Crypto exchanges and retail brokers are fighting for customers as the desire to trade cools

Brokers that offer stock trading and crypto exchanges that sell digital tokens are making progress toward each other’s clients as the glow that drove retail trading volume cools.

Both groups, which serve as gateways for ordinary investors to buy and sell popular assets, look at the most attractive areas in competitors’ markets to counteract the cold caused by this year’s fall in the stock and crypto markets.

A wave of trading in stocks and cryptocurrencies among investors on the move last year gave brokerages a powerful but volatile boom, with high trading volumes and record-breaking new customer registrations.

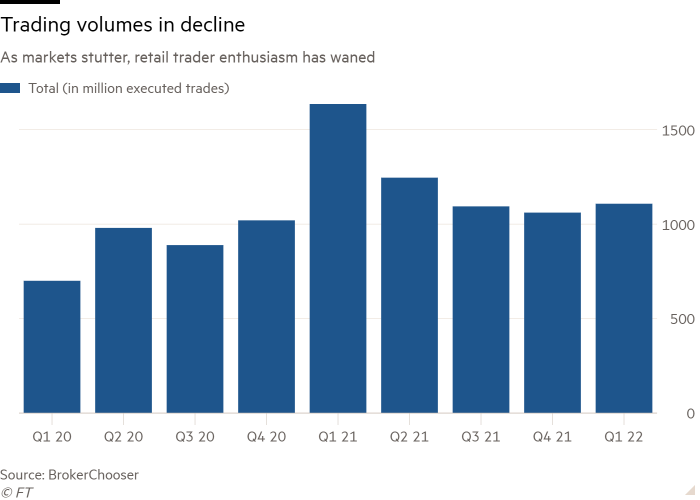

Inflation and rising interest rates have dampened investor enthusiasm. The number of trades placed at traditional American brokerages fell 32 percent in the first quarter of 2022 compared to the previous year, according to analysis from BrokerChooser.

Supported by profits from two years of pandemic trading, some crypto companies are investing in diversification into new markets.

The cryptocurrency exchange FTX starts stock trading this year and has supplemented the strategy with the purchase of the share settlement center Embed Financial and an undisclosed ownership interest in IEX, the regulated exchange. Bitpanda, one of Europe’s largest exchanges, already allows customers to buy shares and ETFs.

Sam Bankman-Fried, FTX’s 30-year-old founder, has also seriously considered a more ambitious goal: to buy memestock broker Robinhood to bolster the company’s stock trading efforts, according to people familiar with the matter. He paid $ 648 million for a 7.6 percent personal stake in Robinhood, co-founded by 35-year-old Vlad Tenev, in May. FTX says no formal M&A talks have been held.

“Many of those who want to invest in crypto also want to invest in stocks… [adding stocks] makes the experience much cleaner, “Bankman-Fried said in an interview with the Financial Times, adding that he” actively looks “at acquisitions.

He said that FTX looks at purchasing companies that either have “strong brands and user bases” or “many of them. . . expertise with special parts of licensing that we do not have much background in ”.

On the other hand, retail brokers try to stay competitive and attract new users in a market where commissions for stock trading are zero.

Robinhood began offering crypto trading in 2018, while Interactive Brokers, which handles approximately 9 percent of the option volume in the United States, has announced plans to enter the crypto area. Public.com allows users to trade both stocks and crypto.

In May, fund manager Fidelity announced that it would allow investors to add cryptocurrencies to their portfolios in 401 (k) pension plans. Fidelity and Charles Schwab are also building a cryptocurrency trading platform with market makers Virtu Financial and Citadel Securities. “We’re spitting new stuff on a really fast clip right now,” said Steve Quirk, Robinhood’s new head of brokerage.

Retail brokers see an opportunity to enter the crypto market before US lawmakers set rules for trading digital assets.

“When the regulators come out with some rules, it’s going to be too late to be in [crypto] markets the right way, says Thomas Peterffy, Chairman of the Board of Interactive Brokers. “It is better to be in the markets already and adapt to the regulations. . . other brokers will go into crypto soon as well, provided that crypto is also still a thing. ”

But both sides face obstacles to breakthrough in each other’s markets.

Bolting technology designed for crypto trading on existing stock platforms may not be easy. “When companies now want to offer crypto, they have one big problem. If they build it themselves, they want a product that is as it is in 2017,” said Eric Demuth, co-founder and CEO of Bitpanda.

The stock market in the United States is also changing as the economics underlying the business models change.

The retail brokers’ business model is under investigation by regulators, especially regarding the practice of paying for order flow. Brokers like Schwab and Robinhood sell their clients’ orders to intermediaries like Citadel Securities and Virtu – and they earned more than $ 3.8 billion last year in payments for their orders.

FTX has already said that they will not sell their order flow to market makers when they start stock trading, and said that profitability is not the main concern.

Bankman-Fried claims that the brokerage industry is ripe for consolidation. “You have thousands of mobile brokers, most of whom do nothing but offer a mobile app that connects to payment flow orders,” he said.

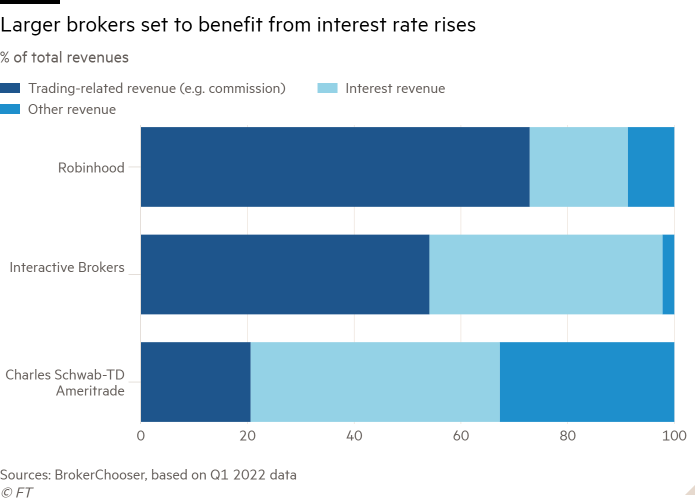

At the same time, interest rates have risen to the highest levels in more than a decade, enabling brokers to collect interest rates and generate income from large account balances. This has helped to offset declines in trading revenues.

It can favor larger established players who have large and established customer bases.

“There is significant revenue upside for the big brokers where clients have a lot of money, namely Schwab and Interactive Brokers,” said Rich Repetto, analyst at Piper Sandler.

More than 45 percent of Schwab’s revenue comes from interest on customer funds, a number that has increased since trading revenues have declined. In contrast, 73 percent of Robinhood’s revenue was related to trading, and only 18 percent comes from interest earned on customer account balances, according to data from the first quarter.

As an illustration of Robinhood’s efforts to increase account balances, the group told clients in June that they would give them as much as $ 800 to transfer their assets to the platform, and repay them for up to $ 75 in exit fees from other brokerages.

Although Robinhood’s revenue per account has fallen to $ 53 per account – analysts note that it may be attractive not for profitability, but rather as a technology company given its elegant user experience and success in getting customers on board. A great deal can prove to be irresistible.

“If it’s a big player that’s rich in money, you’ll jump into the market.