Bitcoin accumulation phase intact, is a bottom finally in?

High gains, retail euphoria and massive rallies haven’t really been on Bitcoin’s plate in recent months. The BTC price is still struggling below the $20,000 mark, but on-chain indicators highlight that recovery from here could be slow and steady.

Bitcoin was stuck in a range between $19,500 and $18,700 last week. It opened this week at a price of $18,900, but the sentiment surrounding Bitcoin and its price performance remained relatively high.

Social indicators obtained from Santiment showed an increase in Bitcoin interest on social platforms over the past weekend. Among the top 100 crypto assets, BTC was a hot topic in over 26% of discussions for the first time since mid-July.

Long-term BTC HODLers remain dormant

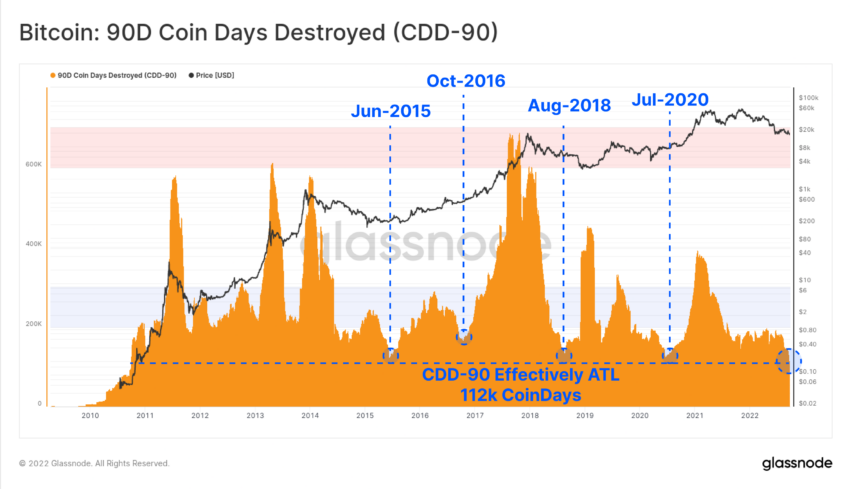

The total volume of Bitcoin coin days destroyed in the last 90 days has actually reached an all-time low. This shows that a high number of HODLed coins have been dormant for several months.

Prior to this, the CDD lows were observed in July 2020, August 2018, October 2016 and June 2015. During the previous ATLs, the BTC price was also in consolidation phases near lower long-term support levels.

Coin Days Destroyed (CDD) is a measure of economic activity that gives more weight to coins that have not been used for a long time. A low CDD count means that bitcoins that have been held for the long term remain largely untouched.

The high number of dormant coins may mean that the conviction rate in BTC is high. This is probably also due to reduced interest in the middle of a bear market, which leads to lower activity in the chain and thus lower indicator values.

The accumulation still continues, but what about whales?

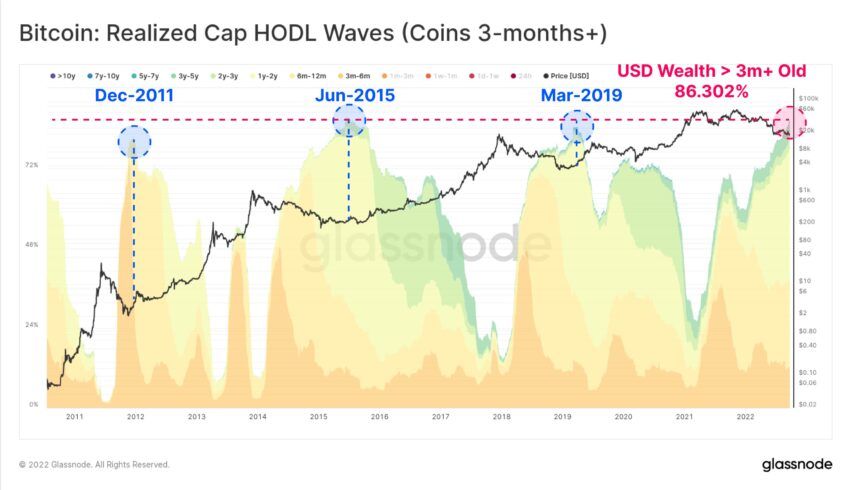

Another interesting trend was that coins older than three months now represent an ATH of 86.3% of all BTC supply measured in USD value. Looking at the Realized Cap HODL Waves chart, it is clear that despite the recent headwinds against prices, Bitcoin HODLers appeared to be steadfast and unwavering in their convictions.

The increasing number of older coins highlights how the accumulation has remained intact at lower prices. Past ATHs for coins older than three months have coincided with market bottoms, but consolidation may continue due to other macroeconomic factors.

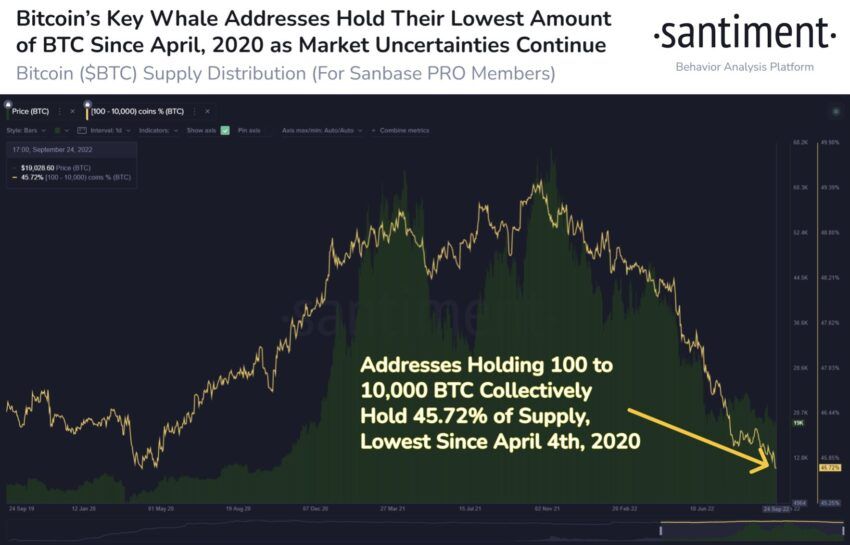

In addition, a worrying trend was seen in the whale address chart. In particular, the amount of Bitcoins held by whales has been falling steadily for the past 11 months now.

While long-term holders have continued to accumulate, the supply held by whales (100-10,000 BTC in this case) has hit a 2.5-year low.

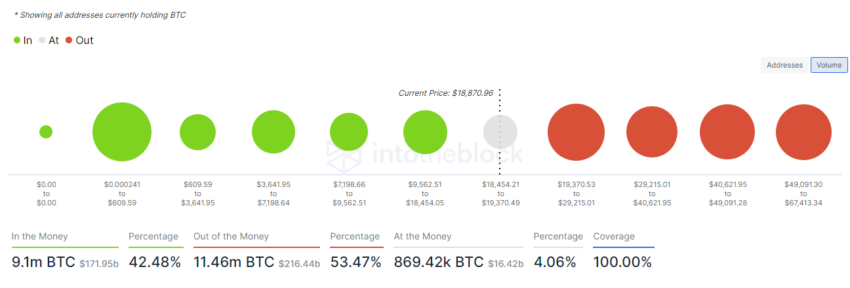

Apparently, in the short term, the next decisive barrier for BTC will be at the $19,025 mark where 869,000 BTC are held by over 1.6 million addresses, according to data from IntoTheBlock’s In and Out of Money Indicator.

Disclaimer

All information on our website is published in good faith and for general information purposes only. Any action the reader takes on the information contained on our website is strictly at their own risk.