A proposed new framework for the Bitcoin price

This is an opinion editor of Vishvas Garg, and Ph.D. in pharmacoeconomics, epidemiology, pharmaceutical policy and results research from the University of New Mexico.

Compared to the world’s total population of over 7.7 billion people, bitcoin is owned in less than 150 million wallets today. While this does not mean that one wallet is translated into one person, it is safe to assume that the vast majority of the world population still does not own any bitcoin at this time.

Block and Wakefield Research conducted a survey of 14 countries and reported that education is the key to bitcoin adoption. People with higher levels of knowledge about Bitcoin were found to be more optimistic about the future. Furthermore, lack of knowledge was found to be the main reason why people did not buy the property.

Bitcoin is a revolutionary force, but in order to significantly increase the adoption rate, the knowledge and perception of Bitcoin must be improved. This can be done by establishing an evidence-based value proposition of bitcoin. Having an evidence-based value proposition for bitcoin available can also enable large investments from different institutions: private, public or public.

To help understand the importance of such a value proposition of bitcoin, let’s use the example of a white paper published by Ark Invest and Block (then Square). This article has shown that bitcoin is the key to an abundant, clean energy future, as it can enable the deployment of significantly more solar and wind energy capacity. What if we could exploit the findings of this research to understand the acceleration of the transition to renewable energy and assess the quantifiable value bitcoin can deliver to society, consumers, merchants, decision makers and financial institutions?

An evidence-based case can be made with:

- Politicians: Why bitcoin adoption should be part of the CO2 elimination strategy with key stakeholders such as the UN Framework Convention on Climate Change.

- Consumers: How owning bitcoin and supporting bitcoin mining is doing its part in the fight against climate change.

- Merchants: How small, medium and large businesses can help combat climate change through the use of bitcoin.

- Society: How the bitcoin-led transition to renewable energy can create a sustainable planet while providing prosperity by creating new jobs.

- Financial Institutions: Why any good ESG-type index should have bitcoin investments as a key criterion for inclusion.

In another case, which I briefly discussed in my recently published article, I believe bitcoin can deliver fair, high-quality healthcare in an affordable way to everyone. In future articles I will share more details about this proposal.

To further enable global adoption of bitcoin, a framework is needed that can be used to quantify the value proposition. A state-of-the-art framework for quantifying the value of bitcoin currently available is Ark Invest’s model. This framework is an excellent approach for calculating the price and performance of bitcoin through the basic analysis of the network and the adoption. But as Cathie Wood – who I think is Benjamin Graham in modern times – kindly agrees with me, sometimes price and network adoption can lie in the long-term value of any asset. This can be especially true for a generational innovation like bitcoin that involves network effects.

The Ark Invest bitcoin valuation framework is very complementary to the proposal proposed in this article. One way to understand this concept is to compare the Ark Invest framework with Benjamin Graham’s The Securities Investor securities framework. In order to fully understand the growth potential of Bitcoin, especially due to the network effects, a comprehensive framework for qualitative and quantitative thinking is guaranteed that can be used to capture the entire long-term value proposition of bitcoin.

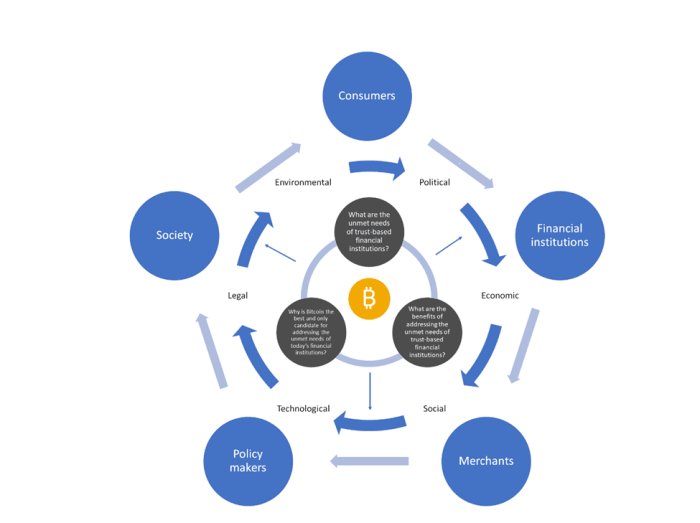

Based on this comprehensive qualitative and quantitative thinking, a framework of three concentric circles is proposed that comprehensively captures the entire long-term value proposition of bitcoin below. See the first figure for more information.

The first and innermost concentric circle are the core of this framework. This core is based on the following three major questions:

- What is the unmet need? This is the purpose of bitcoin.

- What are the benefits of meeting the unmet need? This is the advantage of bitcoin.

- Why is Bitcoin the best and only candidate to meet the unmet need? This is the potential of bitcoin.

The middle concentric circle is made up of the PESTLE (political, economic, social, technological, legal, and environmental) factors from Mike Morrison’s “Strategic Business Diagnostic Tools.” Originally, the PESTLE framework was proposed to understand the impact of external factors on an organization. However, the proposed framework requires the opposite – to seek the answers to the three questions asked in the innermost circle in the context of the PESTLE factors.

The outermost concentric circle represents the direct and indirect stakeholders that may be affected by bitcoin adoption or lack thereof. Depending on the stakeholder being considered, the answers to the three questions asked in connection with the PESTLE factors may vary. For example, to understand the economic benefits of meeting the unmet needs of today’s trust-based financial institutions, the answer may be different for society or consumers versus the financial institutions themselves.

I know Jack Dorsey did not want me to do this, but given the instrumental impact his ideas had on shaping my own, I would kindly suggest that this framework be called the “Blockhead Three Circles (BTC) Value Framework.”

How can this framework be used?

This framework can be used to assess the total long-term net gain of bitcoin, qualitatively or quantitatively, for all key and indirect key stakeholders, including consumers, merchants, decision makers, financial institutions and society.

Such assessments will have a positive impact on the knowledge and perception of bitcoin, which in turn can help drive its adoption globally.

What are the next steps?

There are three major next steps:

- Complete the structure of the proposed BTC value framework: Anyone wishing to provide feedback and input to this framework is welcome to submit their input directly to my Twitter. I will post a link to this article on my profile when publishing.

- Build an open source model based on the BTC Value Framework: One way to take advantage of the framework proposed in this article is to build a model based on it that can help generate evidence to support the value of bitcoin adoption. I encourage other Bitcoin communities to support the development of this model. This model should be built with the “bitcoin standard” and be freely available to everyone in this world.

- Accelerate evidence generation to assess the value of bitcoin: As of today, research studies evaluating the value of bitcoin are still scarce. Especially if we review the existing literature through the lens of the proposed BTC Value Framework, it becomes clear how big the gaps are in the value proposition of bitcoin. Given this, a long-term, open source, coordinated effort to develop bitcoin’s value proposition is justified. This effort should be as open source and inclusive as the technical development of bitcoin itself. Such an effort will create a new high standard for scientific research across any discipline.

This is a guest post by Vishvas Garg. Expressed opinions are entirely their own and do not necessarily reflect the opinions of BTC Inc. or Bitcoin Magazine.