Yield Curve Control And The Fiat End Game – Bitcoin Magazine

Below is an excerpt from a recent issue of Bitcoin Magazine Pro, Bitcoin Magazine premium market’s newsletter. To be among the first to receive this insight and other market analysis on the bitcoin chain straight to your inbox, Subscribe now.

Here comes yield curve control

A central theme of our long-term Bitcoin thesis is the continued failure of centralized monetary policy across global central banks in a world where centralized monetary policy is unlikely to fix, but only exacerbate, larger systemic problems. Failed, pent-up volatility and economic destruction resulting from central bank attempts to solve these problems will only further expand distrust of financial and economic institutions. This opens up an alternative system. We believe that the system, or even a significant part of it, may be Bitcoin.

With the goal of providing a stable, sustainable and useful global monetary system, central banks face one of their greatest challenges in history: solving the global sovereign debt crisis. In response, we will see more monetary and fiscal policy experiments develop and roll out around the world to try to keep the current system afloat. One of these policy experiments is known as yield curve control (YCC) and is becoming more critical to our future. In this post, we will cover what YCC is, its few historical examples, and the future implications of increased YCC deployments.

YCC historical examples

Simply put, YCC is a method for central banks to control or influence interest rates and the overall cost of capital. In practice, a central bank sets its ideal interest rate for a specific debt instrument in the market. They continue to buy or sell that debt instrument (i.e. a 10-year bond) no matter what to maintain the specific interest rate peg they want. Usually they buy with newly printed currency which increases the monetary inflationary pressure.

YCC can be tried for a couple of different reasons: maintaining lower and stable interest rates to stimulate new economic growth, maintaining lower and stable interest rates to lower the cost of borrowing and interest payments or intentionally creating inflation in a deflationary environment (to name a few). Success is only as good as the central bank’s credibility in the market. Markets must “trust” that central banks will continue to follow this policy at all costs.

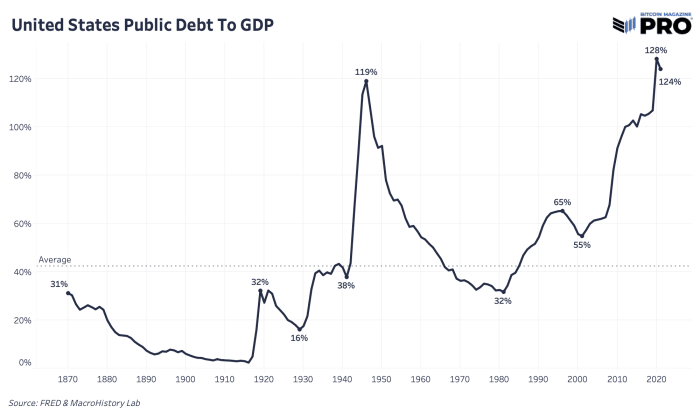

The largest YCC example occurred in the United States in 1942 after World War II. The US incurred huge debt outlays to finance the war, and the Fed capped yields to keep borrowing costs low and stable. During that time, the Fed capped both short-term and long-term interest rates on short-term bills at 0.375% and long-term bonds up to 2.5%. In doing so, the Fed relinquished control over the balance sheet and the money supply, both of which increased to maintain the lower interest rate pegs. It was the chosen method to deal with the unsustainable, spiraling growth in public debt in relation to gross domestic product.

YCC present and future

The European Central Bank (ECB) has effectively engaged in a YCC policy flying under a different banner. The ECB has been buying bonds to try to control the difference in interest rates between the strongest and weakest economies in the eurozone.

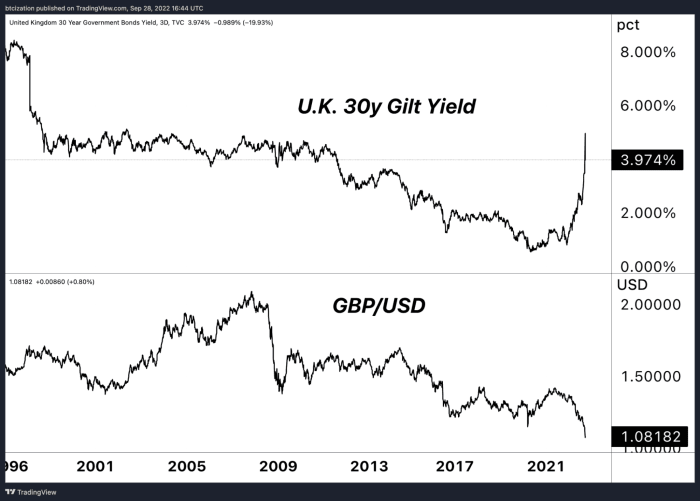

Interest rates have gotten too high too fast for economies to function, and there is a dearth of marginal buyers in the bond market right now as Treasuries are having their worst year-to-date performance in history. That leaves the BoE with no choice but to be the buyer of last resort. If QE restarts and initial bond purchases are not enough, we could easily see a progression to a more stringent and prolonged Yield Cap YCC program.

It was reported that the BoE moved to stop the rout in gilts because of the potential for margin calls across the UK pension system, which has about £1.5 trillion of assets, the majority of which were invested in bonds. Since certain pension funds hedged the volatility risk with bond derivatives, managed by so-called liability-driven investment funds (LDI). As the price of long-dated UK government bonds fell drastically, the derivative positions secured by said bonds as collateral became increasingly exposed to margin calls. While the details are not particularly important, the key point to understand is that when monetary tightening became potentially systemic, the central bank stepped in.

While YCC policies may “kick the can” and limit crisis damage in the short term, it unleashes a whole box of consequences and second-order effects that must be dealt with.

The YCC is essentially the end of any “free market” activity left in the financial and economic systems. There is more active centralized planning to maintain a specific cost of capital on which the entire economy operates. It is done out of necessity to keep the system from total collapse, which has proven to be inevitable in fiat-based monetary systems nearing the end of their shelf life.

YCC prolongs the sovereign debt bubble by allowing governments to lower the overall rate of interest payments and lower borrowing costs in future debt rollovers. Based on the large size of the public debt, the pace of future fiscal deficits, and significant promises of entitlement spending far into the future (Medicare, Social Security, etc.), interest spending will continue to take a larger share of tax revenue from a shrinking tax base under pressure.

Last note

The first use of yield curve control was a global wartime objective. The use was for extreme circumstances. So even the attempted rollout of a YCC or YCC-like program should act as a warning signal to most people that something is seriously wrong. Now we have two of the largest central banks in the world (on the verge of three) that actively follow policies for yield curve control. This is the new development of monetary policy and monetary experiments. Central banks will try whatever it takes to stabilize economic conditions and more monetary deterioration will result.

If ever there was a marketing campaign for why Bitcoin has a place in the world, this is it. As much as we’ve talked about the current macro headwinds needing time to play out and lower bitcoin prices are a likely short-term outcome in the scenario of severe stock market volatility, the wave of monetary policy and relentless liquidity that will have to be unleashed to save the system will be massive. Getting a lower bitcoin price to accumulate a higher position and avoid another potential significant drop in a global recession is a good play (if the market allows), but missing the next big step up is the real lost opportunity after our view.

Relevant previous articles