USD strength and rising yields are holding Bitcoin back

Bitcoin Fundamental Forecast: Neutral

- BTC/USD constrained by rising interest rates and USD strength.

- Bitcoin weathers headwinds, but can prices break current range?

- BTC volatility drops below stocks for the first time since 2020.

Recommended by Tammy Da Costa

Get your free forecast for best trading opportunities

Fed Pivot, Rising Yields and USD Strength – What’s Driving the Markets?

As the Federal Reserve continues to raise interest rates at the most aggressive pace since the 1980s, rising interest rates and USD strength do not bode well for risk assets.

In an environment where persistent inflation, hawkish central banks and economic uncertainty continue to drive sentiment, cryptocurrency and stocks remain vulnerable to geopolitical risks.

Visit DailyFX Education to learn about the role of central banks in global markets

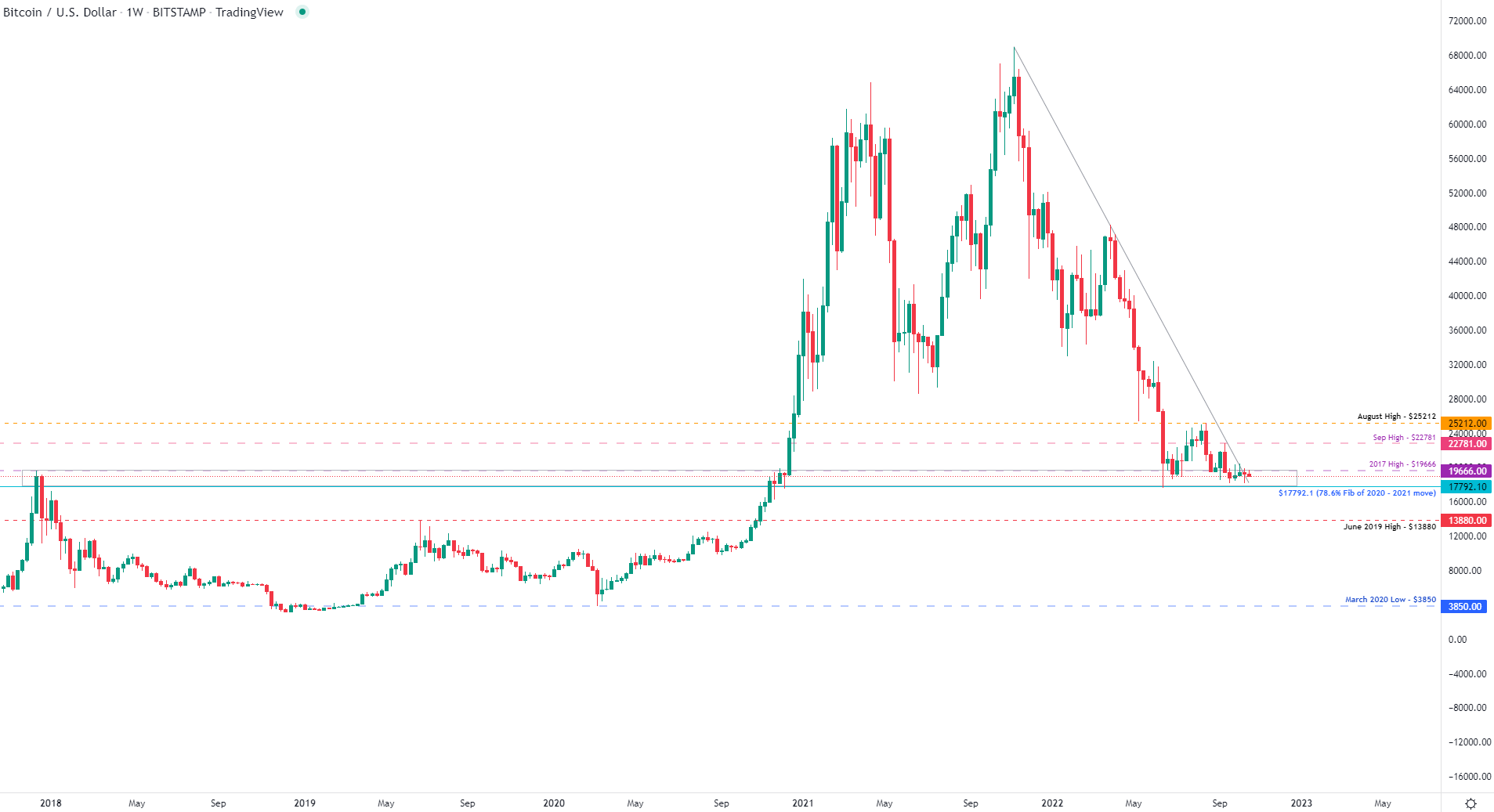

Having lost 74.5% of its value since the November peak of $69,000, a bounce from the June low ($17,592.78) allowed bulls to drive prices higher before reaching another resistance barrier at $20,000.

Recommended by Tammy Da Costa

Get your free Bitcoin forecast

Although cryptocurrency is known for its erratic behavior and large price swings, BTC volatility has fallen below US stock indices for the first time since 2020.

With markets already pricing in another 75 basis point interest rate hike in November, any surprises from the economic calendar or a breach of the current range could allow Bitcoin to establish a new directional bias.

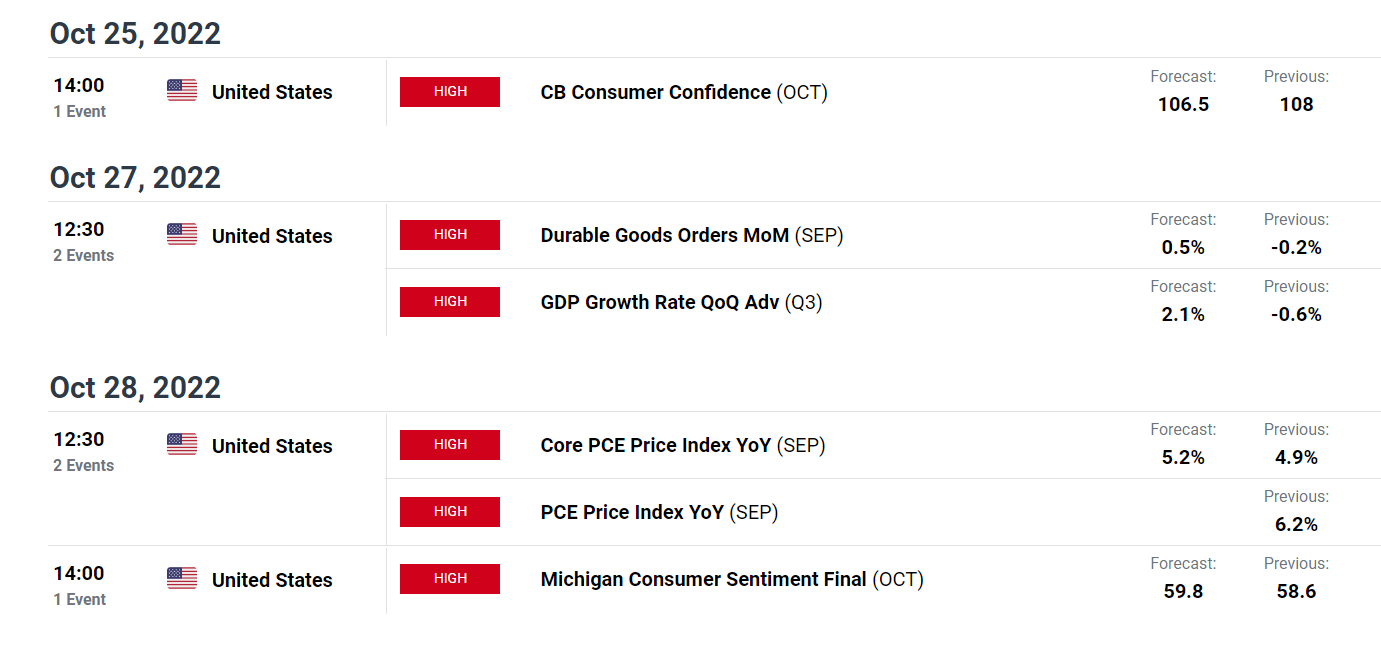

DailyFX Financial Calendar

Bitcoin (BTC/USD) Technical Analysis

With recent price action consolidating between $18183 (monthly low) and $19666 (Dec 2017), further selling pressure and an increase in bearish momentum below $17592 (June low) could see prices fall back towards $16000.

Bitcoin (BTC/USD) Weekly Chart

Chart prepared by Tammy DaCosta using TradingView

Bitcoin key levels

| User support | Resistance |

|---|---|

| S1: 18183 (Current monthly low) | R1: 19666 (December 2017 high) |

| S2: 17792.1 (78.6% Fib 2020 – 2021 move) | R2: 20,000 (Psychic Level) |

| S3: 17592.78 (June low) | R3: 22718 (highest September) |

Trade smarter – Sign up for the DailyFX newsletter

Receive timely and compelling market commentary from the DailyFX team

subscribe to newsletter

— Posted by Tammy Da Costa, Analyst for DailyFX.com

Contact and follow Tammy on Twitter: @Tams707