FT Cryptofinance: JPMorgan turns to ex-Celsius head of crypto advisory

Welcome to this week’s edition of the FT’s Cryptofinance newsletter. Today we take a look at JPMorgan hiring a former Celsius lobbyist.

The revolving door in Washington between government and the private sector, and opponents, is a fact, but every now and then there is one move that causes gasps.

This week, JPMorgan Chase hired Aaron Iovine, a former executive from crypto-lending platform Celsius Network, as its new managing director of digital asset regulatory policy.

Yes, America’s largest bank by market capitalization is hiring the chief lobbyist from a company that froze customer funds and filed for bankruptcy protection this summer. It is currently fighting creditor claims in court and may yet face questions from regulators about who knew what and when, before customers were locked out.

To be clear, there is no evidence to suggest that Iovine was involved in crucial decisions at Celsius, or even the day-to-day running of the company. A lobbyist is not a C-suite position.

Iovine did not respond to a request for comment, but his LinkedIn profile tells us throughout his career he has focused on “developing policies that promote responsible innovation while emphasizing consumer protection and regulatory oversight.”

Still, it’s quite an appearance for JPMorgan to hire someone from one of the most controversial stories in the crypto industry this year. Crypto is still an upstart, garnering a lot of investor interest, but adoption is still very limited. JPMorgan is financial services royalty.

“If you’re a member of Congress and you’re on the fence about crypto, and the person sitting across from you was affiliated with a company that’s at least among the five spectacular flames of the crypto industry to date, it has to take away what you hear from that person ,” a former regulator familiar with the inner workings of the Capitol told JPMorgan, declining to comment on Iovine’s hiring.

Also, the average politician could be forgiven for feeling mixed messages coming from JPMorgan. Jamie Dimon, the bank’s CEO, has long voiced his sentiments on crypto.

Just last month in his congressional testimony, Dimon said: “I’m a big skeptic of crypto-tokens, which you call currency like bitcoin. They’re decentralized Ponzi schemes, and the notion that it’s good for anyone is unbelievable,” before linking them with ransomware, money laundering, sex trafficking and theft, for good measure.

But perhaps JPMorgan and the crypto world have more in common than meets the eye. In many ways, Dimon is a more charismatic, traditional finance version of the crypto bosses who readily offer their views on a variety of issues while their organization appears to be doing something quite different. If anyone points it out, they seem to be channeling the spirit of the poet Walt Whitman — Am I contradicting myself? Very well then, I contradict myself (I am large, I contain quantities).

When it comes to regulation and Washington, both sides seem to want the same thing: clarity. For crypto firms, there is usually legal precision about what counts as a security. For banks, this definition is also important, but only in connection with the finalization of the Basel rules on capital requirements for holding crypto-assets.

In the absence of these rules, banks cannot hold crypto on their balance sheets, which is usually a prelude to trading it on behalf of a customer. But that doesn’t mean they can’t offer anything else the customer wants, from advice to payments to research. Dimon didn’t get to where he is by putting personal views ahead of his clients’ interests.

Celsius was, if nothing else, a very consumer-focused business. The appointment emphasizes that the debate about future regulation of crypto has gone up a notch in the wake of this year’s crypto credit crisis. There are plenty of lessons to be learned about consumer advertising and asset ringfencing, for example.

If so, one can see why JPMorgan might hire people with the most relevant experience. After all, everyone in Washington wants a level playing field tipped in their favor.

What is your view on JPMorgan and Celsius? Email me your thoughts at [email protected].

Weekly highlights

-

Buried in a document from the European Commission on “digitalisation of the energy system” is a line that could have consequences for proof-of-work blockchains. After the successful merger last month, the EU said: “This switch shows that the crypto world can move towards a more efficient system. But we need to go the extra mile for this to happen.” It strikes me as an early warning shot across the bitcoin bow — some in the EU may not give up on banning proof-of-work blockchains.”As long as you continue to support these markets, you’re still enabling their massive carbon footprint,” Digiconomist told – founder Alex de Vries to me.

-

BNY Mellon, one of the world’s largest custodian banks, is “now live” with its service to hold digital assets on behalf of clients, President and CEO Robin Vince said on an earnings call. Currently, it is only available in the US. Vince went on to add that the bank “didn’t invest in this space just for the purpose of storing crypto. We see this as the beginning of a much broader journey.”

-

Payments giant Mastercard this Monday announced Crypto Source, a program designed as a bridge that allows banks to offer crypto trading opportunities to their customers. The announcement, which builds on the company’s partnership with Paxos, is still being prepared for pilot programs, but it made waves across the industry. ETC Group founder and co-CEO Bradley Duke described the BNY and Mastercard moves as a “big vote of confidence in the future of crypto”.

Soundbite of the week: Liz Truss on crypto

OK, this tweet is from January 2018, but it’s been a week of political upheaval in the UK (to say the least) and I’d be remiss not to reflect that somewhere in this week’s newsletter.

Let’s not forget when the now shortest-serving Prime Minister in British history weighed in on what Britain should do on the crypto front.

“We should welcome #cryptocurrencies in a way that does not limit their potential. Free up areas of free enterprise by removing regulations that limit prosperity. #PolicyExchange #futureoffreedom #shakeup.”

I think we’ve had enough shake-up for a week, thanks.

Data mining

Exchange is linked to the development of crypto, although the most committed believe that crypto means decentralization – an attempt to build a financial system that does away with a trusted central intermediary.

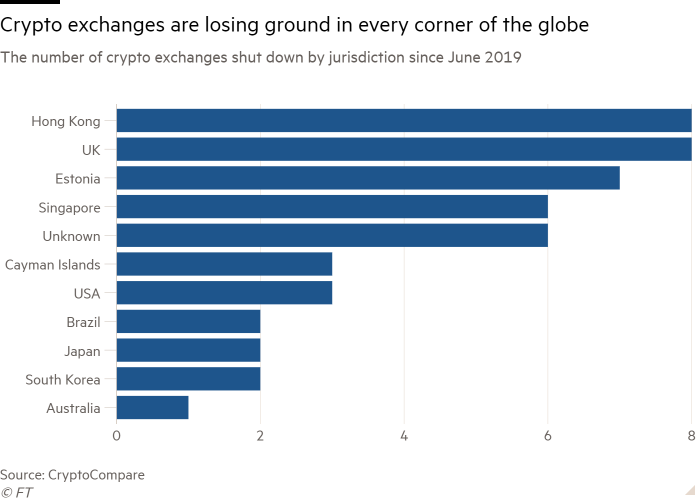

Data from CryptoCompare suggests that since 2019, a total of 68 crypto exchanges have been shut down across the globe.

The chart below provides a snapshot showing us which jurisdictions are leading the way in crypto exchange closures. The UK shares the top spot with Hong Kong, undermining the idea that London will truly transform into the crypto hub that some hope it will become.

That’s it for this week. Have a nice weekend.