’s price would retain or gain value.

DeFi as a stock-like crypto-asset

That is the category Apollo Capital is most interested in, says David Angliss. Simply put, they derive their value from “the rights attached to the assets”.

What does that mean? As the report explains it, “these rights are usually in the form of cash flows that automatically flow to the assets according to the code on which those assets are based.”

“Many DeFi applications are equity-like and backed by cash flows,” the report notes. “Participants in traditional financial markets value stocks as the present value of their future cash flows. If Apple is expected to increase earnings in the future, all else being equal, Apple stock will rise.

“DeFi assets work and accrue value in a similar way. If the expected future cash flows of these applications increase, the value accruing to these tokens will also increase.”

For the purpose of the report, the Apollo DeFi assets use Synthetix (SNX) – a decentralized liquidity protocol for derivatives, and GMX – a decentralized spot and perpetual exchange.

Over the past few months, we’ve covered several other DeFi projects and assets with Apollo that fit into this category, such as dHedge (DHT) and Clearpool (CPOOL).

Debt-like crypto-assets and crypto…currencies

Let’s quickly cover these last two of Apollo’s categories before we head out of here.

We treat them as a bit of a footnote, because Apollo Capital’s investment activities are clearly focused on commodity-like crypto-assets and equity-like crypto-assets. “We believe the utility and applications offered by these assets are groundbreaking,” says the digital fund manager.

That said, they are still major players in the crypto world, and worth a quick dive into to differentiate themselves from the other categories.

Debt-like crypto-assets

Debt-like cryptoassets are also tied to DeFi, Apollo explains — specifically to lending and borrowing-focused protocols like Aave (AAVE), a pioneer in that crypto space.

The assets accrue their value over time, through interest payments from borrowers.

And many decentralized lending protocols have their own debt-like crypto-assets that they distribute to the lenders on the platform. Lenders have the right to these debt-like cryptocurrencies to provide collateralized lending on decentralized platforms.

“The simplest debt-like cryptoassets in DeFi are known as a-tokens,” the report said. “A user receives an a-token when they deposit a crypto-asset into a larger decentralized lending protocol, such as AAVE. An a-token represents a deposit in the lending market, in the same way that a certificate of deposit represents a deposit in a bank with the intention of earn a return.”

Currency-like crypto-assets

Stablecoins are the assets that immediately come to mind here – such as Tether (USDT) and US Dollar Coin (USDC), which are designed to be pegged to the US Dollar.

More generally, “it’s hard to define why currencies are valuable,” says Apollo. “There is no intrinsic value in a $50 bill.”

“It is valuable because the recipient accepts it as such, and unfortunately history is full of examples of currencies becoming worthless.”

Other examples of currency-like assets include cryptoassets that are designed to act as a medium of exchange. And Apollo cites Litecoin (LTC), Bitcoin Cash (BCH) and Bitcoin SV (BSV) as prominent examples.

“We believe it is very difficult for currency-like crypto-assets to achieve significant value, and we do not invest in currency-like crypto-assets,” explains the digital fund manager.

“It is a huge challenge for a volatile crypto-asset to be used as a widespread medium of exchange. We would argue the same for Ethereum and Bitcoin. While currency-like crypto-assets may have high throughput, we believe they are highly unlikely to replace fiat currencies as a de facto medium of exchange.

“Stablecoins are much more likely to succeed as they combine the stability and acceptance of fiat currencies with the digital nature of cryptoassets.”

Of course, this Apollo-led Coinhead summary only scratches the surface of the report, which we recommend reading in its entirety.

Stockhead has not provided, endorsed or otherwise assumed responsibility for any financial product advice contained in this article.