Jiko Banks $40M in Series B Funding to Offer Companies a Way to Park Their Cash in Treasury Bills • TechCrunch

Jiko started life as a mobile bank for consumers. But over time, the fintech startup has evolved its model – mostly driven by demand – and is now making a push into corporate cash storage.

In 2020, Jiko made headlines by being the first fintech to acquire a nationally regulated US bank. The company was also unique in another way: Instead of holding customer deposits, it used the funds to buy short-term treasury bills.

So last November, Jiko revealed that it was pivoting from its consumer-focused model and “accelerating its business-to-business strategy,” as reported by Banking Dive. At the time, the publication reported that the startup had “received a number of inquiries from other fintechs interested in leveraging the technology.”

As a result, it turned into what CEO and co-founder Stephane Lintner describes as a “B2B2C” model.

This year, Jiko found that everyone was “suddenly paying attention to government bills,” Lintner told TechCrunch. For the unfamiliar, T-bills are – according to Investopedia – “a short-term U.S. government debt obligation backed by the Treasury Department with a maturity of one year or less.”

That attention led the startup to once again rethink its strategy to meet the sudden surge in demand. Today, the former Goldman Sachs trader describes Jiko as a “financial network that we are building full stack designed to store and move money at scale.”

“We were focused on retail API access, but we’re seeing such an influx for our enterprise product that we’ve really accelerated and made our money storage product our key offering right now,” Lintner told TechCrunch, “and that’s what we’re all about focused on distribution.”

And now the startup announced that it has raised $40 million in a Series B funding round to help it meet demand.

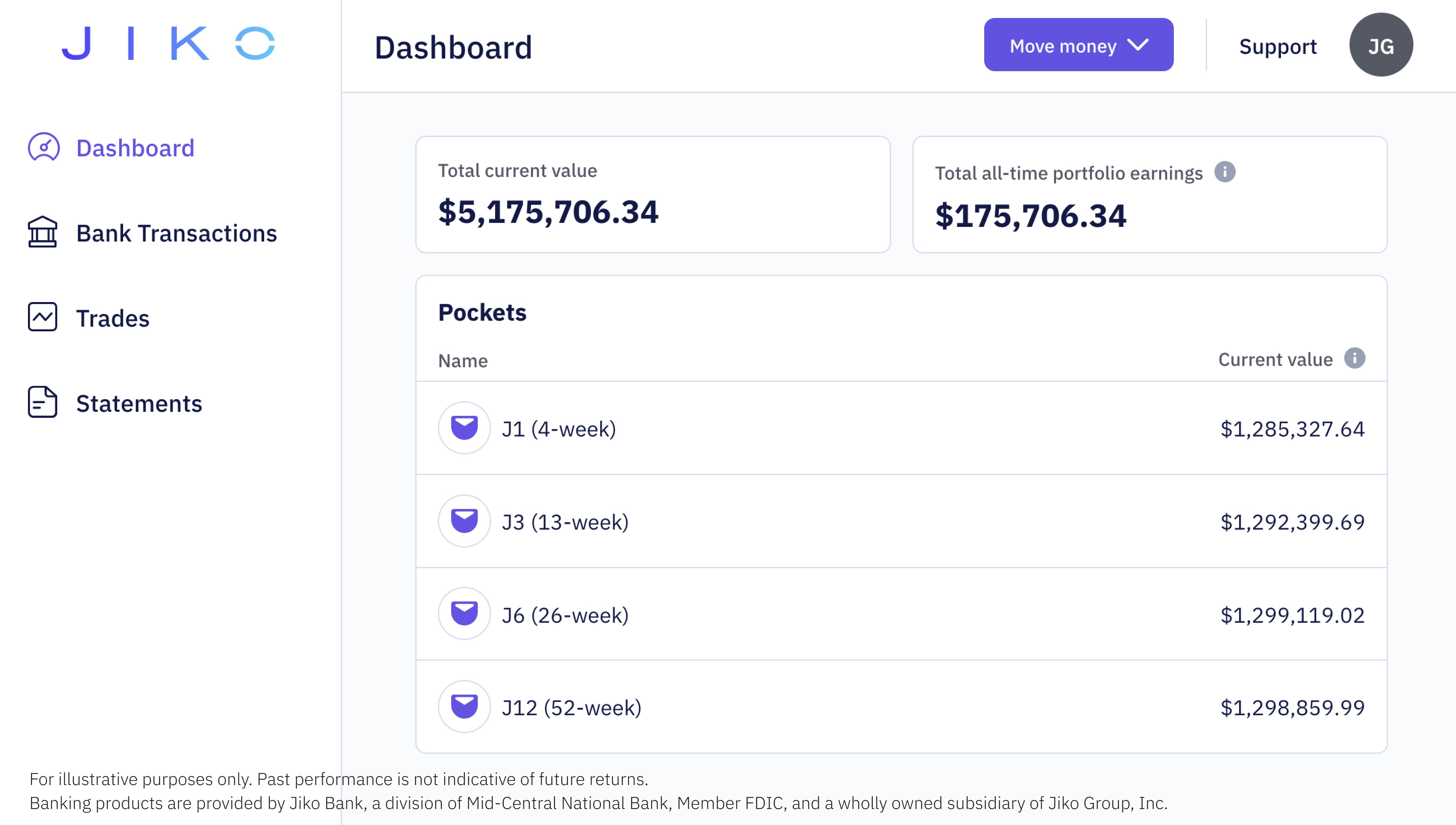

Jiko’s plans for the product, called Jiko Money Storage, are to give companies — from startups to multinationals across a range of industries — “low-cost access” to government bills. The advantage for companies, especially for startups that have raised or have large amounts of cash, is that T-bills are an asset class that offers a “very competitive” potential return, according to Lintner.

On top of that, the fact that Jiko has a bank charter – unlike most other fintech companies – and is a broker-dealer, the company claims it can help its customers carry out banking and financial activities “safer and secure” than other offers.

For example, he describes a money market fund “as a security wrapped around repo markets and maybe some Treasury bills.”

Image credit: Jiko

Jiko’s claims are lofty, but they are ones that clearly a number of investors are willing to bet on.

Red River West led Jiko’s Series B funding, which also included participation from Trousdale Ventures, Owen Van Natta, Temaris & Associates, La Maison Partners, BPI France, Airbus Ventures, Anthem Ventures, Upfront Ventures and Radicle Impact. The new round brings Jiko’s total raised to $87.7 million since its inception in 2016. It declined to disclose valuation.

Soon, the company plans to allow companies to not only store money and deposit it directly into treasury bills with “instant liquidity”, but also to be able to move it 24/7 on the network.

This option, Lintner believes, has proven to be even more appealing in view of the challenging macro environment.

Jiko CEO and co-founder Stephane Lintner. Image credit: Jiko

“Every place that has some money right now has to worry about all the risks that are going on. When you’re deciding where to put it, you need returns, and treasury bills now provide a lot,” he told TechCrunch.

Alfred Véricel, founding partner of Red River West, said his firm was attracted to Jiko’s vision of “an infinitely scalable infrastructure that could unlock a new category in money storage – and access to affordable, usable government bills – thanks to a safe, liquid and competitive B2B product.”

“The launch of Jiko Money Storage also comes in a macroeconomic environment where firms want to make cash work harder to combat inflation and volatility,” he added.

My weekly fintech newsletter, The Interchange, launched on May 1st! Sign up here to get it in your inbox.