Understanding crypto market sentiment is a huge plus for you as a trader. It helps you gather the majority opinions and thoughts about the crypto market, and with such information you can take advantage of the changing directions of the market.

But can that crypto market sentiment be used to make accurate crypto trades?

What is market sentiment?

Every trader has an opinion and explanation for different market conditions. Regardless of the trader’s conviction, however, the market can move in an unexpected direction, causing the trader to lose his money. Why is it like that? One person’s, that is, a retail trading sentiment, is not enough to move the market; it is usually a combination of all trading views and opinions and such a combined feeling is known as market sentiment.

Market sentiment is investors’ general and prevailing attitude and mood towards the crypto market. That is the summation of the market views. A positive market sentiment signals a bull market, while a pessimistic market is a bear market. The combination of the two drives price action, creating short-term and long-term investment opportunities.

Market sentiment is affected by anything and everything, which makes it important that you get as much information as possible about the market when conducting a sentiment analysis. Performing sentimental market analysis usually involves a combination of various indicators and market factors, some of which we will consider in this article.

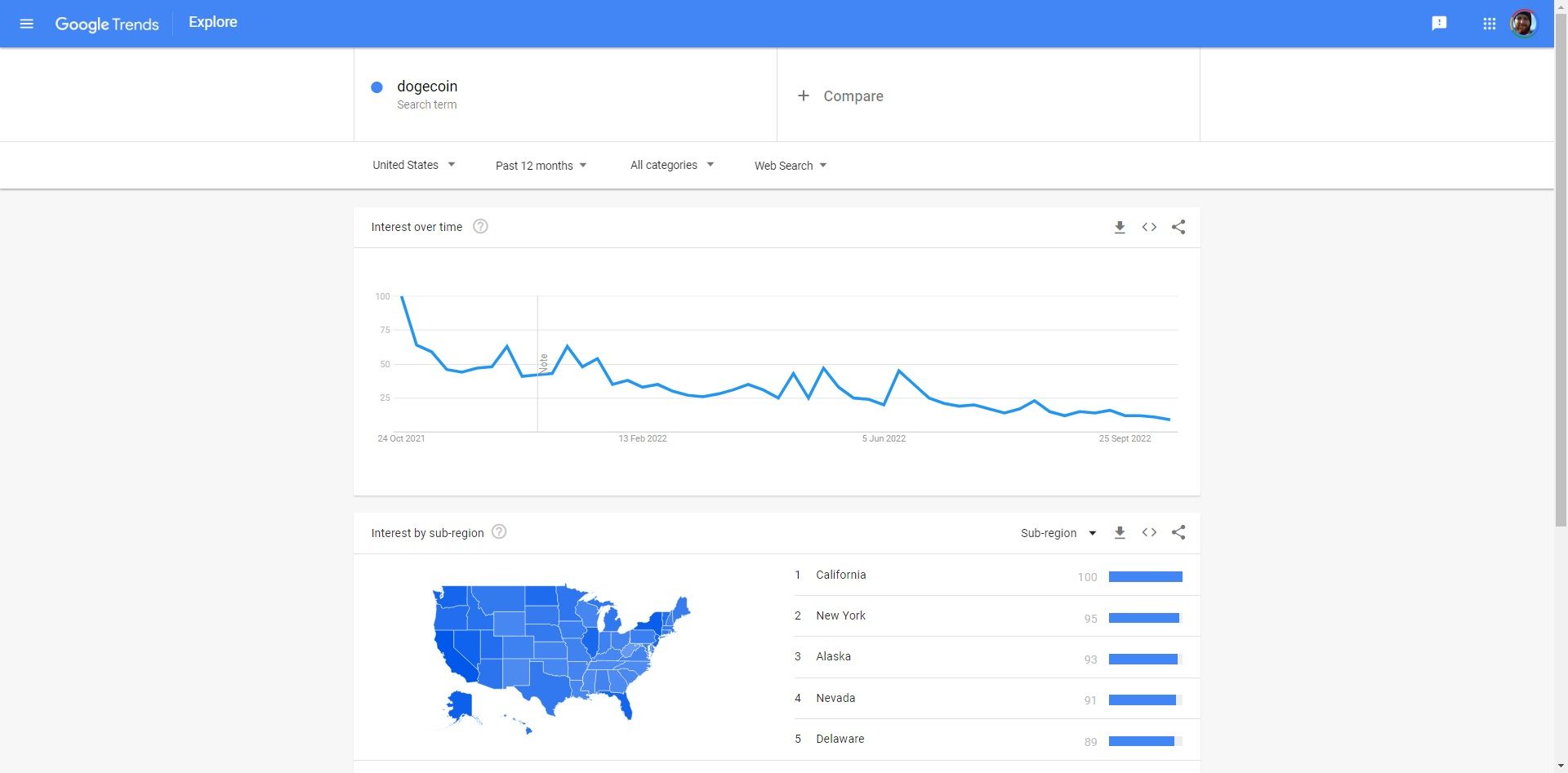

An example of how sentiment affects a market price is Elon Musk’s tweets about Dogecoin in 2021, which caused the price of Doge to rise. His tweets gave many investors more hope in Dogecoin and during that period the price rose dramatically.

How to Measure Crypto Market Sentiment

There is no particular way to measure market sentiment and traders’ dominant trading psychology because various factors affect overall market sentiment. For example, a major crypto exchange crash or hack can cause traders and investors to lose confidence in the market and start withdrawing their investments from other exchanges. Such an event can trigger an unexpected bearish sentiment.

Instead of trying to find a precise way to measure market sentiment. You should get a way to know the views, ideas and thoughts of different people involved in the crypto market. Some things you should be on the lookout for are:

Crypto hype

Cryptohype can influence market sentiment towards a particular cryptocurrency. Such a hype can be triggered by an influencer or major crypto project leader. Sometimes there can be a growing interest in a token. The Elon Musk example we gave earlier is an example of market hype.

One of the ways to measure the hype around a crypto project is to use Google Trends. A high search volume for a specific cryptocurrency can indicate what many investors think.

Crypto related news

You need to be updated with the latest industry news and market happenings from trusted crypto news platforms. A major event, such as the banning of crypto in a country with many crypto investors or the failure of a major crypto exchange, can negatively impact the market.

News related to increased acceptance of cryptocurrency as a payment system in large countries or a large investor choosing to invest heavily in crypto can be positive for the market.

Pages for social media

Checking social media pages to see what a project’s community members think is a good way to gauge sentiment around such a project. Telegram and Discord have become popular platforms for many crypto users and investors, and you will also find them useful for gathering information. Some other platforms where you can gather information include Twitter and Reddit.

Using Crypto Market Sentiment Indicators

Using sentiment indicators can also help you gather information about market sentiment. The biggest challenge with this method is that most crypto sentiment indicators are based on Bitcoin. As a result, you may not be able to use this method for a wide range of cryptocurrencies.

2 Bitcoin Market Sentiment Indicators

You can use a combination of different market sentiment indicators to look for bullish or bearish tendencies in the crypto market. Usually these indicators represent information in the form of a scale. Let’s consider two indicators you can use to get an idea of Bitcoin market sentiment.

1. Bitcoin Fear and Greed Index

This indicator shows Bitcoin’s fear and greed level on a scale from 0 to 100. In addition, the indicator analyzes various information such as market volatility, volume, social media, trends and dominance.

This indicator tries to weigh fear and greed in the market. As Bitcoin’s price increases, more investors want to get in for fear of missing out (FOMO). As a result, many become greedy in the market. Conversely, when the Bitcoin price starts to fall, investors want to get out of the trade for fear of losing their money.

A reading of zero on the Bitcoin Fear and Greed Index indicates that the market is in an extreme state of fear, while a reading of 100 shows that the market is in an extreme state of greed.

2. Bull and bear index

This indicator analyzes social media conversations to show how bullish or bearish they are. A reading of 0 indicates an extremely bearish sentiment, while one signals an extremely bullish sentiment.

The software analysis data is based on 93 sentiments and topics taken from Reddit, Twitter and Bitcointalk and it is updated every hour.

Importance of market sentiment analysis

Conducting a sentiment analysis helps you understand how the price is likely to move in the short term. It becomes more compelling when combined with technical analysis and fundamental trading metrics. Identifying potential price trends before they even occur in the market puts you in a better position to make the most of the information.

Constantly executing trades that are the result of analyzing the market with general market sentiment, technical indicators and fundamental indicators will give you better results. Combining sentiment analysis with your trades will also help you trade with more confidence and purpose and less emotion.

Sentimental analysis is not enough

You cannot rely solely on market sentiment analysis to execute trades. To be successful, you must combine sentiment analysis with technical and fundamental analysis. There is also no guarantee that any major events will significantly affect the market price. It is therefore difficult to predict the market’s reaction at any given time.

The information on this website does not constitute financial advice, investment advice or trading advice and should not be considered as such. MakeUseOf does not provide advice on any trading or investment matters and does not recommend that any particular cryptocurrency should be bought or sold. Always perform your own due diligence and consult a licensed financial advisor for investment advice.