Analyst Firm Says Bitcoin and XRP Flashing Bullish Signals, Predicts Further Downside for One Top-25 Altcoin

Crypto analytics firm Santiment says both Bitcoin (BTC) and XRP are flashing bullish signals amid the market decline.

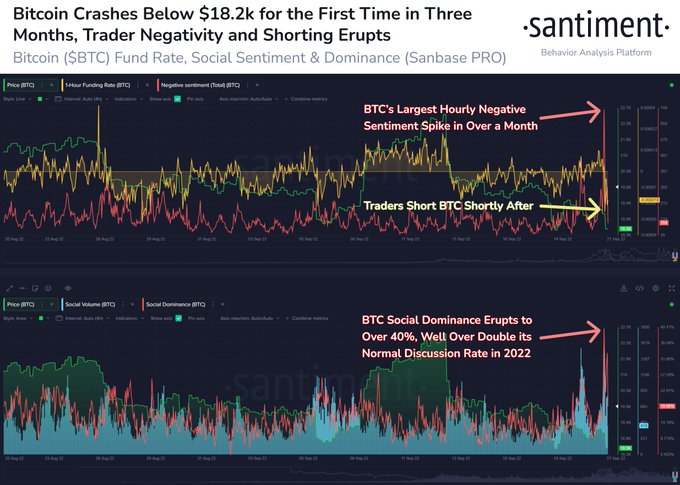

Starting with Bitcoin, Santiment says that the social dominance of the flagship crypto asset has gone up.

According to Santiment, the social dominance metric, which indicates the percentage of discussions on various platforms focused on one asset at any given time relative to other assets, has historically served as a reliable signal for predicting bottoms.

“Bitcoin’s price has hit a three-month low. According to our sentiment data, negative comments rose to monthly highs. Shorting on exchanges has at least stopped the bleeding. BTC social dominance has also increased, which historically is a good bottom signal.”

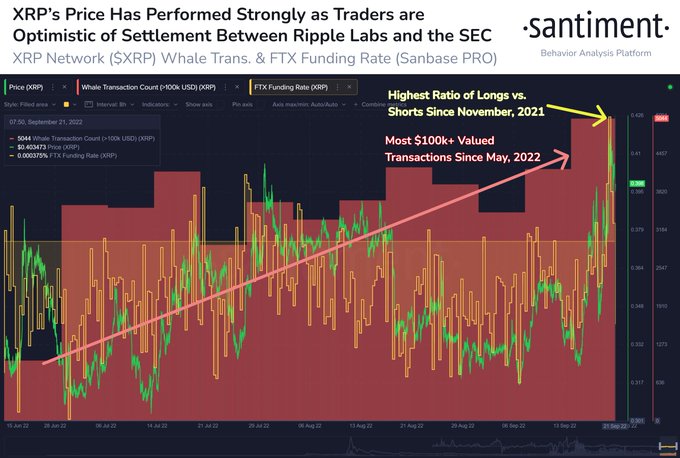

Turn to XRP, Santiment says that optimism among traders that Ripple Labs and the US Securities Exchange will reach a settlement in the ongoing lawsuit has contributed to a price rally for the sixth-largest crypto asset by market capitalization.

“XRP Network is +17% in the last week, while Bitcoin (-5%), Ethereum (-16%) and most cryptos have fallen. The ongoing battles between Ripple and the SEC regarding increased regulation have mainly led to increased trading optimism and high whale movement.”

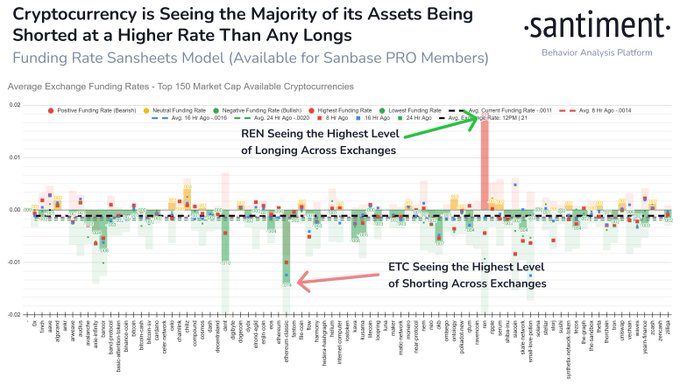

Santiment then transitions to the Ethereum (ETH) fork and proof-of-work blockchain, Ethereum Classic (ETC). The cryptanalysis company says that the 22nd largest crypto asset by market capitalization is set to fall further as short interest rates rise.

According to Santiment, Ethereum Classic is experiencing the highest level of short interest on exchanges among 150 cryptoassets, in contrast to blockchain interoperability platform Ren (REN) which is witnessing the highest level of long interest.

“Ethereum Classic has seen a high level of play against the price, especially after last week’s ETH merger. On the other end, there are many longings for Ren. Overall, however, the perpetual contract funding rates on exchanges point to traders expecting further downside.”

Don’t Miss a Beat – Subscribe to get crypto email alerts delivered straight to your inbox

Check price action

Follow us on TwitterFacebook and Telegram

Surf The Daily Hodl Mix

Disclaimer: Opinions expressed at The Daily Hodl are not investment advice. Investors should do their due diligence before making high-risk investments in Bitcoin, cryptocurrency or digital assets. Please note that your transfers and trades are at your own risk and any losses you incur are your responsibility. The Daily Hodl does not recommend the purchase or sale of cryptocurrencies or digital assets, nor is The Daily Hodl an investment advisor. Please note that The Daily Hodl participates in affiliate marketing.

Featured image: Shutterstock/Helen Pazyuk/WindAwake