Why the Ethereum Merger Was a “Sell the News” Event

Important takeaways

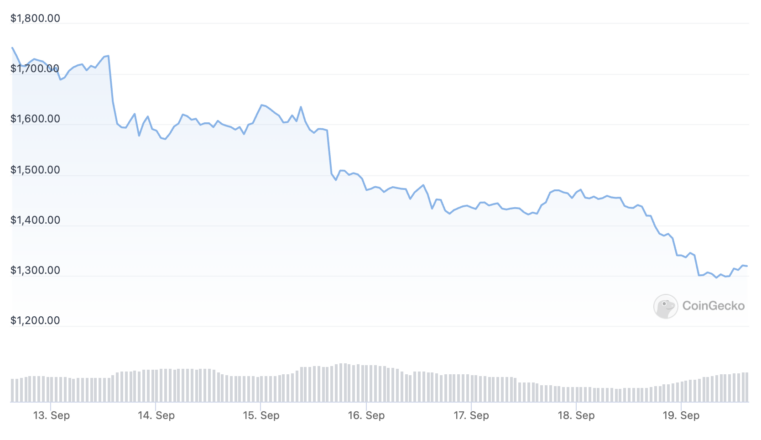

- Ethereum has successfully submitted the merger after years of anticipation, but ETH is down. The number two crypto has lost 25% of its market value in the last week.

- Although the merger brought several notable upgrades, it will likely take time for the market to digest the event.

- The weak macro environment has been a major factor weighing on ETH and other crypto assets this year.

Share this article

Ethereum made history when it completed “the Merge” from Proof-of-Stake last week, but ETH has seen a sharp decline since the update was sent.

Ethereum hits sale after merger

Crypto traders are rushing to sell Ethereum after last week’s highly anticipated “Merge” event.

The world’s second-largest blockchain has recorded heavy losses since switching to a Proof-of-Stake consensus mechanism early Thursday. ETH was trading just above $1,606 when the merge was posted, but has since fallen by around 17.8%, trading at $1,320 at press time.

ETH showed weakness ahead of the event, taking a hit on Wednesday when the US Consumer Price Index registered a higher than expected 8.3% inflation rate. According to CoinGecko data, it is down 25.1% in the last week.

The Ethereum selloff comes as most major cryptoassets suffer from market volatility. September has historically been a weak month for crypto prices, and the recent market action has added to the pain for crypto hopefuls after months of selling. Bitcoin broke below $19,000 on Monday, currently trading at $18,684. Ethereum-related tokens such as Ethereum Classic and Lido have also slipped on the decline, respectively shaving 12.6% and 9% of their market capitalization in the last 24 hours. ETHW, the original token for the Proof-of-Work Ethereum chain launched after the merger, has fallen to $5.49 after topping $50 on some exchanges ahead of the event.

While ETH holders had pinned their hopes on the merger acting as a catalyst for bullish price action for Ethereum’s native asset, the event appears to have suffered from the “sell the news” effect. “Buy the rumor, sell the news” is a popular phrase in the financial markets. It refers to the practice of buying an asset ahead of a major event in anticipation of a price increase before selling the asset afterwards. Coinbase going public on the Nasdaq was another example of a “sell the news” event; many market participants hoped that the US exchange listing would boost Bitcoin to $100,000 after the event, but the top crypto hit a high of $64,000 on the day and lost over 50% of its market value in six weeks.

Changes to Ethereum

Expectations for the merger were high, partly because it was many years in the making, and partly because it was such a great technological feat. Discussed by Ethereum co-founder Vitalik Buterin since the blockchain’s inception, the transition from Proof-of-Work to Proof-of-Stake has often led to comparisons to an airplane changing its engine midway.

When the merger was completed, Ethereum introduced several important changes. First, and arguably Ethereum’s most important step in preparing for mainstream adoption to date, the blockchain reduced energy consumption by around 99.95% by ditching Proof-of-Work miners. Several mainstream news channels, including Guardian, The independentand Financial Timesreported on the merger when it aired last week, leading with discussions about the blockchain’s improved carbon footprint.

Additionally, Ethereum cut its ETH issuance by around 90% with the move to Proof-of-Stake since it no longer needs to pay miners. In accordance ultrasound. money data, the circulating ETH supply has increased by around 3,000 ETH since the merger, down from the 53,000 ETH it would have paid out under Proof-of-Work. The reduction in issuance was hailed as a bullish catalyst for ETH, with the likes of Arthur Hayes describing the Merge trade as “a no-brainer” based on the basic switch.

ETH holders can earn a return of around 4% by staking their assets to secure the network, and with the move to a more ESG-friendly consensus mechanism, the possibility of institutional investors deploying capital in ETH fueled a narrative that the merger would help the asset wave.

A delayed reaction

While Ethereum has introduced several improvements, there are several factors that could explain why ETH has not responded as its biggest fans had hoped. The reduction in the ETH supply occurs gradually over time. It is likely that the market will need time to process the impact of such a large change, similar to how Bitcoin only tends to increase in value months after its “halving events”. With the supply cut, ETH could theoretically become a deflationary asset, or “ultrasound” as it has been called in the Ethereum community, but market participants may wait to see how the change plays out before buying into ETH.

Similarly, while Ethereum has received green credentials with the exchange, it may take some time for hedge funds and other large players to invest in ETH (institutions and traditional financial firms tend to move more slowly than crypto-native investors). The merger is also unlikely to transform mainstream opinion towards crypto and its climate costs. The entire asset class came under scrutiny in 2021 over the environmental impact of Proof-of-Work mining, and the climate issue has arguably been a significant barrier to preventing mass adoption. While Ethereum has cut its energy consumption, the world’s largest cryptocurrency still uses Proof-of-Work and will likely do so for years to come. Even if potential investors are aware that Ethereum uses Proof-of-Stake, they may still have an aversion to crypto due to Bitcoin’s energy usage. Like the ETH issuance cut, it could take months or years for the energy consumption reduction to improve Ethereum’s appeal among both institutional and retail investors.

The macro picture

Besides the Ethereum Merge itself, the broader crypto market and its place in the current macroeconomic climate may explain why ETH is down. Like Ethereum, Bitcoin is over 70% below its November 2021 peak, leading to an almost year-long decline in the crypto market. Cryptocurrencies have traded in close correlation with traditional stocks in 2022, suffering heavy losses at the mercy of the Federal Reserve and its ongoing economic tightening policies. In response to rising inflation, the Fed has raised interest rates throughout the year, and asset risk has suffered as a result. Fed Chair Jerome Powell’s latest indications of further “pain” ahead suggest more gains could be coming, especially after the latest inflation data came in above estimates last week. The Fed has said it wants to get inflation down to 2%; the US central bank is expected to announce a new interest rate hike of either 75 or 100 basis points this Wednesday.

Prior to the merger, Ethereum dominated the market. Hype for the event reached a fever pitch, especially after EthereumPoW’s plans to split the chain came to fruition in August. But now that the event has passed, traders need a new narrative to get behind. With the merger completed amid a period of macroeconomic uncertainty and no bullish catalysts on the horizon, it’s no wonder Ethereum’s biggest update ever turned into a “sell the news” event. At least Ethereum’s fundamentals have improved as market sentiment turns and interest in crypto returns—assuming it does at some point, of course.

Disclosure: At the time of writing, the author of this piece owned ETH and several other cryptocurrencies.