What is Aptos? Inside the new motion-based layer 1 chain

Important takeaways

- Aptos is a new high-speed Layer 1 blockchain that uses a new smart contract programming language called Move.

- The project is billed as the technological successor to Meta’s abandoned blockchain network, Diem.

- Due to its stated theoretical throughput of 100,000 transactions per second, Aptos has been called a potential “Solana killer.”

Share this article

Aptos is a scalable Proof-of-Stake Layer 1 blockchain that uses a new smart contract programming language called Move. The project is developed by Aptos Labs, a blockchain startup led by two former Meta employees.

Aptos unpacked

Aptos is a Proof-of-Stake-based Layer 1 blockchain that combines parallel transaction processing with a new smart contract language called Move to achieve a theoretical transaction throughput of over 100,000 transactions per second. Developed by two former Meta engineers, Mo Shaikh and Avery Ching, the project is considered the technological successor to Meta’s abandoned blockchain project Diem.

Aptos first made waves in the crypto industry in March of this year after it emerged that it had raised $200 million in a seed round led by renowned venture capital firm Andreessen Horowitz. In July, the startup raised an additional $150 million at a pre-money valuation of $1.9 billion in a Series A funding round led by FTX Ventures and Jump Crypto, before reaching a valuation of $4 billion two months later in a venture raise led by Binance Labs.

It is worth highlighting that Aptos did all this before launching their blockchain, which was only published on the mainnet on October 17th. To reward the early adopters of the testnet and fairly distribute the initial token allocation, Aptos sent 150 APT tokens (worth approximately $1,237 at launch) to 110,235 eligible addresses. Per CoinGecko data, Aptos currently has a fully diluted market cap of around $9.2 billion despite launching just a few days ago with little activity on the network. Beyond its origins and links to Meta, the project’s valuation has raised questions.

What makes Aptos special?

From a technical perspective, the driving force behind Aptos boils down to two things: Move, the Rust-based programming language independently developed by Meta, and the network’s unique parallel transaction processing capabilities.

Move is a new smart contract programming language that emphasizes security and flexibility. The ecosystem includes a compiler, a virtual machine, and many other developer tools that effectively serve as the backbone of the Aptos network. Although Meta originally wanted Move to power the Diem blockchain, the language was designed to be platform-agnostic with aspirations to evolve into the “JavaScript of Web3” in terms of usage. In other words, Meta intended Move to become the preferred language for developers to quickly write secure code involving digital assets.

Using Move, Aptos was built to theoretically achieve high transaction throughput and scalability without sacrificing security. It utilizes a pipelined and modular approach for the critical stages of transaction processing. For context, most blockchains, especially the best ones like Bitcoin and Ethereum, execute transactions and smart contracts sequentially. Simply put, this means that all transactions in the mempool – where all submitted transactions await confirmation from the network’s validators – must be verified individually and in a specific order. This means that the growth of the network’s computing power does not translate into faster transaction processing because the entire network is effectively doing the same thing and acting as a single node.

Aptos differs from other blockchains in its parallelized approach to transaction processing and execution, meaning that the network utilizes all available physical resources to process many transactions simultaneously. This leads to much greater network throughput and transaction speeds, resulting in significantly lower costs and a better user experience for blockchain users. Aptos expands on this issue in its technical whitepaper:

“To maximize throughput, increase concurrency and reduce technical complexity, transaction processing on the Aptos blockchain is divided into separate stages. Each stage is completely independent and individually parallelizable, resembling modern superscalar processor architectures. Not only does this provide significant performance benefits, but it also enable Apto’s blockchain to offer new modes of validator-client interaction.”

But while Aptos claims to have already achieved 10,000 transactions per second on its testnet and is aiming for 100,000 transactions per second as its next milestone, users should take the claims with a grain of salt as they are yet to be battle-tested. Other Layer 1 networks and sidechains making similar claims, including Solana and Polygon, have had a number of network outages since their inception and have otherwise been criticized for being too centralized.

Questionable Tokenomics

On October 17, Aptos sparked significant outrage in the crypto community when it launched its blockchain and native governance and utility token APT without first disclosing its total supply, distribution or issuance rate to the public. After APT’s price fell by about 40% in its first trading hours, Aptos tried to correct its mistake and calm the community’s fury by revealing tokenomics.

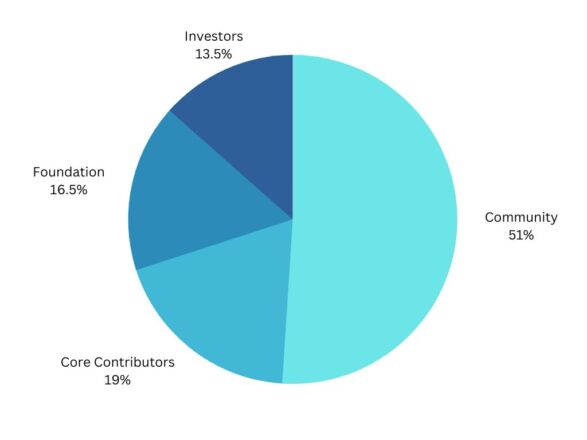

Despite the generous airdrop to over 100,000 addresses, the move towards transparency was met with even more outrage after the community learned that the entire token supply was allocated to early investors and the company. Namely, instead of giving the community the 51% of tokens allegedly allocated to it directly, either through airdrops, grants or stake rewards, Aptos allocated them to Aptos Labs and the Aptos Foundation. Furthermore, according to the team’s blog post, “82% of tokens on the network are staked across all categories,” meaning the company and early insiders will earn the most stake rewards that are not subject to lock-in.

Beyond that, Aptos currently has a circulating supply of 130 million tokens, a total supply of 1,000,935,772, and an unlimited maximum supply. According to the official token supply schedule, the inflation rate will start at 7% and decrease by 1.5% annually until it reaches an annual supply rate of 3.25% (expected to take over 50 years). The transaction fees will initially be burned, although this mechanic may be revised through governance voting in the future.

Is Aptos the next Solana killer?

Despite being on the run for less than a week, Aptos has already been heralded as a potential “Solana killer.” This is primarily due to its stated throughput of 100,000 transactions per second. By comparison, Solana can only handle around 60,000 – but it suffers from network-wide outages on a regular basis.

Beyond its high scalability, Aptos shares other similarities with Solana, including its strong venture capital backing and top-down approach to ecosystem building. With a multi-billion dollar war chest from the start and the allure of being the “shiny new thing,” Aptos could well steal Solana’s spotlight in the future if it can develop a thriving ecosystem. Besides, it should certainly help with that Austin Virtsthe former marketing manager at Solana, is now responsible for ecosystem building at Aptos.

All things considered, Solana is still miles ahead of Aptos in terms of ecosystem health and network adoption. By keeping its tokenomics opaque and allocating most of its supply to early investors and insiders, Aptos began its crypto journey on shaky terms with the crypto community, which could hurt it in the long run. But if Aptos delivers even half of what it set out to achieve on the technology front, it has a chance to take significant market share from all other smart contract-enabled Layer 1 networks.

Disclosure: At the time of writing, the author of this feature owned ETH and several other cryptocurrencies.