FinWise: An Unknown, Low-Cost, Growing Microcap Fintech Firm (NASDAQ:FINW)

Viorika

Get to know FinWise

FinWise (NASDAQ:FINW) share price is too cheap for a fast-growing fintech company and deserves to compete for a place in your portfolio. FinWise is ripe for a price rise as it becomes more well known (11/2021 IPO) and operates from the miscategorized microcap shell ($117M).

On the surface, FinWise is categorized as an operation of the factory regional bank, but their operation of factory services accounts for less than 4% of their revenue. FinWise would be more properly categorized as a financial technology bank that offers online lending services.

FinWise has not always been more than a regional bank as the fintech transformation started in 2010 when there was a change in management. Kent Landvatter came up with and changed the firm’s strategic direction towards developing exponentially scalable lending services. It took a few years to make the adjustment, but in 2014 FinWise launched their SBA 7(A) small business loan program, and in 2016 they rolled out FinView Analytics and their Strategic Partners Loan program.

FinWise scaling

These two new lending programs have grown dramatically and now account for more than 95% of FinWise’s revenue.

Sources of non-interest income ($20 million) in the first half of 2022 were:

-

77% strategic loan programs

-

20% SBA 7(A) Lending

-

3% lending for residential and commercial property

-

0.4% POS lending (growth opportunity)

Strategic loan program

FinWise’s largest, youngest and fastest growing industry is the strategic loan programme. FinWise works with various technology companies that streamline their lending process, but may not have the ability or the right licenses to make the loans. FinWise creates the loans and then sells +99% of them back to its various partners. When FinWise does this, they earn a fee and they collect data that powers their FinView analytics platform. Fee income from these partnerships has grown by more than 85% in the past half year compared to $6.9 million to $12.8 million.

In the short term, revenue may fluctuate, but with FinWise continuing to add 2-3 partners per year, I expect growth to continue in the long term. FinWise currently partners with: Upstart, Edly, American First Finance, Mulligan Funding, Great American Finance, OppLoans, Lending Point, Rise, Reach Financial and Empower.

FinWise is building a moat

In their strategic programs, I found that Cross River Bank was a direct competitor to FinWise as I found that they originally held 70% of Upstart’s loans, while FinWise only held 25%. I continued to track FinWise vs Cross River Bank over time and FinWise was gaining market share. According to KBRA on February 24, 2022, 62.7% of Upstart’s loans were originated by Cross River Bank and 18.77% by FinWise. Then checked back on April 12, 2022, FinWise gave 40.25% of Upstarts loans and CRB was at 59.75%. FinWise started 5 years later than CRB origination loans for Upstart and FinWise continues to gain market share. According to Upstart, the plan is for CRB and FinWise to be used 50/50 going forward as stated in KBRA’s report from June 3, if the loan fits within both banks’ origination requirements they (Upstart) will send for origination from each bank “randomly”.

The second largest line of business for FinWise is their Small Business Associations loan program where they originate, hold and sell SBA loans, most of which are sourced from the Business Finance Group (BFG). To protect this relationship and the business, FinWise acquired a 10% stake in BFG and has negotiated an option to buy them outright and a first right of refusal until January 1, 2028.

Interest income – another competitive advantage

In the first half of 2022, FinWise generated $13 million in interest income and $9 million in non-interest income from its fees and gains on loan sales. So not only do FinWise benefit from origination fees, service fees and upsell loans, they also have first choice on loans they originate. This can be seen in the fact that FinWise had $2.1 billion last quarter, but chose to keep less than 1% ($1.8 million) of those loans that originated on their books.

How FinWise stacks up

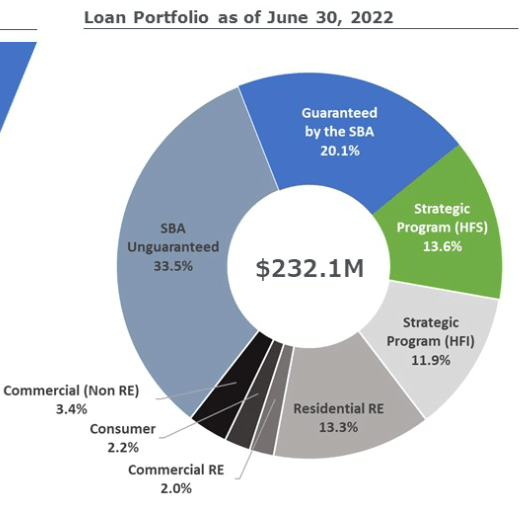

FinWise is categorized as a regional bank, but 97% of their non-interest income and 80% of their loan portfolio comes from their fintech business lines. The loan portfolio as of 30 June 2022 is below.

Subtly

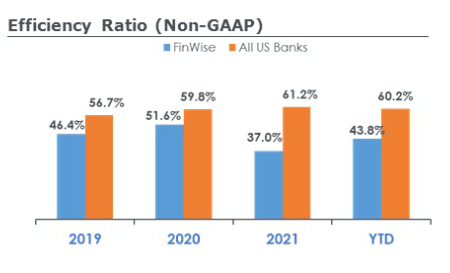

If I’m right in uncovering a potential gem, they should stand out in a few metrics when I compare FinWise to the average bank. Let’s see where they stand in terms of efficiency and interest margin compared to the average US bank. I expect FinWise’s efficiency to be excellent if the technology and software they have built works and makes FinWise a more efficient bank. FinWise’s efficiency rate so far in 2022 is 43.8% (efficiency rate is defined as the total non-interest expense divided by the sum of net interest and fee income). As Investopedia puts it “An efficiency ratio of 50% or less is considered optimal.” So far in 2022, FinWise is at 43.8% compared to the average US bank at 60.2%.

Subtly

So FinWise is considered to be efficient, now let’s see if they earn a premium on the loans they have in house by choosing the best of the best by looking at net interest margin. As of June 30, 2022, the average net interest margin for US banks was 2.7% and FinWise was 13.5%.

Subtly

It appears that FinView, FinWise’s internal analytics platform is working as FinWise’s net interest margin was 5x the average. (So far 0.3% of their loans are past due).

Danger

Although I try to paint the picture that FinWise is a fintech company, I don’t want to give any impression that they don’t have banking risk. Their current loan portfolio consists of $233 million, of which only 33.7% is guaranteed, 20.1% by SBA and 13.6% by their strategic partners. As the Federal Reserve works to bring inflation under control, we may get a good stress test sooner rather than later on FinWise’s loan portfolio. Seeking Alpha’s editors may not like me adding this to the article, but I think it’s worth mentioning that default risk is real, and that’s the primary reason I don’t have more.

Management – Reduces our risk

Default risk is never good, but it helps to know we’re in this boat/rocketship together. Insiders own 24% of the outstanding shares.

FinWise’s share structure is:

- 13,567,311 diluted shares – includes 170,558 warrants @ $6.67 and 619,516 stock options not yet exercised.

- No preference shares or minority interests

CEO Kent Landvatter owns 6.8% of the company. His leadership and proven track record is accompanied by Cannon, COO who has over 20 years of banking experience, including Vice President of Operations at EnerBank where she helped build a point of sale (POS) lending program from 23 to 285 full-time employees and from $10 million to $1.4 billion in total assets. POS is only 0.4% of FinWise’s current fee revenue, but is another growth opportunity not included in my valuations below.

A few more tailwinds for FinWise not mentioned earlier

FinWise announced a share buyback program to buy up to 5% of their outstanding shares (August 2022)

FinWise’s direct competitor Cross River Bank is private and harder to understand, but it’s worth mentioning that they recently raised $620 million, at a $3 billion valuation.

The POS software market FinWise is entering is worth more than $9 billion and is expected to grow.

The Peer to Peer Marketplace that FinWise serves is expected to grow at nearly 15% CAGR and reach $5.1 billion by 2032.

The 180-day lock-up period for shares after the IPO ended in May, and if there was any selling, it could soon taper off.

Valuations

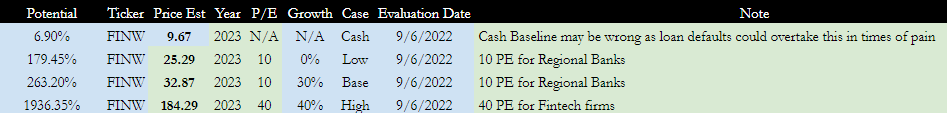

There are many great and growing businesses that are known and priced that way, but fortunately for us, FinWise is not there yet. FinWise is almost 3 times cheaper than the average mutual bank by P/E (10 P/E for the iShares US Regional Banks ETF) and FinWise is 11 times cheaper than your average fintech company with an average P/E of 40 (FINX Global X FinTech ETFs).

My base price estimate for FinWise is $32/share, of which is based on a P/E of 10 (regional bank average) and 30% year-over-year growth. My low price target is their cash value of $9.67 and my high price target is $184, which is based on 40% year-over-year growth and a multiple in line with their fintech peers.

Share price forecast FINW (author)

Conclusion

In conclusion, FinWise appears to be an undervalued, unknown, growing and profitable banking/fintech firm. If FinWise’s loan portfolio remains strong through the current stress test and this story becomes better known, I think FinWise’s valuation could go 10x and still be cheap compared to its fintech peers.