MicroStrategy: There Are Better Alternatives to Owning Bitcoin (MSTR)

The Aeon

Analyze MicroStrategy Incorporated (NASDAQ:MSTR) using a sum of parts valuation, I believe the company is overvalued by over 60%. Even if one is bullish on Bitcoin (BTC-USD), there are a number of ways to gain exposure without it having to pay the exorbitant premium to NAV on MSTR shares. Bitcoin is unlikely to rally sustainably until macro risk appetite improves. Investors can monitor this by looking at the ratio of the Invesco S&P 500 High Beta ETF (SPHB) to the Invesco S&P 500 Low Volatility ETF (SPLV) ETF.

Brief company overview

MicroStrategy Incorporated, led by Mercurial chairman Michael Saylor (former CEO), is a business intelligence software company that also happens to own ~130k Bitcoins.

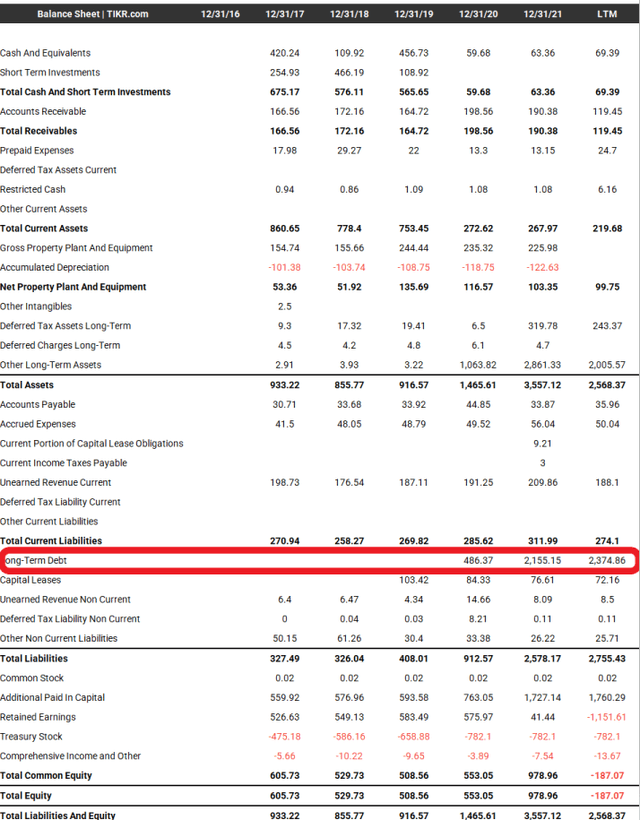

MSTR, once a sleepy small-cap survivor of the dot-com bust, adopted its Bitcoin strategy shortly after the COVID pandemic. First, it used part of its cash holdings to acquire ~21k Bitcoins in August 2020 at ~$11,600 / Bitcoin. After exhausting its cash reserves, MSTR went even further, issuing more than $2 billion in debt to raise even more Bitcoins (Figure 1).

Figure 1 – MSTR Balance (tikr.com)

Ultimately, the company acquired approximately 130,000 Bitcoins for $4 billion in consideration, financed through multiple debt issuances.

Share Price Rode The Bitcoin Rocket

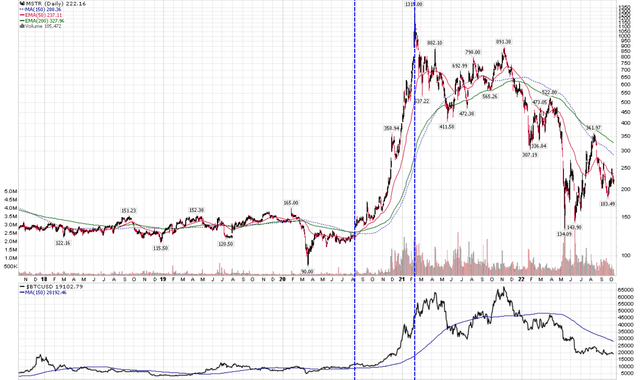

MSTR stock price rode the Bitcoin rocket, peaking at $1,315 in early 2021, nearly 10 times the pre-pandemic range of $115 to $165 (Figure 2).

Figure 2 – MSTR benefited greatly from the rise in the price of bitcoin (Author created with price chart from stockcharts.com)

MSTR’s rise was even more remarkable, given that the Bitcoin price only rose from ~$11,000 when MSTR first bought them, to $45,000 when MSTR peaked at $1,315.

Part of the reason for MSTR’s meteoric rise was scarcity. At the time, MSTR was one of the few vehicles that investors could use to speculate on the price of Bitcoin. In effect, MSTR traded like a Bitcoin ETF, with a significant premium to its “Net Asset Value”.

However, as 2021 progressed, crypto investors began to have more investment options. First, ETFs like the Purpose Bitcoin ETF (BTCC:CA) that hold Bitcoins started trading on Canadian exchanges. Furthermore, crypto exchanges such as Coinbase (COIN) became popular, giving investors direct access to crypto assets. Finally, ETFs such as the ProShares Bitcoin Strategy ETF (BITO) were launched on US exchanges that gave investors exposure to Bitcoin through futures contracts.

With so many ways to gain crypto and Bitcoin exposure, why would anyone need to buy MicroStrategy stock?

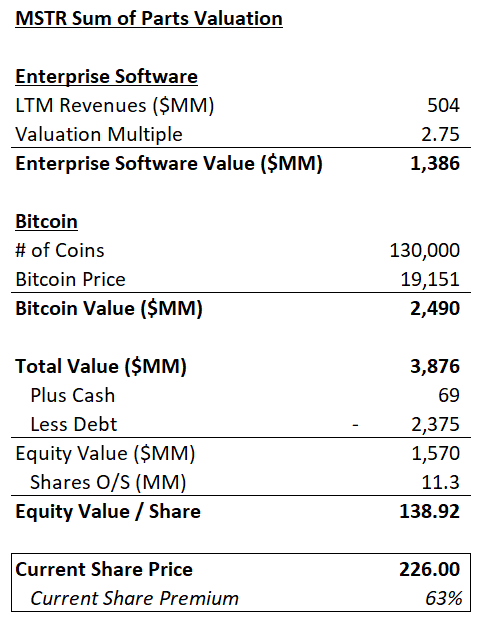

Sum of parts Valuation suggests that the share is 60% overvalued

By valuing MicroStrategy using a sum-of-parts analysis, assuming the Enterprise Software business trades at 2.75x price/sales (the business traded between 2.5 – 3.0x price/sales prior to adopting the Bitcoin strategy ) I come up with an equity value of $139 / share. With the shares currently trading at $226/share, I believe they are overvalued by over 60%.

Figure 3 – MSTR Sum of Parts Valuation (Author created)

Bitcoin highly correlated with risk appetite

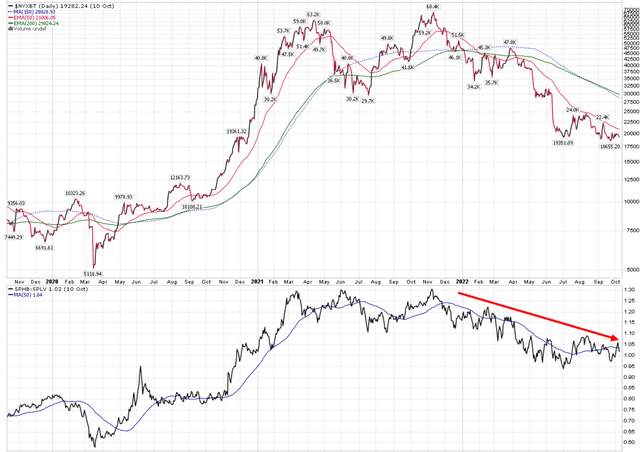

Putting aside the bull case for Bitcoin, since you either believe it or you don’t, we can see matter-of-factly evidence that Bitcoin prices are highly correlated with risk appetite, as measured by the ratio of the Invesco S&P 500 High Beta ETF to the Invesco S&P 500 Low Volatility ETF. Figure 4 shows the price of Bitcoin ebb and flow as the SPHB/SPLV ratio rises and falls.

Figure 4 – Risk appetite measured by SPHB/SPLV (Author created with price chart from stockcharts.com)

At the moment, risk appetite remains in a downward trend, hampered by the Fed’s rate hikes and tighter financial conditions. Until the macro situation changes, Bitcoin is unlikely to experience a sustainable rally.

Risk To My Call

The risk of my cautious call is obviously that if the Bitcoin price rises sustainably, then my bearish view on MicroStrategy will be proven wrong. I believe investors can protect themselves against this risk by pairing trades of MSTR with an asset that has a positive influence on Bitcoin prices. For example, if we go long the BITO ETF (BITO trades near NAV) and short MSTR, we can hedge out most of the Bitcoin risk and just bet that MSTR’s premium to NAV declines over time.

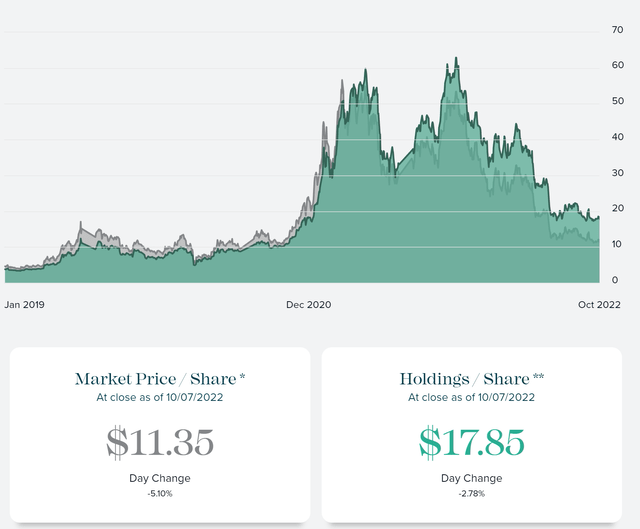

Investors who are bullish on Bitcoin may even want to bet on Grayscale Bitcoin Trust (OTC:GBTC), as it is currently trading at a 37% discount to NAV (Figure 5). Historically, when Bitcoin was in a bull phase, GBTC had traded at a premium to NAV as high as 30% (January 2021). However, GBTC has a problem in that the trust currently does not have a built-in mechanism to close the discount to NAV. It was hoped that GBTC’s proposed conversion to become an ETF would close the discount, but to date the SEC has denied the GBTC conversion proposal.

Figure 5 – GBTC discount to NAV (grayscale.com)

Investors should note that any pairs trading strategy will involve shorting MSTR, which may introduce idiosyncratic risks associated with shorting meme-like stocks such as MSTR.

Conclusion

I believe MSTR is overvalued by over 60% if we analyze the company using a sum of parts values. Even if one is bullish on Bitcoin prices, there are a number of ways to gain exposure without having to pay the exorbitant premium to NAV on MSTR shares. For example, investors can choose the BITO ETF which trades at NAV, or the GBTC trust which trades at a 37% discount to NAV.

In my opinion, Bitcoin is unlikely to rise sustainably until macro risk appetite improves. Investors can monitor this by looking at the relationship between the SPHB and the SPLV ETF.