How eight state regulators orchestrated crypto lender Nexo’s takedown and why it matters

- Nexo, a leading crypto lender, was caught off guard by eight state regulators who publicly took action regarding security breaches.

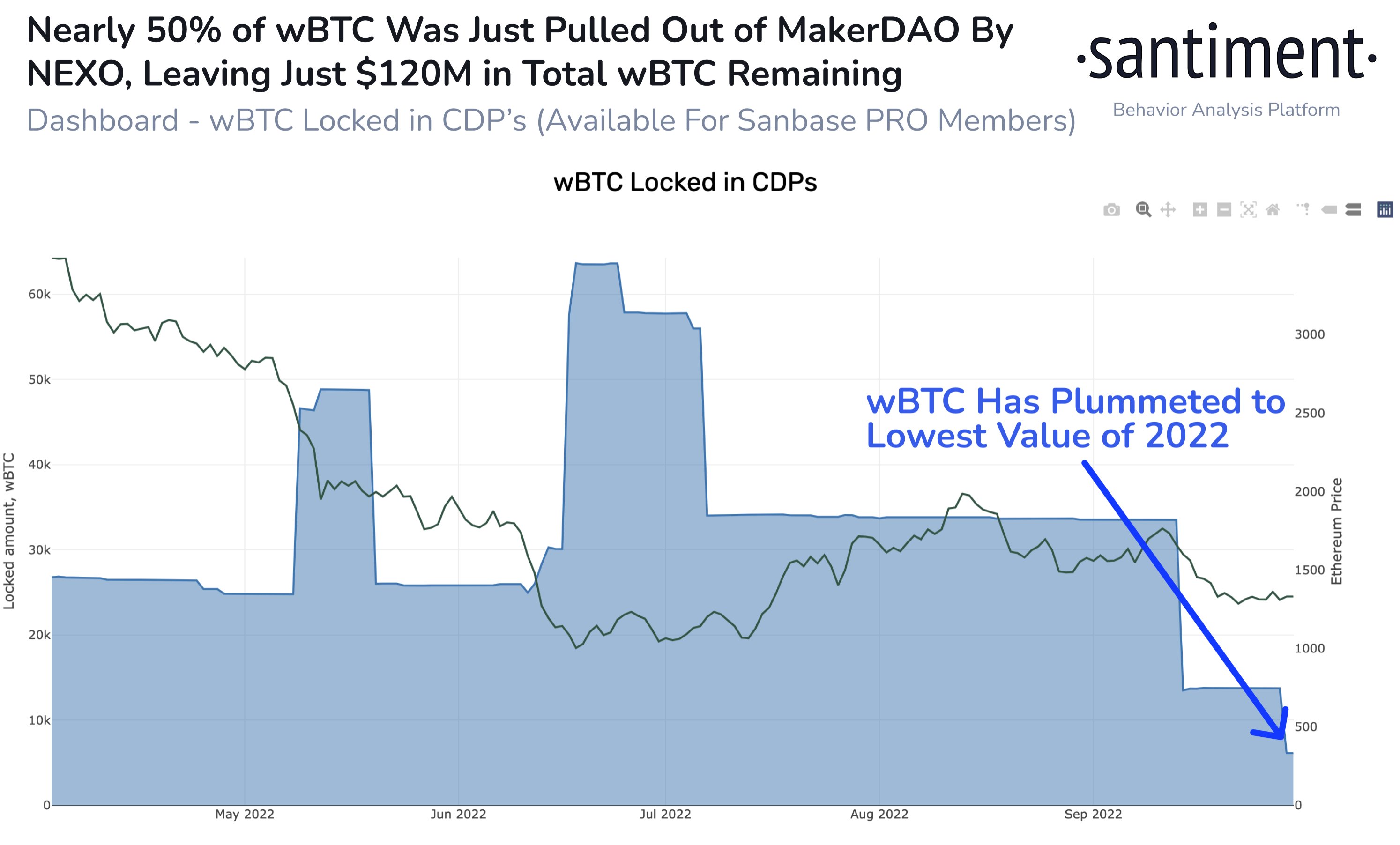

- Under regulatory pressure, Nexo withdrew nearly 50% of the wrapped Bitcoin, an Ethereum-based token whose value is tied to BTC.

- Analysts believe the wBTC price is at risk of falling as the lender crumbles under pressure and makes big moves on MakerDAO.

Earlier this week, the California Department of Financial Protection & Innovation (DFPI) filed a cease and desist order against Nexo’s Earn Interest product. The state authority claimed that Nexo offered a security product that was not approved by the government for sale in the form of an investment contract. Nexo has suffered a tear at the hands of regulators and made major moves, pulling out 50% of wBTC held in MakerDAO.

Also read: Bitcoin mass adoption: Spain’s largest telecom company accepts BTC and crypto

Nexo hit by regulatory push-back, makes big moves

The California Department of Financial Protection & Innovation (DFPI) filed a cease and desist order against Nexo’s Earn Interest product. DFPI was joined by seven other states Kentucky, New York, Maryland, Oklahoma, South Carolina, Washington and Vermont that took action against Nexo.

Kalin Metodiev, co-founder and managing partner of crypto lender Nexo, stated that his firm was “surprised” by the way regulators publicly cracked down on the firm for securities violations. Metodiev explained that Nexo has tried to take responsibility and engaged in direct conversion with regulators such as the Securities and Exchange Commission (SEC).

Metodiev said,

We were a little surprised that this news was thrown out publicly, you know, because this is not a process that just started this week. We’ve been working with our legal counsel in the US that we’ve used over the last couple of years to specifically navigate these waters in these conversations.

As Nexo works with regulators and tackles the looming issues, crypto intelligence tracker Santiment has noted major moves by the crypto lender in packaged Bitcoin (wBTC), an Ethereum-based token backed one-to-one with Bitcoin.

Analysts at Santiment identified Nexo’s big move, the crypto lender withdrawing nearly 50% of wBTC held in Maker DAO. This has left $120 million in wBTC locked in a Collateralized Debt Position (CDP). A CDP is created when security is locked into a MakerDAO’s smart contract. It generates the decentralized stablecoin DAI.

Analysts are monitoring Nexo’s move to decipher the crypto lender’s plans for its free assets.

wBTC locked in CDPs

Interestingly, Nexo’s move has pushed the wBTC price to its lowest value in 2022. Analysts believe the wBTC price is at risk of further decline if Nexo pulls packaged Bitcoin out of Maker DAO.