MercadoLibre (MELI): A Fintech Juggernaut (NASDAQ:MELI)

Editor’s Note: Seeking Alpha is proud to welcome Jonah Lupton as a new contributor. It’s easy to become a Seeking Alpha contributor and earn money from your best investment ideas. Active contributors also get free access to SA Premium. Click here to find out more »

imaginima

Dissertation: Profitable growth

MercadoLibre (NASDAQ:MELI) is largely known as Amazon/eBay in Latin America due to its e-commerce business. While e-commerce in LatAm will continue to grow significantly with an approx. 25% CAGR between 2021-2025 as projected by Americas Market Intelligence (AMI), Fintech Solutions of MELI is the segment to watch closely as it is now, and will remain, the main growth engine of the entire company.

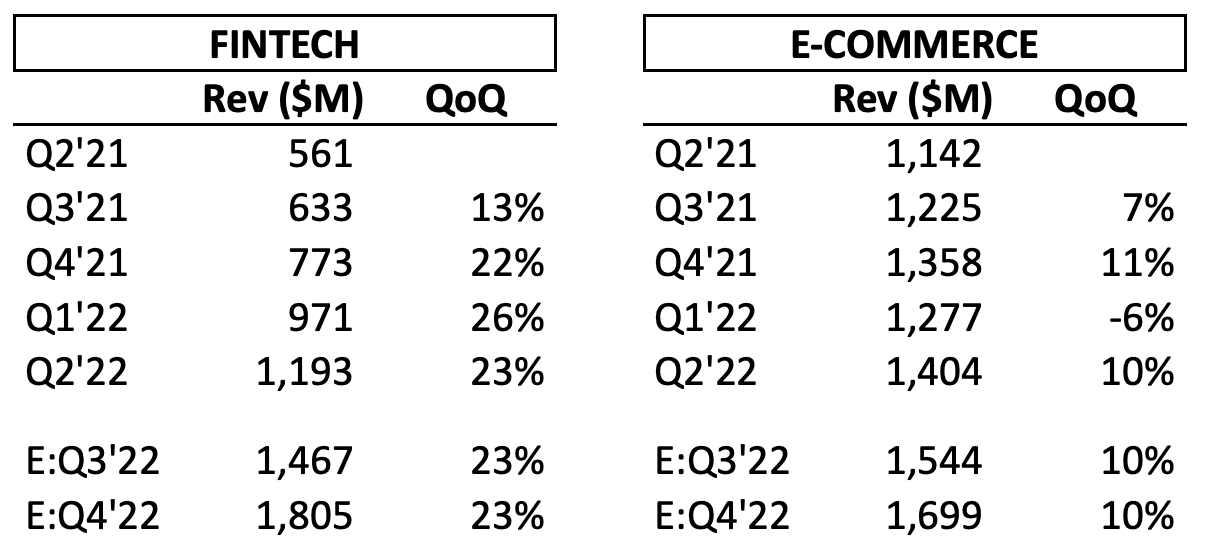

Within the underbanked geography of Latin America lies the fintech juggernaut, MercadoPago, which is set to overtake MELI’s e-commerce revenue in Q4’22 if we assume consistent QoQ growth of 23% and 10% (see estimates below). In fact, it could even happen in Q3’22 considering that a 10% QoQ growth for e-commerce is generous given the current macro headwinds. Regardless of when that happens, the narrative around MELI as an e-commerce company is starting to shift to fintech, and I think it’s currently being underestimated by the market and masked by macro e-commerce news.

Author’s estimate

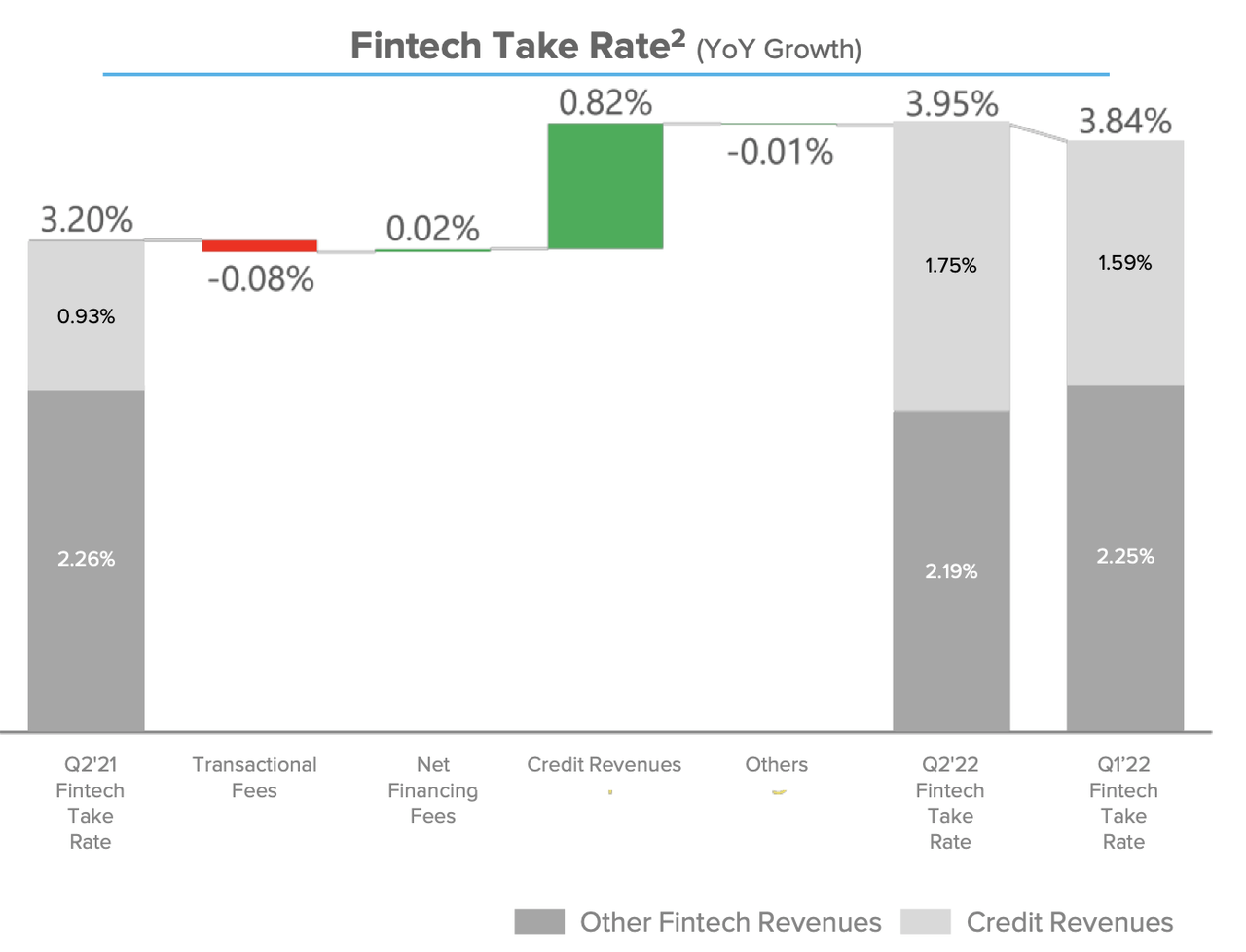

MELI reinvests a large portion of the capital in the growth of the business while remaining profitable, maintaining free cash flow generation, increasing margins and also increasing cap rates. The take rate for the fintech segment is particularly strong and expanded to 3.95% in Q2’22 from 3.84% in Q1’22 and 3.20% in Q2’21. Take rate will be an important metric to monitor each quarter given the significant growth of TPV and the credit portfolio as it is a function of gross fintech revenue.

MercadoLibre presentation

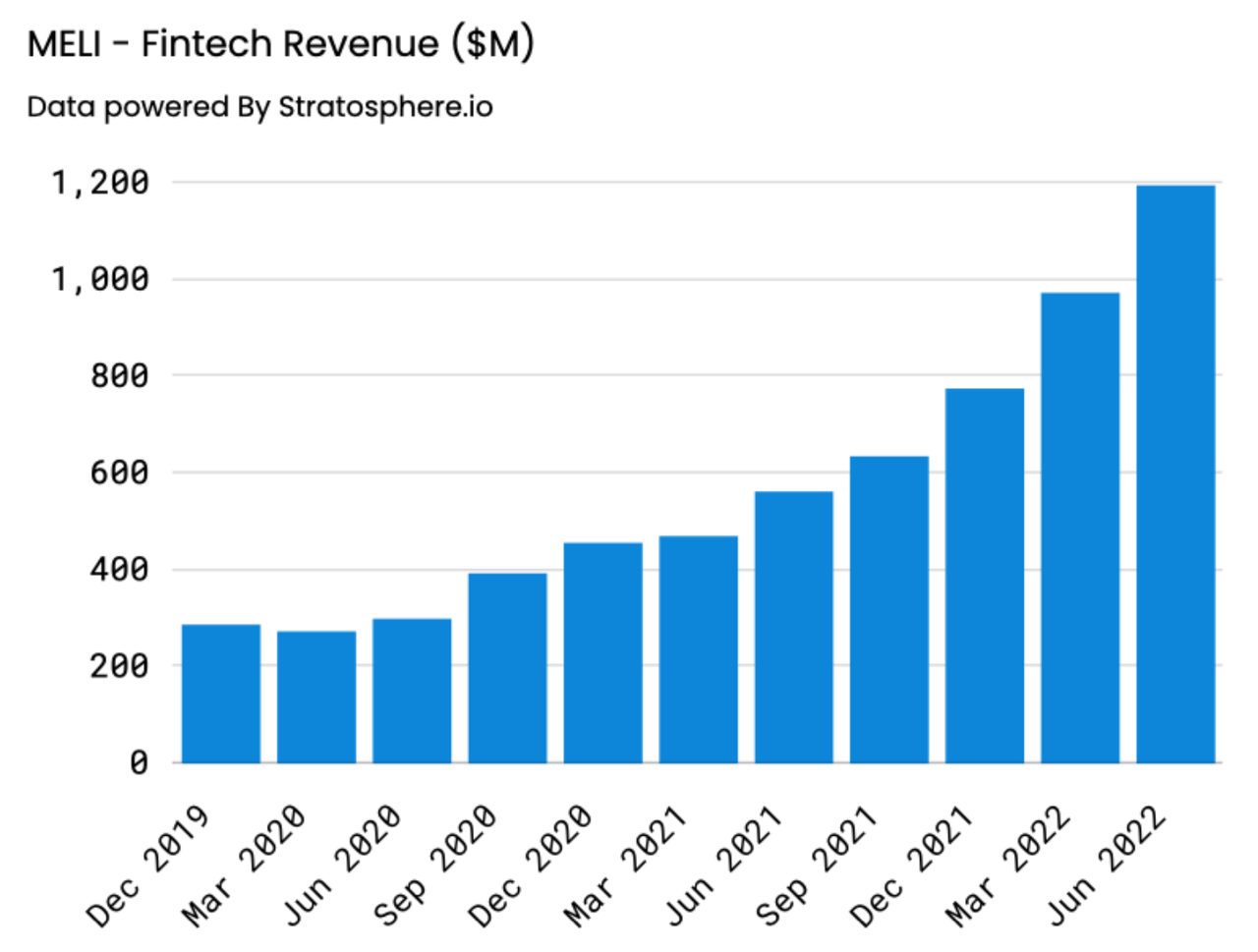

Exceptional Fintech growth

Fintech revenue aggregated for Q2 2022 grew 107% year-over-year to $1.19 billion. In comparison, e-commerce/marketplace revenue for Q2 2022 increased 23% to $1.40 billion. Mercado Pago is an integrated online and offline payment solution, card issuer and digital wallet that just surpassed TPV (Total Payment Volume) of $30B in Q2 2022 for the first time ever.

Google search

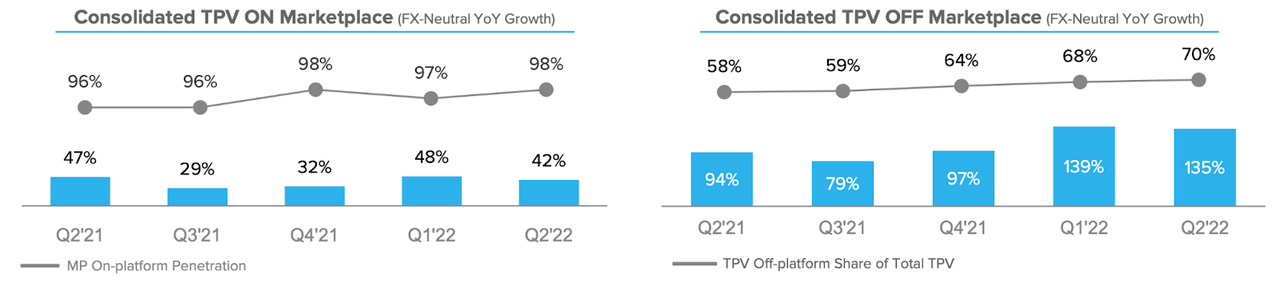

MercadoPago grew total TPV by 84% YoY (FX neutral basis), which is impressive, but let’s dig deeper to see what is responsible for driving this growth.

-

ON Marketplace TPV: “Measure of the total US dollar amount of all marketplace transactions paid for using MercadoPago, excluding shipping and financing fees.”

-

OFF Marketplace TPV: “Measures the total US dollar amount of all transactions paid to use MercadoPago through merchant services for online payment, MPoS, QR and wallet payments, and card payments.”

Off Marketplace TPV, which is the crown jewel, grew 135% year-on-year and now accounts for 70% of the total TPV for MELI. I would like to see this continue at high growth rates because it improves their market penetration and serves an underbanked population to help digitize LatAm. A key reason why I am very positive about the future growth and profitability of MELI is that Pago has grown Off Marketplace TPV by over 100% year-on-year, which will serve as a key growth driver as it expands their reach for to bring brand new customers into the MercadoLibre ecosystem of products and services. This obviously opens up further opportunities for cross-selling.

MercadoLibre presentation

Digital Accounts TPV within Off Marketplace TPV is the area that leverages the underbanked region of LatAm and consists of wallet payments, P2P transfers between MercadoPago Wallets and prepaid, debit and credit cards. Digital Accounts TPV grew by 189% YoY on a currency neutral basis, demonstrating that they have succeeded in acquiring new customers and introducing digital payments to a population that has lacked banking innovation for many years. The significant growth was not only driven by the gradual addition of unique fintech users, but also from existing users increasing their transactions on wallet payments/transfers, QR and card usage. This shows that when a new user creates an account, they continue to increase their usage over time.

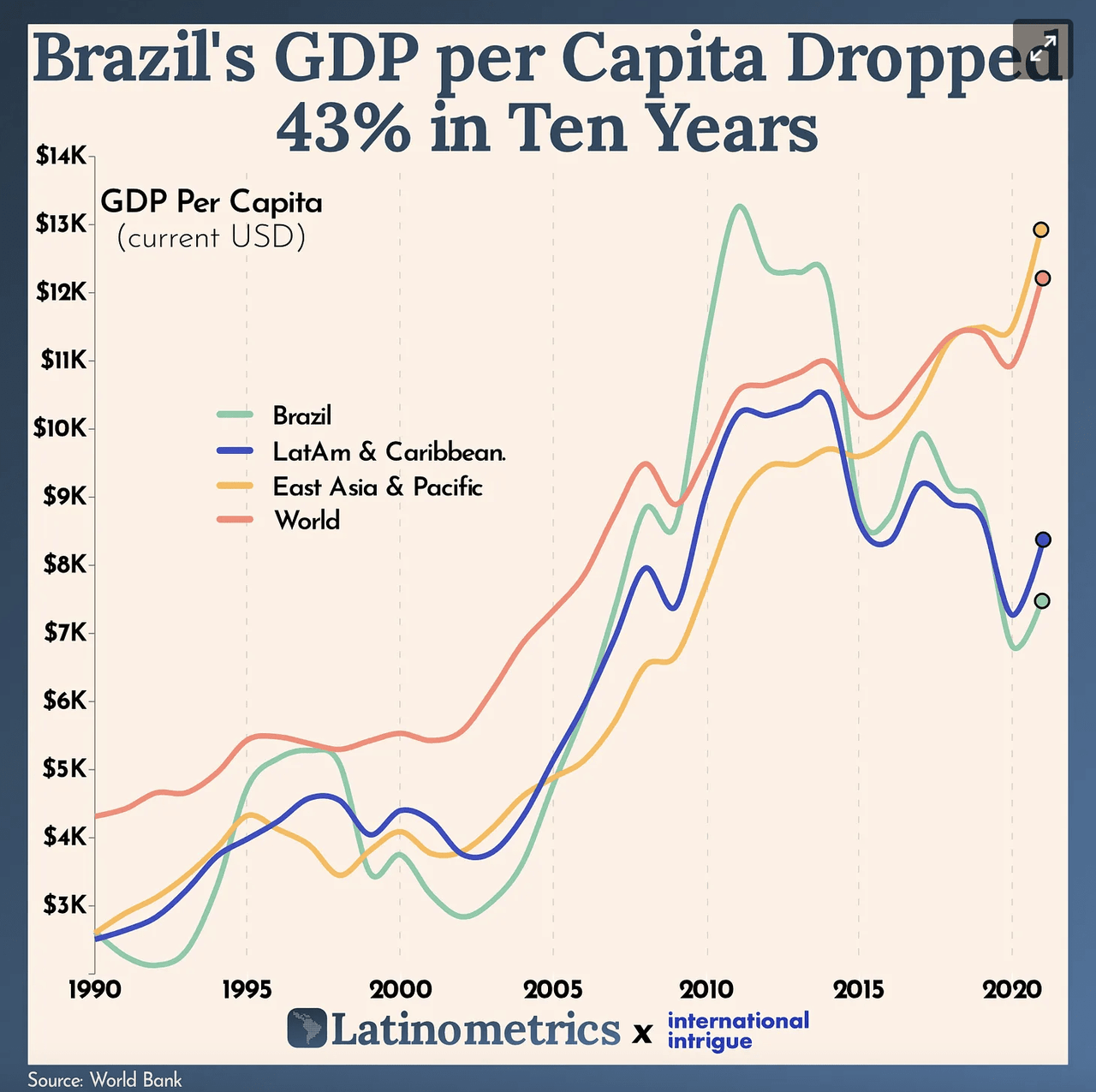

Not fascinated by geographical headwinds

What is even more impressive is that MELI continues to perform over the past 10 years with consistently high growth rates amid significant reductions in GDP per capita in their main regions. By comparison, the rest of the world has seen increases in GDP per capita. It appears that the secular tailwinds of e-commerce and fintech innovation have created stronger pressure than the many macro headwinds pushing back.

Latinometrics

The bottom line

Beating consensus estimates on revenue, gross margin, gross profit, TPV and adjusted EPS for Q2’22, MELI is proving its resilience given the global macro headwinds in addition to the specific geographic headwinds in LatAm. Management is proving its ability to execute quarter after quarter and continue to grow all business segments and gain market share. The long-term outlook for MELI looks promising given the low penetration rate of e-communications and digital banking services in LatAm, which should drive growth in the coming years.

The long-term potential of MELI and its proven ability to be profitable while growing significantly should instill confidence in shareholders despite the many risks it faces. I couldn’t agree more with management as they noted in their Q2’22 note to shareholders: “The best is yet to come.”

We own shares and plan to increase that position in the near future in case of any pullbacks.

Looking for high-quality growth companies to maximize long-term returns?

I run a premium service called Disciplined growth investor on the Seeking Alpha Marketplace, where my team publishes in-depth research on quality growth companies to drive long-term returns. The service also includes quarterly earnings analysis, buy/sell trade alerts, my personal portfolio updates, live chat and much more.

Join one free 14-day trial now and access 10+ deep dives into the most promising quality growth companies for 2022 and beyond.