Even Bitcoin and Crypto can’t fight the Fed’s interest rates

Alex Wong

Bitcoin (BTC-USD) has long been championed as an alternative asset class. Now, at a time when many investors are seeking just that, amid hit after hit in stocks as the Federal Reserve continues to raise interest rates, Bitcoin is more correlated to stock market than ever before. As Bitcoin becomes more mainstream, I don’t expect this trend to reverse. All of this is problematic for Bitcoin as an asset.

September 0.75bp Rate Hike Tanks Bitcoin

On Wednesday, the Federal Reserve met and decided on another increase of 0.75 basis points. In addition, they made it excessively clear that curbing inflation is the Fed’s number one priority:

The committee seeks to achieve maximum employment and inflation of 2 per cent in the longer term. In support of these goals, The Committee decided to raise the target range for the federal funds rate to 3 to 3-1/4 percent and expects that ongoing increases in the target range will be appropriate. In addition, The committee will continue to reduce its holdings of government securities and agency debt and agency mortgage-backed securitiesas described in the Plans to Reduce the Size of the Federal Reserve’s Balance Sheet issued in May. The committee is strongly committed to bringing inflation back to the target of 2 per cent.

This subsequently caused the stock markets to fall. But it also sent Bitcoin down. If the goal of Bitcoin and other cryptocurrencies like Ethereum (ETH-USD) is to “decentralize finance” and provide an alternative asset class for investors, Wednesday’s performance was highly problematic.

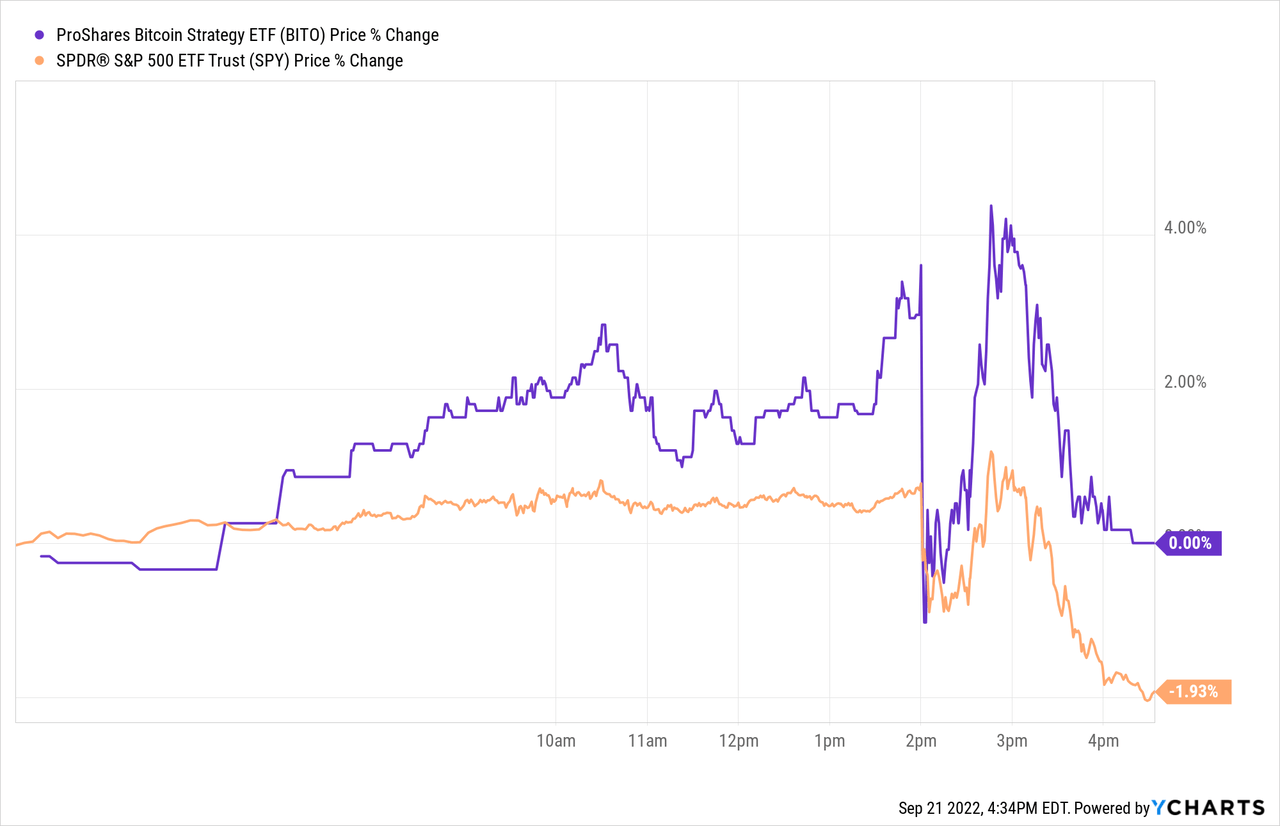

The graph above shows ProShare’s Bitcoin Trust (BITO) and SPDR’s SPY ETF (SPY) moving almost perfectly in sync following the Fed’s announcement at 2 p.m.

Recent research shows that Bitcoin is increasingly linked to stocks

This connection is also not purely anecdotal, nor is it a one-off event. According to a study published by the International Monetary Fund in January,

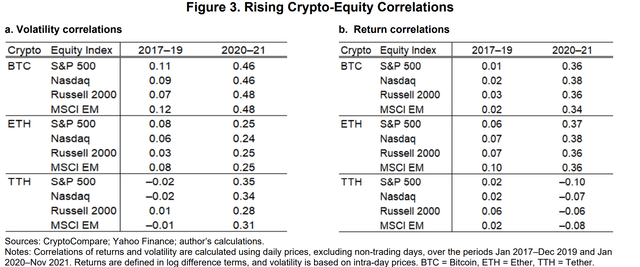

The findings suggest that the correlation between crypto and stock markets has increased noticeably during 2017-2021.6 For example, compared to pre-pandemic years, the correlation between Bitcoin price volatility and S&P 500 index volatility has increased more than fourfold, while Bitcoin’s contribution to the variation in the S&P 500 index, volatility is estimated to have increased by around 16 percentage points in the post-pandemic period.

The volatility of Bitcoin is generally much higher than the stock market, and it is increasingly correlated with stocks. This correlation increased fourfold between 2017 and 2021, according to the study:

“Cryptic Connections: Spillovers between Crypto and Equity Markets” (Tara Iyer, published IMF)

The spillover effect from the S&P 500 (SP500) to Bitcoin has increased even more strongly than in the opposite direction, suggesting that stock markets are increasingly determining the movement of crypto:

For example, volatility spillovers from Bitcoin and Tether to the S&P 500 have increased by around 16 and 6 percentage points respectively between 2017-19 and 2020-21, while volatility spillovers from the S&P 500 to Bitcoin and Tether have increased by 13-15 percentage points (Figure 5). Similarly, return spillovers from Bitcoin and Tether until the S&P 500 has increased by 10 and 6 percentage pointswhile they in the opposite direction has increased by 12-13 percentage points (Figure 6).

This increased correlation has been called “temporary” in a report by 21Shares, suggesting that this is only a short-term phenomenon and that long-term crypto remains useful for asset diversification. However, given the significant rise in recent years, the idea that crypto and stocks will be decoupled again is questionable.

This is primarily because Bitcoin, along with Ethereum and other major coins, is no longer a niche asset. Institutional investors have piled into the crypto space, and in the absence of fundamentals to make buy and sell decisions (as one might consider with stocks), crypto is quickly being traded on sentiment swings.

And sentiment never fluctuates like when Jerome Powell raises interest rates.

Remove

One of the problems with discussing Bitcoin trading separately from the stock market is that such decoupling often assumes a calm market environment. For example, in this June article:

Despite hitting a 17-month high correlation with the S&P 500 this year, Bitcoin has a proven track record of effectively remaining uncorrelated from stocks. As market conditions become safer, Bitcoin will return to its normal self and trade uncorrelated.

But the time when you most want an asset class that is not correlated to the stock market is in an inflationary market that is facing significant bearish pressure. Unfortunately for crypto investors, the opposite is the case.

Ironically, it seems that Bitcoin’s adoption may also be its downfall. As Bitcoin is increasingly accepted by mainstream financial services, it loses its value and becomes just another asset in a basket. Decentralization isn’t much use if your asset is owned and processed by the biggest banks in the world.

I’ve already discussed why I don’t think Bitcoin is useful as an actual currency. However, it is increasingly clear that Bitcoin is not a very good asset class either. It is highly correlated with stocks, except more volatile in a hostile market environment. To me, that means now, perhaps more than ever, is a good time to stay away.