Crypto Contrarian: The Market Hates Litecoin, It Shouldn’t (Cryptocurrency:LTC-USD)

Phira Phonruewianghing/iStock Editorial via Getty Images

One of the most bizarre investor disconnects I’ve seen in crypto is the one I’ve found in Litecoin (LTC-USD) over the past year or so. Like many other risk market assets, crypto investors can become emotionally attached to certain ideas. This the emotional relationship bulls have with their magical internet money is just as visible in the bears. We see this proven with some who will steadfastly ignore all blockchain-based assets as investable ideas. But this emotional bearishness towards crypto is not just limited to the anti-crypto crowd. Even the crypto market has an illogical emotional problem with certain assets. One of these assets is Litecoin. Litecoin is a fork of Bitcoin (BTC-USD). It has four times the circulation, faster block times and much cheaper transactions. Although it has historically spent quite a bit of time as a Top 5 coin by market cap, it is currently placed at #20. Given the activity on the network, I think it should have been higher.

Litecoin is a legitimate competitor to Bitcoin in the peer-to-peer payments category, but so far the crypto investment community has been too saturated with BTC and ETH maximalists for LTC to get a proper bid. In this article I will show how little love there is for Litecoin in the crypto investment community, as well as how Litecoin is proving to be a viable crypto with real payment tools. We will also explore valuations which I believe will tap into the opposite opportunity we have in LTC.

Crypto investors hate Litecoin

The crypto investment market has virtually no interest in Litecoin. We can see this quite clearly in the performance of Litecoin against Bitcoin. Throughout each crypto bull cycle, Litecoin has failed to make new highs when priced in Bitcoin. LTC is now near all-time lows when priced in BTC. An LTC measured in BTC has made lower highs and lower lows throughout each crypto cycle from 0.04 BTC in 2013 to 0.0018 BTC earlier this year. The metric now sits at 0.0027 – still far from the previous cycle high.

CoinMarketCap

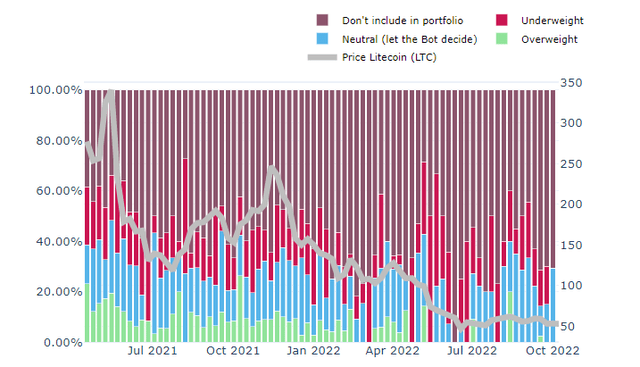

We can see symptoms of this underperformance in pricing throughout the crypto research community. Real Vision has a crypto portfolio survey where users share their views on a curated list of crypto coins. They have the option to vote overweight, underweight, neutral, or not include the coin in the portfolio at all. Real Vision’s survey respondents have become more bearish on LTC over the lifetime of the survey. 20% of respondents voted to be overweight LTC in October 2021, with only 40% saying they should not include LTC in their portfolio. The survey has now produced zero overweight votes in 17 of the past 20 weeks and three consecutive weeks with at least 70% voting not to include LTC at all:

RealVisionBot.com

And it’s not just Real Vision’s survey respondents who apparently don’t see the value in Litecoin. Crypto research firm Messari doesn’t seem to have published a Litecoin-focused analysis in nearly 3 years. Even speculators have avoided Litecoin.

| Futures open interest | 1 October 2021 | 1 October 2022 | OOOO |

|---|---|---|---|

| Bitcoin (000s) | 311.3 | 639.3 | 105.4% |

| Litecoin (millions) | 1.97 | 3.19 | 61.9% |

| Ripple (XRP-USD) (millions) | 741.45 | 1,567 | 111.3% |

| Dogecoin (DOGE-USD) (millions) | 1657 | 2,419 | 46.0% |

| Bitcoin Cash (BCH-USD) (000s) | 384.8 | 1,470 | 282.0% |

Source: CoinGlass

While other cryptoassets such as Bitcoin have seen rising futures open interest in recent weeks, Litecoin’s OI has lagged most of the other payment-focused blockchains. The only exception in that table is Dogecoinwhich drew much of its futures speculation during the meme-stock/meme-coin mania over a year ago.

Litecoin is one of the cryptocurrencies to which exposure can be gained through the traditional open market via Grayscale’s Litecoin Investment Trust (OTCQX:LTCN). While almost all of the Grayscale funds trade at a discount to net asset value, Grayscale’s Litecoin Investment Trust has the third largest negative premium price ratio among its entire portfolio of single asset investment funds at a 41% discount to NAV:

CoinGlass

When I covered Ethereum Classic back in late August, I showed how there is a correlation between the size of Grayscale’s holdings and the discount to the fund’s NAV. Essentially, the argument I made was that the more shades of gray there is of a coin’s total market value, the greater the NAV discount is generally in the fund. Interestingly, the Litecoin fund was an outlier here:

| Underlying assets in shades of grey | Fund % of Total MC | Fund premium |

|---|---|---|

| Ethereum Classic | 8.57% | -67.54% |

| Horizen (ZEN-USD) | 4.62% | -9.45% |

| Bitcoin | 3.26% | -36.19% |

| Ethereum (ETH-USD) | 2.41% | -30.86% |

| Livepeer (LPT-USD) | 2.35% | -54.13% |

| Zcash (ZEC-USD) | 2.10% | -22.33% |

| Litecoin | 2.08% | -41.25% |

| Bitcoin Cash | 1.60% | -25.69% |

| Decentralized Land (MANA-USD) | 0.97% | -1.18% |

| Basic Attention Token (BAT-USD) | 0.39% | -17.36% |

| Stellar (XLM-USD) | 0.30% | 6.38% |

| ChainLink (LINK-USD) | 0.06% | 27.76% |

| Filecoin (FIL-USD) | 0.04% | 426.32% |

Sources: CoinGlass, premiums per 9/30 bars. Market Cap calculations from CoinMarketCap data and grayscale inventory data

Despite grayscale accounting for a larger percentage of the total market cap in six other coins, the Litecoin fund trades at the third largest discount; subsequently only Livepeer and Ethereum Classic. Here we again see the investment community’s lack of respect for Litecoin.

Lack of social engagement

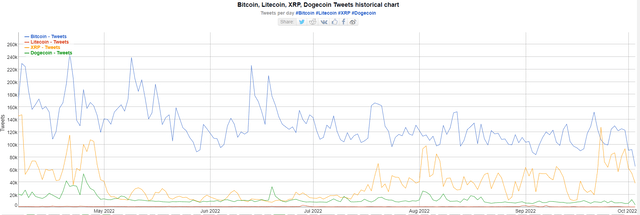

You’re also not going to find much Litecoin interest on Twitter. Over the past six months, there have generally been somewhere between 500 and 1,500 tweets about Litecoin on any given day.

BitInfoCharts

This is far below the daily tweet activity seen in coin communities such as Dogecoin, Ripple and Bitcoin. If you can’t see the red line for Litecoin above, it’s because it barely exists compared to the other three coins in the chart. In a quick scan of Twitter for Litecoin-specific comments, much of the engagement is negative and often results in one of Litecoin’s core criticisms; Litecoin’s founder Charlie Lee pursued a career at Coinbase several years ago.

Crypto users love Litecoin

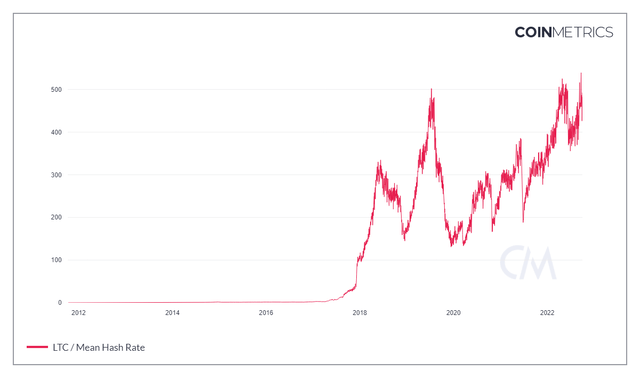

Despite the lack of investment demand for LTC, Litecoin as a network continues to impress in key network metrics such as wallet addresses, hash rate, daily transactions. As seen in this average hashrate chart below, Litecoin’s network security hit a new all-time high in September:

CoinMetrics

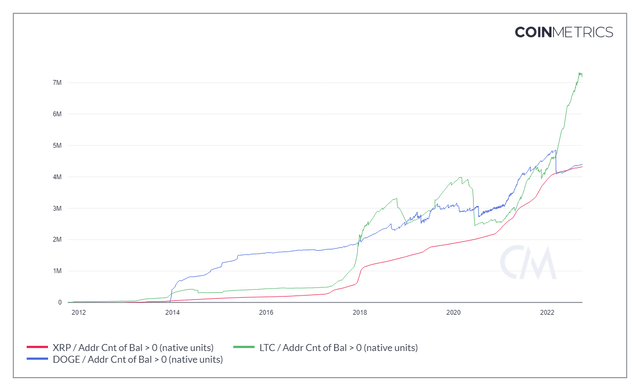

However, the more impressive metric I see in Litecoin is the growth in LTC’s non-zero addresses compared to better capitalized payment companies. Below we can see that the number increased in line with the growth of Dogecoin and Ripple during 2021:

CoinMetrics

But 2022 has been all about Litecoin address growth compared to the other two networks. In addition to the growth in non-zero addresses over the past two years, Litecoin has arguably seen better decentralization than any of the other payment networks whose coin ownership by top 100 addresses is any indication:

| Top 100 addresses | 1 October 2020 | 1 October 2022 |

| Bitcoin | 14.2% | 15.7% |

| Litecoin | 41.7% | 32.6% |

| Bitcoin Cash | 29.3% | 34.7% |

| Dogecoin | 59.7% | 69.4% |

Source: BitInfoCharts

Bitcoin, Bitcoin Cash and Dogecoin have all seen growth in Top 100 address concentration, while Litecoin has seen a large reduction from nearly 42% two years ago to just under 33% now. Despite lower coin price highs when priced in BTC, LTC still finds utility in transactions. LTC is now used to a far greater extent than several other higher ranked cryptocurrencies through Bitpay:

| % of transactions | March | April | Can | June | July |

|---|---|---|---|---|---|

| BTC | 56.8% | 56.5% | 54.9% | 53.3% | 47.9% |

| ETH | 11.1% | 10.9% | 10.5% | 9.7% | 10.0% |

| XRP | 0.7% | 0.8% | 1.1% | 0.7% | 0.6% |

| DOGE | 6.8% | 6.9% | 6.4% | 6.2% | 11.0% |

| LTC | 14.4% | 15.5% | 18.0% | 21.2% | 22.1% |

Source: Bitpay

While Litecoin has been the second most used blockchain for transactions on Bitpay for several months, it is clearly taking share away from Bitcoin in a sustained trend over several months.

Valuation calculations

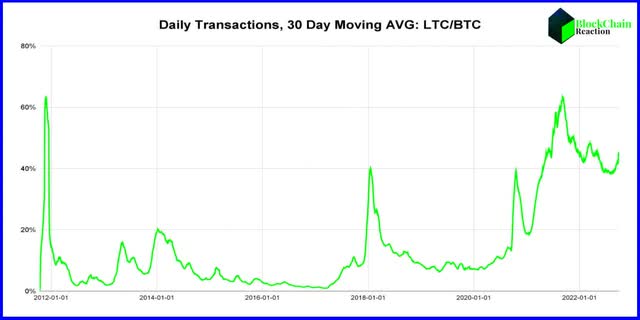

When we look at the daily transaction count as a 30-day moving average, we can get a good sense of how the networks are being utilized. Taking the 30-day moving average for LTC and dividing it by BTC’s 30-day moving average for transactions tells us that Litecoin seems to be gaining momentum as a payment network.

CoinMetrics/BCR

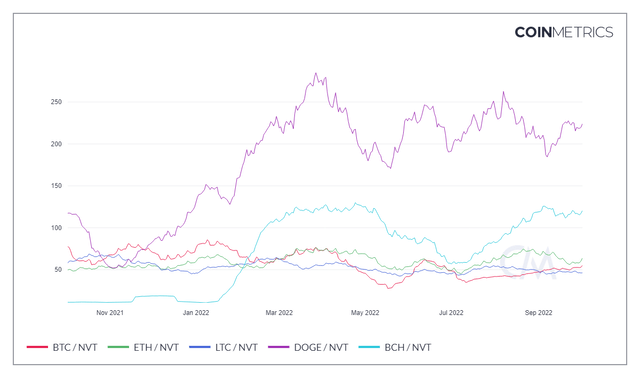

As a percentage of Bitcoin’s daily transactions, Litecoin’s usage has grown from 5-10% in the years before the crypto bubble in 2017 to over 40% now. One of the other ways one can look to value these crypto networks is with a calculation credited to Bitcoin analyst Willy Woo. The calculation is NVT ratio or network value in relation to transactions. The way it is calculated is by dividing the market capitalization by the daily USD denominated transaction volume.

CoinMetrics

At a 46.2 NVT, not only has Litecoin been significantly cheaper than Dogecoin and Bitcoin Cash for years, but it is cheaper than Bitcoin back in September.

Risks

Like all cryptos, there is significant risk when investing in Litecoin. Given Ethereum’s successful transition from proof-of-work to proof-of-stake, I believe there will be additional pressure on the remaining PoW chains to do the same. It could risk centralizing these public blockchains to a far greater extent if the chain developers buckle under the pressure and switch to PoS.

Summary

I am convinced that the crypto investment market is completely wrong about Litecoin. LTC is one of the most widely used payment-focused blockchains for peer-to-peer transactions. Like Bitcoin, the hash rate for Litecoin continues to grow. The wallet addresses with non-zero balances have grown. And the concentration of top LTC holders has actually decreased over the past two years, while notable payment peers have seen increases in concentration. Litecoin has become a valuable peer-to-peer payment network with good decentralization. Yet the market still respects it for some reason. We can see that disrespect through the lack of coverage of the coin and through the massive discount to NAV in Grayscale’s fund. The market hates Litecoin. But it shouldn’t.

Editor’s Note: This article was submitted as part of Seeking Alpha’s Best Contrarian Investment Contest which runs through October 10th. With cash prizes and a chance to chat with the CEO, this competition – open to all contributors – is not one you want to miss. Click here to find out more and submit your article today!