2 Warren Buffett Fintech Stocks That Can Boost Your Portfolio

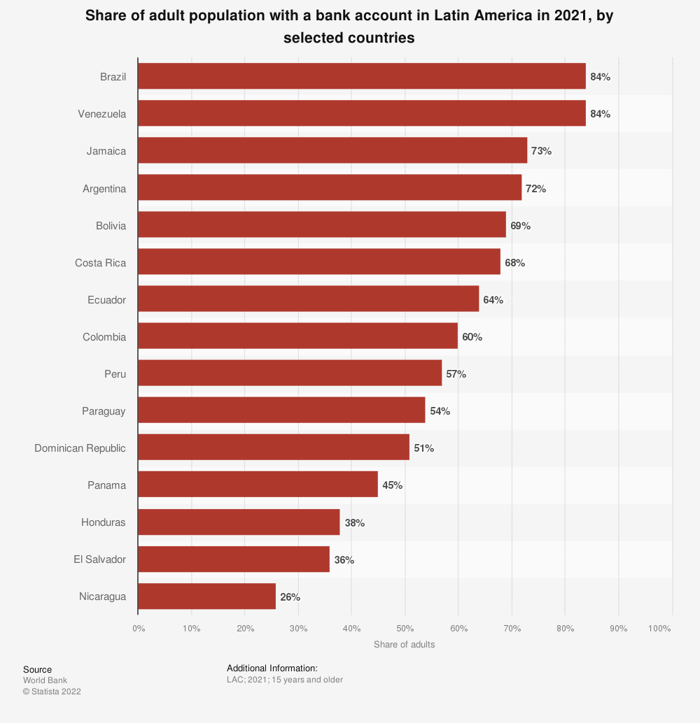

Latin America’s fintech environment differs significantly from that of the United States. That part of the world is primarily a cash-based society, and large parts of the population have neither a bank account nor a credit card. Therefore, bringing these consumers into a fintech ecosystem requires a different approach.

A few fintech companies are making a strong effort to develop the right approach and potentially take advantage of a large, largely untapped market. Their efforts caught the attention of famous investor Warren Buffett and his Berkshire Hathaway holding company. Buffett liked what he had seen so far and (through Berkshire) invested in it Stoneco (STNE 1.03%) and Now Holdings (NOW 0.23%).

Given both companies’ strong growth potential, both Buffett and the investors who follow him are showing some patience in hopes of making significant gains. Let’s take a closer look at these two potential superchargers and see if it’s worth following Buffett’s lead.

1. Stoneco

Stoneco operates in Latin America’s largest market, Brazil. It provides technology solutions for small and medium-sized enterprises (SMEs) in the South American country.

Stoneco offers and integrates various solutions that handle payments, e-commerce and sales management tools. However, their customer service stands out in Brazil’s competitive fintech market. It prides itself on a “no red tape” approach. This can bring customer service personnel close to customers, and these representatives have the autonomy to resolve client issues quickly.

Stoneco’s business model attracted Berkshire to buy 14.2 million shares ahead of its IPO in late 2018. Buffett’s team sold about 3.5 million shares in the first quarter of 2021 when the stock was trading near its peak. It ended up being a wise move. Headwinds such as COVID-19, rising inflation, a presidential election and policy changes from Brazil’s central bank hammered Stoneco’s loan portfolio and slowed sales growth for a time. Consequently, Stoneco’s share price has fallen almost 90% from its early 2021 high.

Stoneco has since recovered somewhat, with H1 2022 revenue of 4.4 billion reais ($830 million) up 195% compared to the same period in 2021. Adjusted net income rose 302% to 128 million reais ($24 million) during of that period. Analysts are predicting 90% revenue growth for the year, which should serve as a tailwind for the fintech stock.

Also, Stoneco’s price-to-sales (P/S) ratio of 2 is close to an all-time low. It may partly be an indication of the political and economic uncertainty that remains in the home country. But given its growth, Stoneco shares will probably appreciate its challenges.

2. Now Holdings

Nu Holdings operates a fintech-oriented bank, NuBank. It seeks to leverage technology and cutting-edge business practices to provide financial solutions to both individuals and small and medium-sized businesses.

This is important because in Latin America a few banks have traditionally dominated the industry. That situation left much of Latin America’s population unbanked. Now, thanks to Nu Holdings, citizens and small businesses that were previously frozen out of the banking system now have access to bank accounts and credit cards.

Data source: World Bank.

NuBank’s approach helped its customer base grow to more than 70 million customers spread across Brazil, Mexico and Colombia. More than 5 million of these customers received their first credit card or bank account through NuBank.

Like Stoneco, Buffett invested in this company before its IPO (this one in December 2021), buying more than 107 million shares of the Brazilian bank. Admittedly, Buffett is probably being patient with this one, as the stock price has fallen by about two-thirds since its post-IPO peak, a factor that seems to contradict at least one of the important rules Warren Buffett follows.

Despite this decline, revenue for the first two quarters of 2022 came in at just over $2 billion, 250% higher than the same period in 2021. And while the losses seem modest, rising expenses and taxes meant losses rose 16% to 75 million dollars for period.

But Nu’s P/S ratio, now at 10, is an 80% discount to the sales multiple at the time of its IPO. Considering the valuation and transformative potential of Nu Holdings, one can see why Buffett’s team took an interest.

Will Healy has positions in Berkshire Hathaway (B shares). The Motley Fool has positions in and recommends Berkshire Hathaway (B shares) and Stoneco LTD. The Motley Fool recommends the following options: long January 2023 $200 calls on Berkshire Hathaway (B shares), short January 2023 $200 puts on Berkshire Hathaway (B shares), and short January 2023 $265 calls on Berkshire Hathaway (B shares). The Motley Fool has a disclosure policy.