Find the Bitcoin signal through the noise

I was struck by some inspiration today when Nathaniel Whittemore covered a couple of New York Times hit pieces aimed at Bitcoin in a recent episode of his podcast, “The Breakdown.” The first article tried to challenge the decentralization of Bitcoin by using mining statistics from the first days when very few people were mining. Another article by Paul Krugman tried to downplay Bitcoin by saying that it was essentially useless. It comes from a Nobel Prize-winning economist who is notorious for an article that the internet is a passing fad. Why do we trust these people, let alone care what they think?

The difference between signal and noise is simple, but difficult to see in times of panic such as today or euphoria when prices are parabolic. In my eyes, price in itself is noise. Price is made on the margins; Buyers and sellers outperform each other for short periods of time. It tells you nothing about network strength or long-term use. Price stories are nothing more than attempts to generate clicks by inspiring fear or greed based on short-term price movements.

Signal, on the other hand, is deeper; a look under the hood, if you will. Stories about hash rates that have reached a record high, suggesting that the network is more secure than ever. Stories that show unique bitcoin addresses that have reached a record high, indicating continuous growth of users. Stories of a Bank of America poll indicating that 90% of Americans plan to invest in bitcoin over the next year, showing continued adoption and further growth. All these topics have been covered in recent days, regardless of the price drop. Signal.

Signal about Bitcoin happens every single day, but we seem to be inundated with fear, uncertainty and doubt (RD & D) hit pieces and predictions for technical analysis of crystal balls about the doom of the world. I’m here to remind you that most media companies are all about clicks. Clickbait drives engagement and engagement generates advertising revenue. Do not let these headlines fool you, there are signals hidden everywhere, and there are many valuable articles that contain much more than one can see.

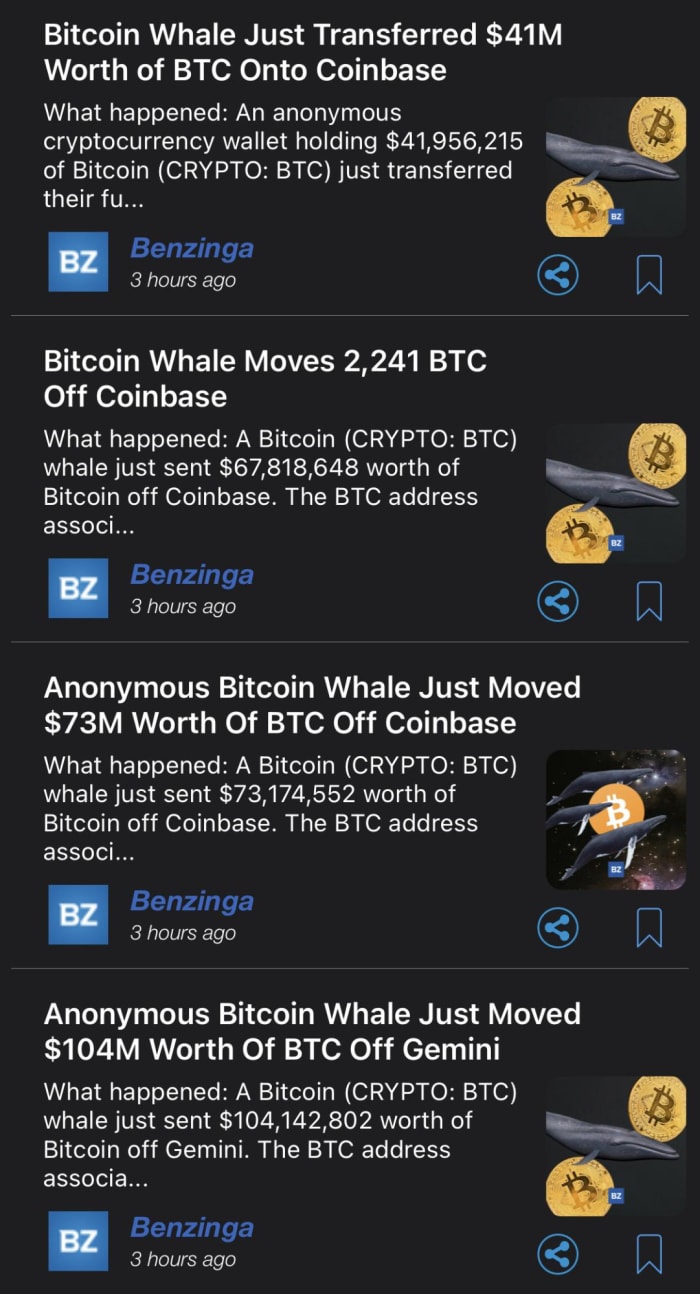

A Miniature Case Study: Benzinga Whale Alerts June 10, 2022

I noticed a few days ago that in a few minutes Benzinga had published two articles: one about a whale exchange deposit and the other about a whale withdrawal. Bezinga will often price the deposit in US dollars, while the withdrawal is held in bitcoin terms. The articles are almost identical for each type of transaction and will characterize swap deposits as a bearish signal, while describing swap withdrawals as a sound long-term holding technique.

“Why it matters: Cryptocurrency transfers from wallets to exchanges are usually a bearish signal.”

Against:

Why it matters: Bitcoin ‘Whales’ (investors who own $ 10 million or more in BTC) usually send cryptocurrencies from exchanges when they plan to hold their investments for a longer period of time. Storing large amounts of money on an exchange carries an extra risk for theft, as stock market wallets are the most coveted target for cryptocurrency hackers. “

Perhaps more interestingly, if you take the time to do the math, you can see as clearly as day that exchange withdrawals largely outweigh the deposits. In this specific excerpt, with almost $ 200,000,000. Nine whole digits. So where is the bearish signal here?

They could have gathered over days or weeks and written a thoughtful article about the movements of the right whale to really dive into the actual signal, but they do not. Because like the New York Times, headlines and clicks are all that matters. They just want the volume.

Technologically driven deflation, Jeff Booth’s dissertation as described in his book, “The Price of Tomorrow”, takes place right before our eyes. The Internet has disabled access and distribution of information. An advantage for billions, but also a double-edged sword that has cut the once-large media companies’ financial positions, forcing them to fight tiny publishers like Benzinga for your attention.

That’s one of the reasons I like Bitcoin Magazine so much. They have many articles criticizing Bitcoin. They do it all the time, but it’s fundamentally different in the sense that you do not find it with a flashy headline to engage alone. I see it as a means of driving the network forward: experts presenting their case to develop conversation with other experts. Not a thinly veiled hit that can easily be disproved or obviously biased. Download the Carrot app and Bitcoin Magazine will even pay you to read their articles. Value for value; a mutually beneficial transaction. Can you say the same about Benzinga? New York Times? I did not even get access to the New York Times articles because they are hiding behind a payment wall. A practical small obstacle to amplifying the echo chamber.

Finding the right signal through all this noise seems to be getting harder and harder, especially in this perceived bear market. All I can say is, do not trust the headlines. Especially when they are shocking or sensational. Media companies follow their incentives just like everyone else. When the incentive is to drive as much engagement as possible, sometimes the juicy headline turns out to be the complete opposite of what was actually written.

This is a guest post by Mickey Koss. Expressed opinions are entirely their own and do not necessarily reflect the opinions of BTC Inc. or Bitcoin Magazine.