Could BTC Be Heading To $13,000 Amid The Global Liquidity Crisis?

- Bitcoin is considered a liquidity sponge by analysts, soaking up excess money supply in times of crisis.

- The current global liquidity squeeze has a magnified negative impact on the Bitcoin price due to its illiquid supply of 77.15%.

- Bitcoin price could drop to the $13,000 level over the next month — before bouncing back to the $29,000 target, analysts say.

Bitcoin price is heavily influenced by liquidity conditions – one of the most important factors in any market. The global liquidity crisis has greatly affected the Bitcoin price and as a result analysts present a bearish outlook for BTC.

Also read: Bitcoin Price: Analysts Think BTC Is King, Robert Kiyosaki Is Bullish On Bitcoin

How the global decline in liquidity has affected the Bitcoin price

Sam Rule, senior crypto market analyst at Bitcoin Magazine claims that one of the most important factors in any market is liquidity. Liquidity can be defined in many different ways, but the analyst looks at global liquidity and its impact on the Bitcoin price.

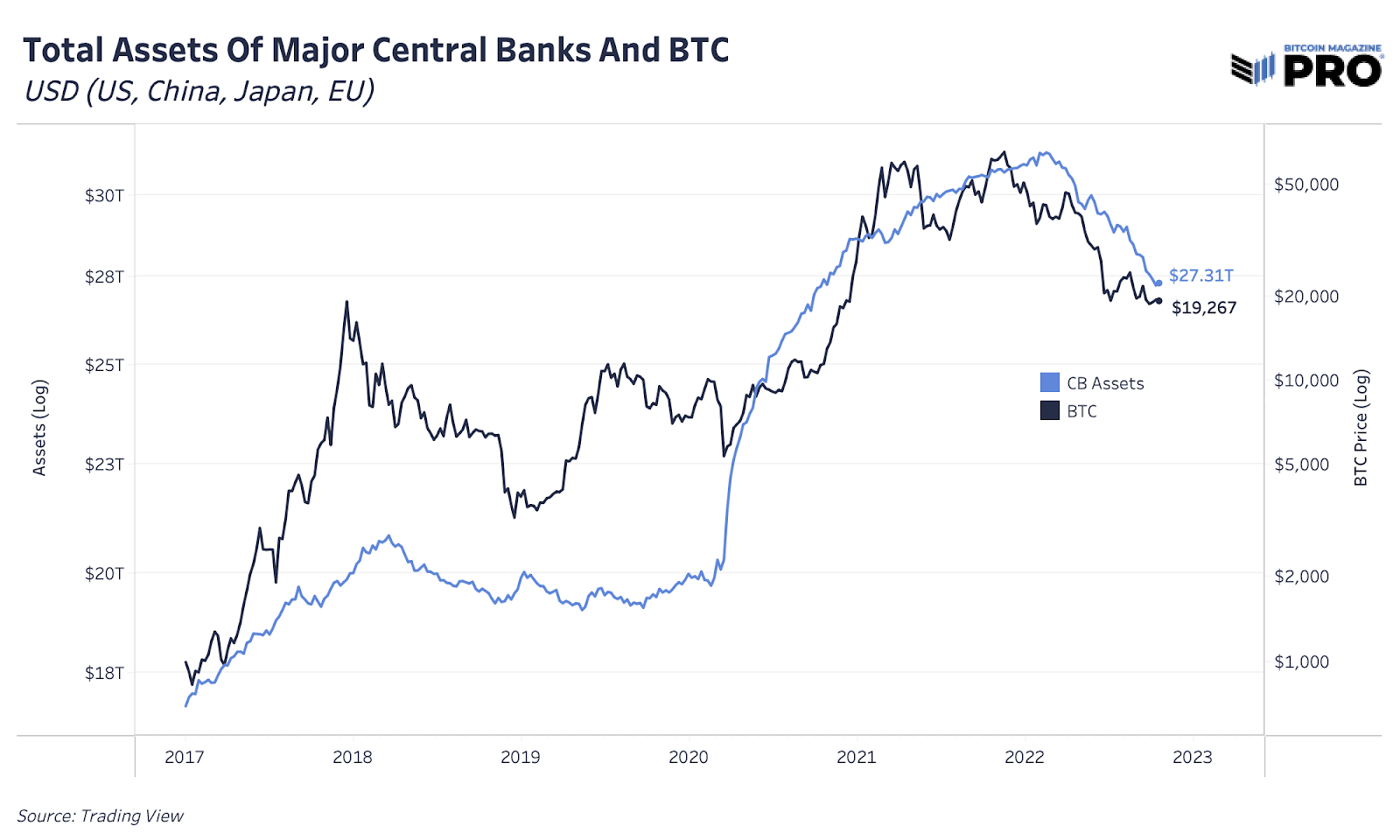

A high-level view of liquidity is based on the state of central bank balance sheets around the world. During recent crises, central banks have become primary liquidity channels for the economy by keeping interest rates low and buying up government debt, mortgage-backed securities and other financial instruments. Rule argues that this injection of liquidity has come from the purchase of assets that are overall riskier. This has led to one of the biggest increases in valuations globally, in the last 12 years, since the Great Financial Crisis.

Central bank balance sheets in the US, China, Japan and the EU have reached $31 trillion in 2022, nearly ten times the level of 2003. Although this is an increasing trend over the past two decades, fiscal and monetary policy for 2020 in response to the COVID-19 the pandemic took balances to record levels.

Total assets of major central banks and Bitcoin

Rule notes that Bitcoin’s new all-time high of $60,000 in March 2021 coincided with an annual peak in the rate of change in accumulation by major central banks.

Since then, however, central banks have reversed their previously expansionary monetary policy to combat rising inflation, and now, instead of pumping liquidity into the economy, they are pulling it out. The implication is that this reversal of policy has been a major macro driver of the BTC price decline over the past year, as well as volatility in all markets.

Will Bitcoin price reach $13,000 or $29,000 first?

NekozTek, a cryptoanalyst and trader, notes that active Bitcoin sales by miners stopped about a month ago. The sale of Bitcoin by miners increases the selling pressure on the asset and negatively affects the BTC price. Mining reserves have been falling consistently since early August 2022 and October 13 marks an increase in reserves. The analyst is bullish on Bitcoin and expects the price to rise over the next few months.

Bitcoin miner reserve v. price usd

Aditya Roy, cryptoanalyst and trader compared the 2018 bear market to the ongoing Bitcoin cycle and predicted that BTC could bottom in November, reaching the $13,000 level.

Roy identified a support level around $18,000 formed by the multiple bottoms touched by the price since June 2022. This level, should it break, would likely see a volatile move south. According to the technical analyst, the number of touches increases as a level is exposed to volatility until the final break when it arrives, suggesting the risk of an explosive move south if the $18,000 support zone cracks.

BTC-USD exchange rate chart