P2P Bitcoin Trading in India to Double from 2021 Despite Bear Market

P2P bitcoin trading volume in India has increased following the implementation of harsh tax laws. In particular, the 3rd quarter of 2022 had great growth.

According to data from Coin Dance, P2P bitcoin trading in India has almost doubled in the past year. The data looks at the trading volumes of India on Paxful, with current weekly volumes of around 121 BTC. At the same time last year, weekly volumes were at 65 BTC.

Bitcoin trading in India is on the rise

July saw the largest trading volume, with the number crossing 570 BTC. There has been a noticeable year-over-year increase since Q3 2021, when Indians traded $11.2 million worth of BTC. In Q3 2022, this figure was $15.7 million

That represents a 40% increase in bitcoin trading in the country, which has been hit hard by the new tax regulations that came into effect this year. The 3rd quarter in particular had the biggest increase in P2P trading, which was after the tax scheme came into force.

It is not surprising that there would be a jump in direct trade. The tax regime has many Indians trying to find different ways to invest in the market, and there will undoubtedly be more regulations in the future.

Crypto exchange volumes have fallen in India

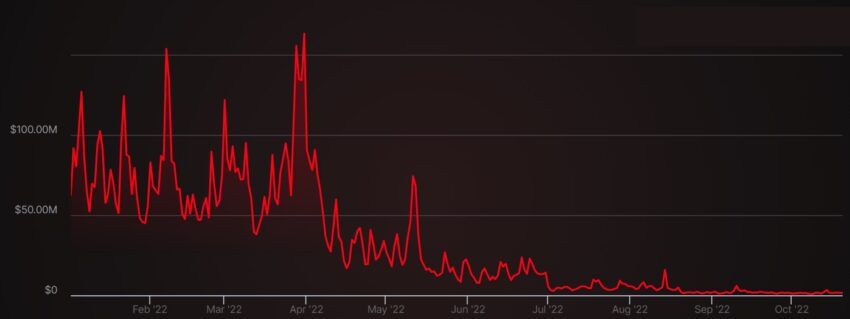

Meanwhile, crypto exchanges in India are suffering as volumes have declined since the tax laws were implemented. Major exchanges WazirX, Zebpay and CoinDCX have also seen trading volumes drop significantly.

Numbers were consistently high through the end of May across all exchanges, with WazirX seeing volumes as high as $163 million. Zebpay and CoinDCX had volumes as high as $27 million and $49 million respectively.

Since May, volumes on all exchanges have consistently been below $1 million. The harsh tax laws have greatly reduced the desire to trade, while crypto companies decide to leave the country for crypto-friendly regions such as Dubai.

New tax regimes are hurting the crypto market

The tax rules in India implement some tough rules for the citizens and do not even allow them to offset laws. This has turned Indians away from the asset class, although it still has a fairly large following with at least 100 million crypto investors. There have been several opinions criticizing the rules, saying they will stifle innovation.

For example, ZebPay has decided to get licenses in Singapore and Dubai. WazirX has also had to let go of 40% of its staff following the crypto winter and falling volumes.

Disclaimer

All information on our website is published in good faith and for general information purposes only. Any action the reader takes on the information contained on our website is strictly at their own risk.