Will Bitcoin see a repeat of November 2018

The Bitcoin price is hovering just below $19,000 at the time of writing, not far from the local low of $18,300. When the Consumer Price Index (CPI) and Producer Price Index (PPI) data were released last week, the BTC price plunged to exactly that price level.

Unexpectedly for many, a very quick bounce occurred, catching shorters off guard. With November 2nd – when the FED meets again – in mind, the Bitcoin price doesn’t have much room to fall below that level at the moment. A look at the chain also suggests that another crash is possible in the near term, although there are also positive signals.

According to CryptoQuant, a bear market signal appears when the realized price of all long-term owners (blue line) exceeds the realized price of all coins bought (red line) and when the BTC price falls below the realized price of long-term owners and the realized price of all coins.

The analysis concludes that the Bitcoin price has been in a bear market for 124 days. In this regard, the drop from $6,000 to $3,000 is comparable to the price drop from $30,000 to $18,000, as the percentage drop in the last bear market from $6,000 to $3,000 was 50%.

That said, the bottom may not have been seen yet:

The drop from $30.7k to $18.2k was 41%. A 50% drop from $30.7k would put BTC at $15k (-18% from today’s price). As is the delta price of $14.7k.

Conflicting Chain Data for Bitcoin

With Santiment, another major chain analysis service, stated that the Bitcoin market ideally needs to see accumulation at the moment, while small traders remain bearish and spread doom and gloom.

However, conflicting data are emerging in this regard. Thus, Bitcoin’s small to medium addresses (with 0.1 to 10 BTC) have recently reached an all-time high of 15.9% of available supply. At the same time, whales with 100 to 10,000 BTC have recorded a three-year low of 45.6% of the supply.

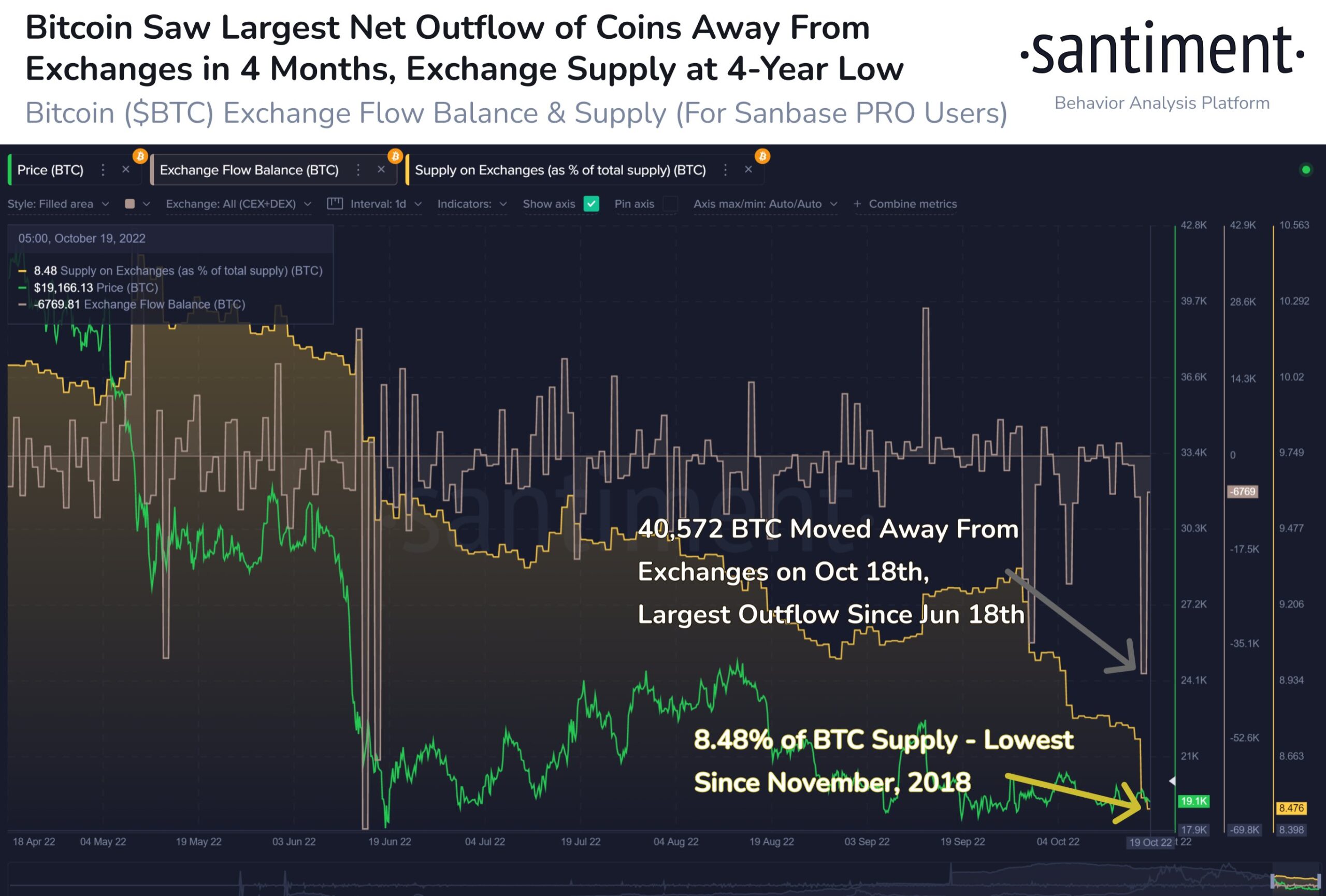

On the bullish side, Bitcoin experienced a massive outflow of coins from exchanges on October 18. Santiment recorded the largest daily volume in 4 months, which amounted to 40,572 BTC. With this, the supply of coins on all exchanges has dropped to 8.48%. This means that the risk of a future sale has decreased at least somewhat.

Bullish data is also reported by the third major chain supplier Glassnode. Bitcoin supply which has not moved for the past 6 months is approaching an all-time low. It currently stands at 18.12% of circulating supply or approximately 3.485 million BTC. Glass node write:

Historically, very low volumes of mobile supply usually occur after prolonged bear markets.

Jim Bianco, president of Bianco Research LLC, recently cited an old trading adage, “Never short a dull market”, may apply more than ever to the Bitcoin market.

According to his analysis, realized volatility which means the decline or actual volatility is at a 2-year low and is registering one of the lowest levels of all time.

The markets are based on apathy, not excitement. BTC and ETH have apathy. The S&P 500 is almost the opposite, as prices move like a video game. This could also be another sign that the TradFi/Crypto relationship is breaking. If so, this is long-term bullish for crypto.

Diverging volatility can therefore be a sign of this shift and ultimately trigger a long-term positive trend.