September Crypto Winners: XRP, TSUKA and Terra Coins Pumped; Evmos and Synthetix did not

So it was the crypto market’s September (aka SeptemBear). As England’s former Test batsman Paul Collingwood said when Australian legend Adam Gilchrist retired: “Thank God for that.”

There’s no guarantee that October will be any better, but let’s take a look at what has and hasn’t performed over the past 30 days.

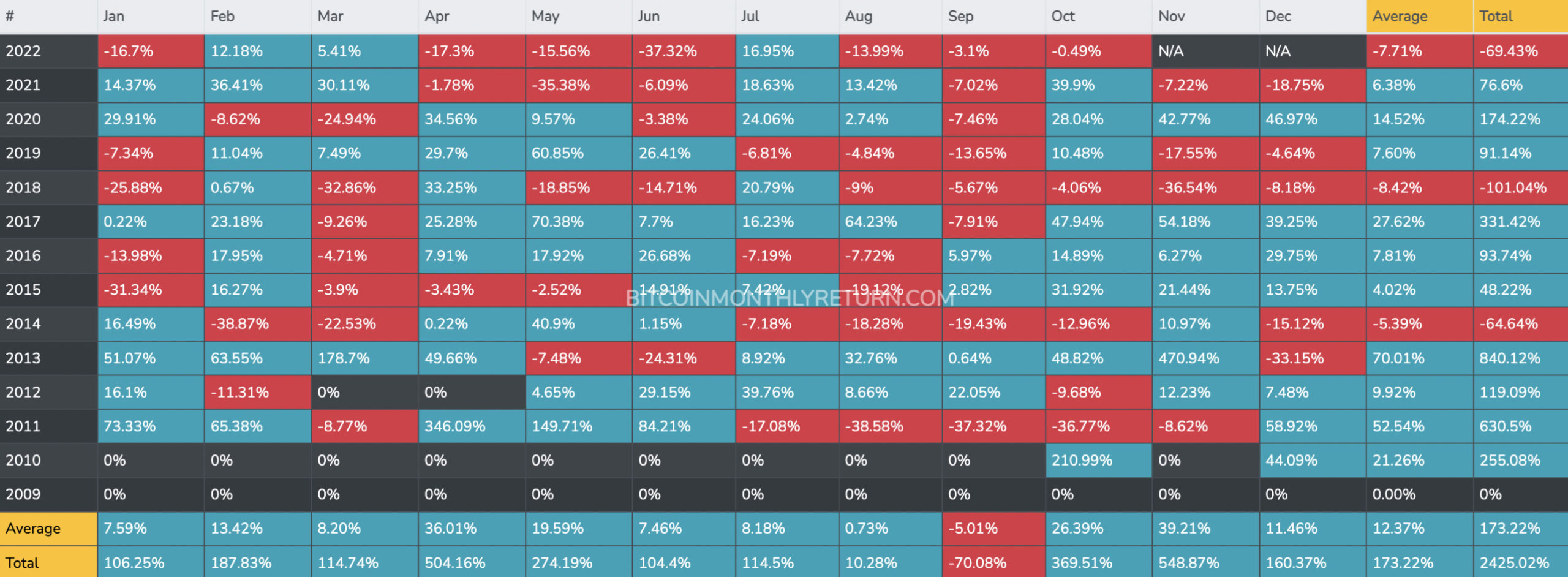

If we only look at Bitcoin as the leading crypto market barometer, September (-3.1%) was not quite as bad as generally feared, as you can see from the Bitcoin monthly returns table below.

Starting the month at around $20,000, BTC closed it around $19,300. Not a terrible fall in crypto terms, but there was certainly a lot of choppy and mixed feelings in between (see the CoinGecko chart below).

October, sometimes referred to as “Uptober” in the cryptosphere, is usually one of the top three months for crypto investors judging by the data. So there is some hope floating around for the next few weeks – mostly based on past results.

That said, these are obviously quite extraordinary times for macroeconomics. It probably is road too much to hope for another 2017 or 2021, but we can offer a small prayer to the fickle crypto portfolio gods that we don’t have a repeat of 2011.

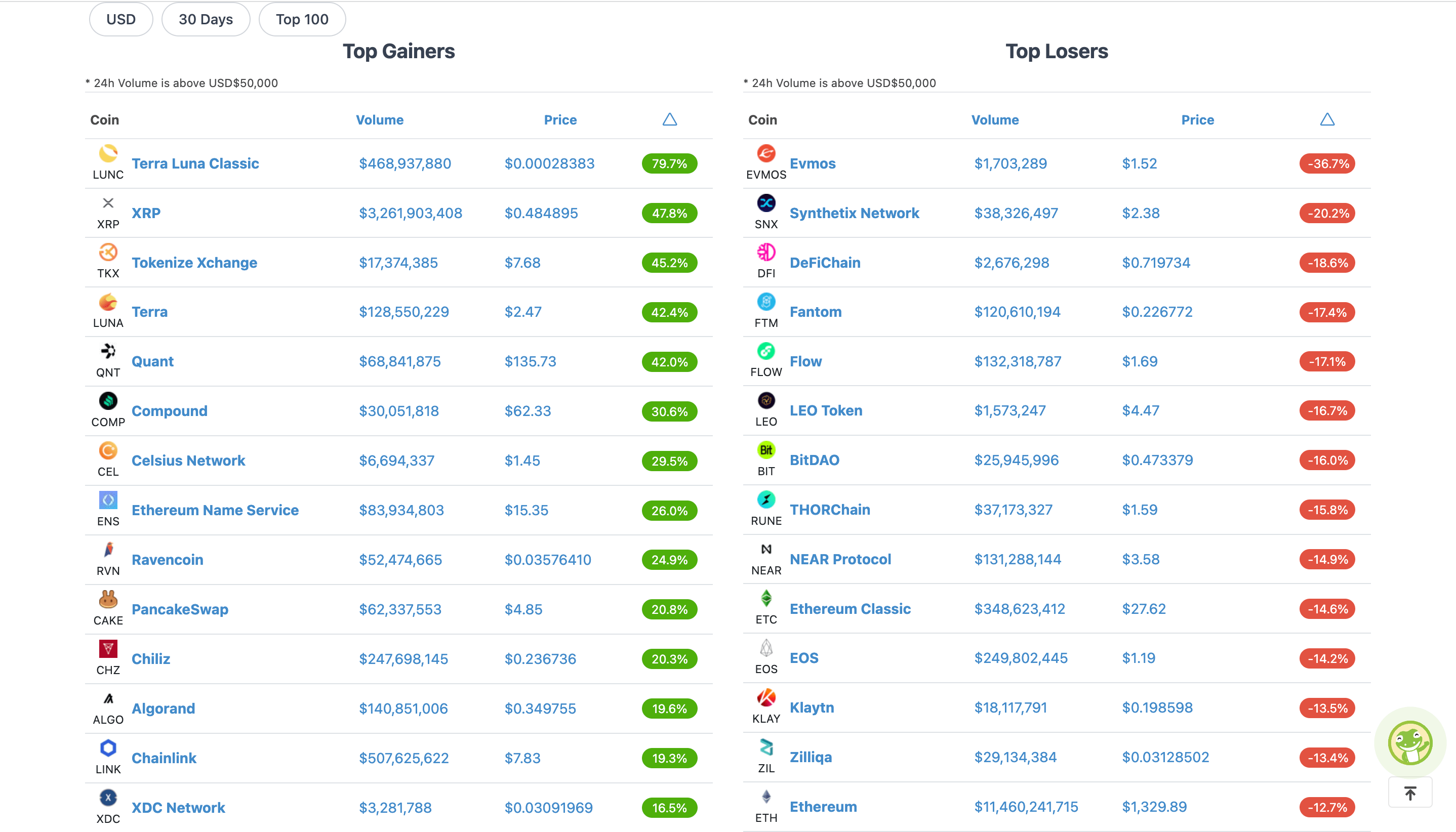

September’s leading winners and losers in the top 100

Terra firmer (than it was in May)

Terra Luna Classic (LUNC) (+79.7%) led the rise for the month, by a significant margin.

We’ve flagged the trade/investment risk on this one a few times, given the controversial recent history of the Terra brand.

Terra (LUNA) (+42.4%) also makes the top gainer list, while its founder, Do Kwon, is reportedly wanted by Interpol for apparent violations of South Korea’s capital markets law.

It’s a bit confusing, but LUNC is original The Terra LUNA coin, while now called LUNA (also known as LUNA2) was created as an airdrop by Kwon as part of a “regeneration strategy” for the Terra ecosystem.

In May, we witnessed the implosion of Terra’s LUNA network, where billions of investor dollars were lost, triggering a domino-like “crypto contagion” effect that brought down or severely damaged several high-profile platforms and crypto market entities.

Why do these coins keep seeing sporadic pumping? Whales can have fun, so it’s definitely been an “enter at your own risk” trade.

That said, LUNC had a direct reason for at least part of the recent surge. It can be attributed to an announcement by crypto exchange Binance, which reportedly plans to implement a “burning mechanism to burn all trading fees on LUNC spot and margin trading pairs”. This should effectively cut the token’s supply.

» Binance to implement Terra Classic (LUNC) burning mechanism

Quick thread on what we do and why below.

— CZ 🔶 Binance (@cz_binance) 26 September 2022

The ripple effect

As for XRP, at the time of writing it is up more than 12% in the last 24 hours and close to 50% for the whole of September.

The money transfer network and digital currency was created by Ripple Labs, which is still in the middle of a much-publicized and bitter legal dispute with the US Securities and Exchange Commission. The SEC claims that the initial token sale of XRP in 2018 violated US securities laws. Ripple strongly disputes this.

A victory for the SEC would set a worrisome precedent for the vast majority of the crypto industry, especially any project that engaged in ICO (initial coin offering) token sales. A win for Ripple Labs would be seen as a huge boost – not just for XRP, but for crypto in general.

There have been developments in the trial this month that are seen as potentially favoring Ripple Labs’ chances of a victory. Hence the XRP pump. To get the bigger picture, check out our recent articles on the topic here, here and here.

Evmos and Synthetix wash

Sometimes it can be more difficult to determine why certain coins have performed worse than others. Especially when they appear to be solid projects with solid foundations.

Evmos (EVMOS) (-36.7%), for example, had one throbbing Augustwhich led the top 100 crypto gainers of that month, which was based on excitement for its fee-based network upgrade that is about sustainable growth for the token model.

There has been no indication that the Evmos decline in September has been justified, so perhaps it is a case of buyer fatigue or “sell the news”, a la Ethereum and its headline-dominating merger. Ethereum (ETH) was also an ultimately double-digit loser in September (-12.7%).

Synthetix (SNX) was another notable decline in September, and yet there seems to be a lot going on with the protocol in terms of DeFi “builds” and upgrades.

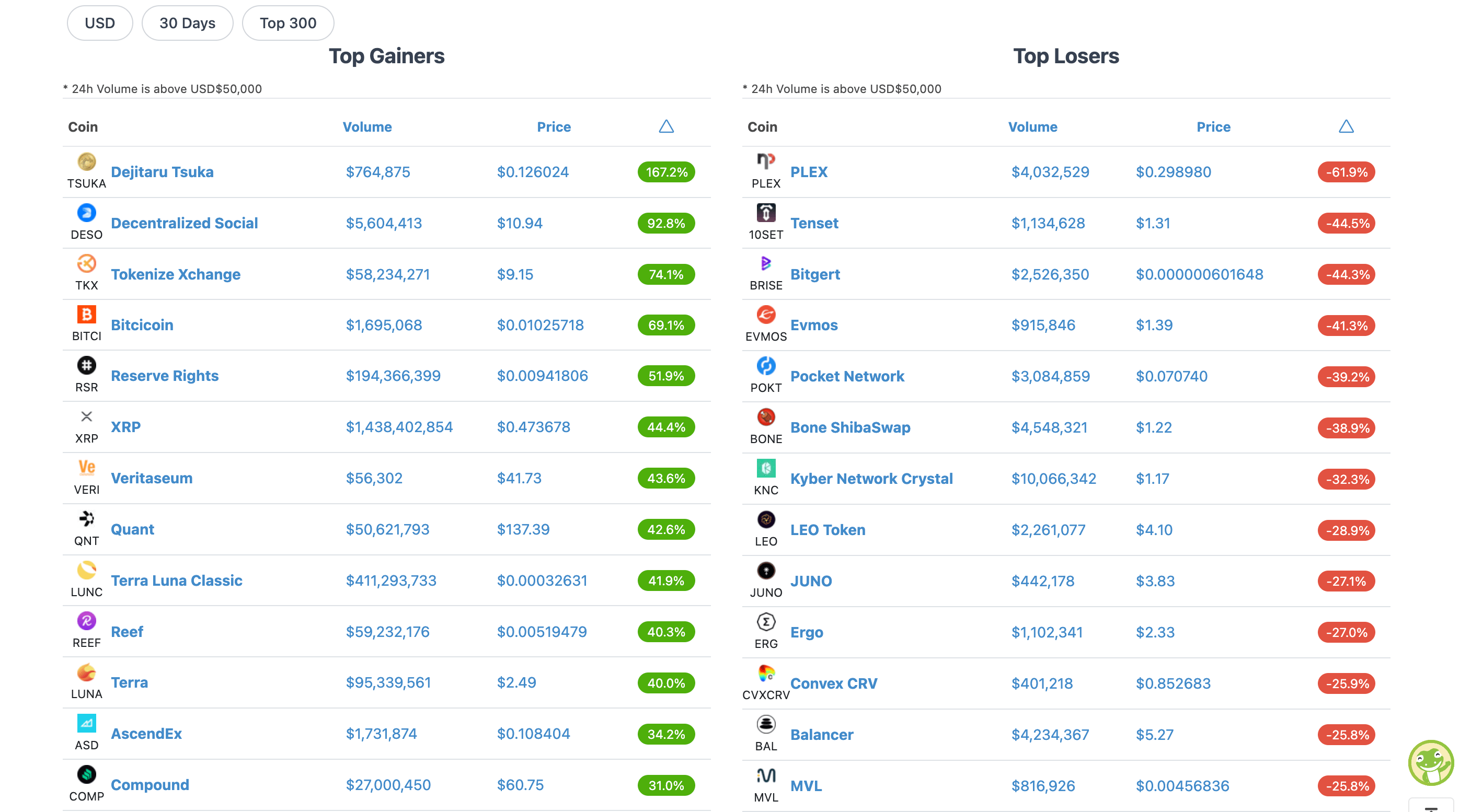

Top 10 Winners and Losers in the Top 300: What is TSUKA?

Finally, zooming out a bit, here were the top 10 winners and losers from the top 300 cryptos by market cap, with thanks again to CoinGecko…

How fungible is Dejitaru Tsuka (TSUKA)? It may have flown under Coinhead’s radar, but it has pumped more than 167% in the last 30 days or so.

A quick glance tells us that it is a “meme coin” ERC-20 (Ethereum-based) token. And according to The Daily HODL website, it is rumored to have been created by “Ryoshi” – the same developer behind Dogecoin’s main dog coin competitor, Shiba Inu (SHIB).

Considering the Shiba Inu’s history of absolutely outsized mind-blowing wins (in its earlier days), it’s perhaps not surprising that this one has had a bit of a pump on the back of another, older tale.

Per CoinGecko statistics, SHIB is currently up 19,838,473.6% from its early low back in 2020. TSUKA is, at the time of writing, up 883% from its all-time low two months ago.

What does it do and what’s the point? It doesn’t seem easy to answer.

“Dejitaru Tsuka touts itself as a decentralized community centered around meditation, reflection and research,” wrote The Daily HODL.

The Dejitaru Tsuka dragon is “the harbinger of abundance and wealth,” according to the meme coin’s website, which cites Japanese lore.

Today, 26 September 2022, we mark our 4-month anniversary

We will take the opportunity to celebrate YOU 💜

All the wonderful sangha members who have built this beautiful community together 🙏

Take these 2 minutes to enjoy some heartwarming community messages $tsuka pic.twitter.com/gXVtdG4Lqk

— TSUKA (@Dejitaru_Tsuka) 26 September 2022

Righto. In any case, we can keep a bit of a non-financially advised eye on it. Meme coins can sometimes be a leading indicator of crypto market hype and hype.

Overall, despite a somewhat tepid September for crypto price action, it still very much feels like the year to live even more dangerously than usual for risk markets.

There has been some strange talk about it on Crypto Twitter here and therebut we wouldn’t bet also heavy on the Fed making a surprise pivot before the end of the year to restart the money printer.

That said, the UK just announced that they are doing just that amidst crazy inflation levels there, so who the hell knows what these central bankers are actually thinking and planning.

invest in 2022:pic.twitter.com/vuo990sUj1

— yzy.eth (@LilMoonLambo) 29 September 2022