How to Denominate in Bitcoin Terms – Bitcoin Magazine

This is an opinion editorial by Stephan Livera, host of the “Stephan Livera Podcast” and CEO of Swan Bitcoin International.

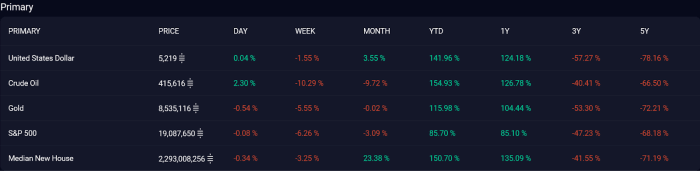

Many fiat currencies are struggling to retain purchasing power in USD. The macro conversation on finance Twitter is now about how the total system is breaking down, and the fact that you can’t lose a Ponzi.

Now is a great time to tap the advantage that Bitcoin brings: not being a fiat currency that can be printed on demand. It’s time to denominate in bitcoin terms.

What is happening in Fiat’s currency markets?

As you may be aware, many fiat currencies crash against the USD. This does not necessarily mean that the USD “goes up” either, it also loses purchasing power, just at a reduced pace.

Year-to-date (YTD) for major fiat currencies vs USD:

- GBP is down from $1.34 to $1.057 — a 21% drop

- JPY is down from 0.0087 to 0.0069 – a 20% drop

- EUR is down from $1.13 to $0.97 — a 15% drop

The Bank of England is now starting a new wave of bond purchases, or in other words, the deterioration continues. GBP holders and savers will continue to have their savings destroyed by the money printer over time. They are sacrificed on the altar of “financial stability”.

With fiat currencies devaluing this quickly, it’s not such a crazy idea that we should value things directly in rate or BTC terms. While nocoiners love to hate Bitcoin for not being at all-time highs, the reality is that long-term Bitcoin users have benefited dramatically, both in terms of purchasing power and freedom.

The loss of confidence in fiat currencies is driving a fundamental shift in thinking. If our precoiner friends were afraid of bitcoin because of volatility before, the difference in volatility between bitcoin and fiat coins has decreased, so it makes sense to start using bitcoin denominations.

What does it mean to denote in Bitcoin terms?

It means evaluating financial costs and benefits in Bitcoin or satoshi terms. This includes financial valuation of our net worth in bitcoin/sat terms. This is really what matters in the long run for Bitcoin Maximalists after all. If you think that everything is going to be priced in rate one day, why not start now?

I’ve personally entered my net worth in bitcoin terms for a while now, but I’ve struggled with the next part: daily expenses. For me this is mainly due to mental arithmetic. So my next step is to focus more on evaluating the bitcoin cost of income and spending on daily goods. If we are serious about bitcoin as better money, we should show it.

Practical Tips on Bitcoin Denomination

Start by keeping your finger on the pulse of what the “rate per dollar” price is. You can do this using Coinkite’s BLOCKCLOCK (aka, Moscow Time) or perhaps on sites like Bitbo.io that display it. You can also use conversion tools like bitkoin.io or preev.com. Pricedinbitcoin21.com is also a useful site that shows all kinds of bitcoin denominated prices.

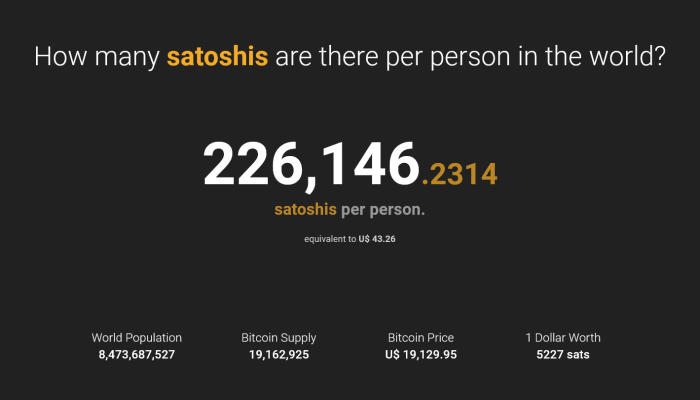

For mental calculations, a tip is to start with a rate per dollar. So, for example, if 1 BTC = $19,067, then the bet per dollar is about 5,200, so $10 is about 52,000 bet, $100 is about 520,000 bet, and $1,000 is about 5.2 million bet.

Another hurdle is just having to continually reset prices if we actually are cites real products/services in bitcoin terms. But so it is, this is our well-known cross to bear, and it benefits the user in the long term to operate in this way.

Of course, there may come a point where the bitcoin price for something set a few years/cycles ago is no longer appropriate, but this just requires realignment. And to be fair, this is something all fiat dealers must do regardless.

This isn’t new, we’re just taking it back

In the earlier days of Bitcoin, it was more common to talk about the BTC values of things. Perhaps it became more difficult because of the price increase and dealing with small fractions of a bitcoin in our heads.

However, remember that early services and games ranging from SealsWithClubs, to MPOE, to SatoshiDice were bitcoin denominated! Some early exchanges on Bitcoin Talk forums were bitcoin-denominated. So really this is just bringing back what Bitcoiners used to do.

Of course, there are some in the Bitcoin space who are already bitcoin-denominated even in terms of the service/product they sell. Notably, the CoinJoin services are bitcoin-denominated (see e.g. the Whirlpool fee calculator here), and various individuals in the area operate without fiat bank accounts, so they obviously do better to be bitcoin-denominated.

We should also note that the Lightning Network helps here as well. Various Lightning services, tips and wallets are set at face value. For example, the Alby and Podcasting 2.0 apps are sat-denominated. People running routing nodes on the Lightning Network set their base fees and variable fees (ppm, or parts per million) in satoshi terms, which we can see by browsing Lightning nodes on explorers like mempool.space.

On the question of amount: Bitcoin or Sats?

A long-standing theme in Bitcoiner circles is the point unit bias, which is believed to be behind some shitcoins pumping. The nocoiner coming in sees a very low price per unit and buys shitcoin thinking, “Hey, it’s coming from a low base, so there’s more upside.” So the rationale is that if we all talked only in terms of rate (and not in BTC terms), bitcoin could also exploit this effect.

But this doesn’t come for free, it’s a trade-off. It may well be high net worth investors (HNWI) who are getting into bitcoin and because they want to buy “a whole coin” they are buying more than they otherwise would have. We can even argue that the amount HNWIs buy is higher, and thus the effect HNWIs have is higher. And now most people know the oft-quoted statistic about how “even if every millionaire on earth wanted a whole bitcoin, they couldn’t get it.”

Remember that if you divide the number of sats by the number of people on earth, that number comes out to around 226,000 sats (see satsperperson).

But perhaps this unt bias question is neither here nor there. As long as there is a simple option or toggle between BTC terms and satt terms in our apps and services, it probably doesn’t matter much. In practice, I think people will only refer to things of lesser value in sat terms, and greater value items in BTC terms.

You can’t completely avoid doing Fiat conversions

I understand that a criticism here might be that many of our daily living expenses are still nominal, and that we can’t completely escape it (yet). Nocoiners may also criticize us for still valuing bitcoin in USD, but the process must start somewhere.

Starting somewhere means we should try to think in bitcoin or set terms first. So if we talk about the price of things, list the bitcoin terms price first. Or perhaps more provocatively, list the bitcoin price just and let the other person do a calculation. Let’s disrupt the network effect of fiat currency and not let our lives be controlled by the fiat currencies.

This is a guest post by Stephan Livera. Opinions expressed are entirely their own and do not necessarily reflect the opinions of BTC Inc or Bitcoin Magazine.