Bitcoin Faces Global Market Liquidity Steamroller – Bitcoin Magazine

Below is an excerpt from a recent issue of Bitcoin Magazine Pro, Bitcoin Magazine premium market’s newsletter. To be among the first to receive this insight and other market analysis on the bitcoin chain straight to your inbox, Subscribe now.

Liquidity is in the driver’s seat

By far, one of the most important factors in any market is liquidity – which can be defined in many different ways. In this piece, we cover some ways to think about global liquidity and how it affects bitcoin.

An overall view of liquidity is the central banks’ balance sheets. As central banks have become the marginal buyer of their own government debt, mortgage-backed securities and other financial instruments, this has added more liquidity to the market to buy assets further up the risk curve. A seller of government bonds is a buyer of another asset. When the system has more reserves, money, capital, etc. (however you want to describe it), they have to go somewhere.

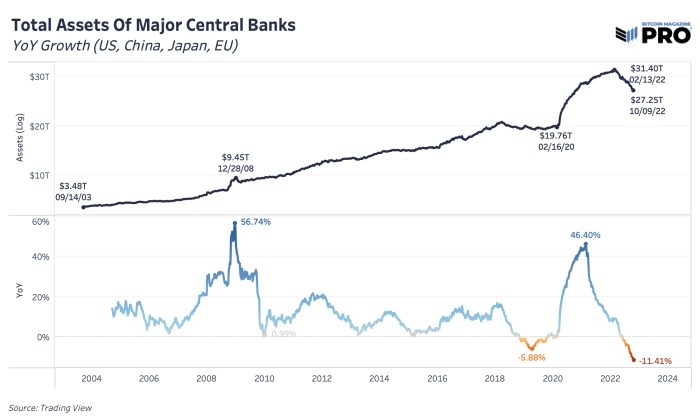

In many ways, this has led to one of the biggest increases in asset valuations globally in the past 12 years, coinciding with the new era of experiments with quantitative easing and debt monetization. Central bank balance sheets across the US, China, Japan and the EU reached over $31 trillion earlier this year, which is almost 10 times from the levels back in 2003. This was already a growing trend for decades, but fiscal and monetary policy for 2020 policy took the balance sheets to record levels in a time of global crisis.

Since earlier this year, we have seen a peak in central bank assets and a global effort to liquidate these balance sheets. The peak in the S&P 500 was just two months before all the quantitative tightening (QT) we see today. While not the only factor driving price and valuations in the market, bitcoin’s price and cycle have been similarly affected. The annual rate of change spike in major central bank holdings occurred just weeks before bitcoin’s first push to new all-time highs around $60,000, back in March 2021. Whether it’s the direct impact and influence of central banks or the market’s perception of that impact, there has been a clear macro driver for all markets over the past 18 months.

With a market capitalization of mere fractions of global wealth, bitcoin has faced the liquidity vapor that has hammered every other market in the world. If we use the framework that bitcoin is a liquidity sponge (more so than other assets) – soaking up all the excess money supply and liquidity in the system in times of crisis expansion – the significant liquidity drop will cut the other way. Coupled with bitcoin’s inelastic illiquid supply profile of 77.15% with a large number of last-resort HODLers, the negative effect on price is magnified much more than other assets.

One of the potential drivers of liquidity in the market is the amount of money in the system, measured as global M2 in USD. M2 money supply includes cash, checking deposits, savings deposits and other liquid forms of currency. Both cyclical expansions in global M2 supply have occurred during the expansions of global central bank assets and the expansions of bitcoin cycles.

We view bitcoin as a monetary inflation hedge (or liquidity hedge) rather than a “CPI” (or price) inflation hedge. Monetary deterioration, more units in the system over time, has driven many asset classes higher. Nevertheless, bitcoin is by far the best designed asset in our view and one of the best performing assets to buck the future trend of perpetual monetary deterioration, money supply expansion and central bank asset expansion.

It is unclear how long a significant reduction in the Fed’s balance sheet can actually last. We’ve only seen about a 2% reduction from a peak $8.96 trillion balance sheet problem. Eventually we see balance sheet expansion as the only option to keep the entire monetary system afloat, but so far the market has underestimated how far the Fed has been willing to go.

The lack of viable monetary policy options and the inevitability of this perpetual balance sheet expansion is one of the strongest cases for bitcoin’s long-term success. What else can central banks and fiscal policy makers do in future times of recession and crisis?

Relevant previous articles: