Why I Cut Riot Blockchain from Buy to Neutral (NASDAQ:RIOT)

salarko/iStock Editorial via Getty Images

It seems like everywhere you look, there are weaknesses in this market. It’s been tough out there, and let’s not forget that September is a seasonally weak period in the equity markets. Risk behavior has been the name of game for most of 2022, and that’s certainly true right now. There are few groups that exemplify risk behavior more than Bitcoin miners, as they are hugely volatile and make big moves in both directions. One such miner is Riot Blockchain (NASDAQ:RIOT), a stock that I think is in no man’s land right now. Below we will discuss some of the factors you should consider if you want to trade Riot.

I last covered Riot back in May after Q1 earnings with a “buy” rating. At the time, we had yet to see the full fury of this bear market, and while Riot has posted much higher prices since that play, some lower ones have been posted as well. The thinking at the time was that Bitcoin was trading with support and the valuation of Riot was cheap. Bitcoin has subsequently made lower troughs in panic selling over the summer, and Riot’s valuation has moved around a bunch. Let’s take a look at these factors and more below with the knowledge of another four months of price data.

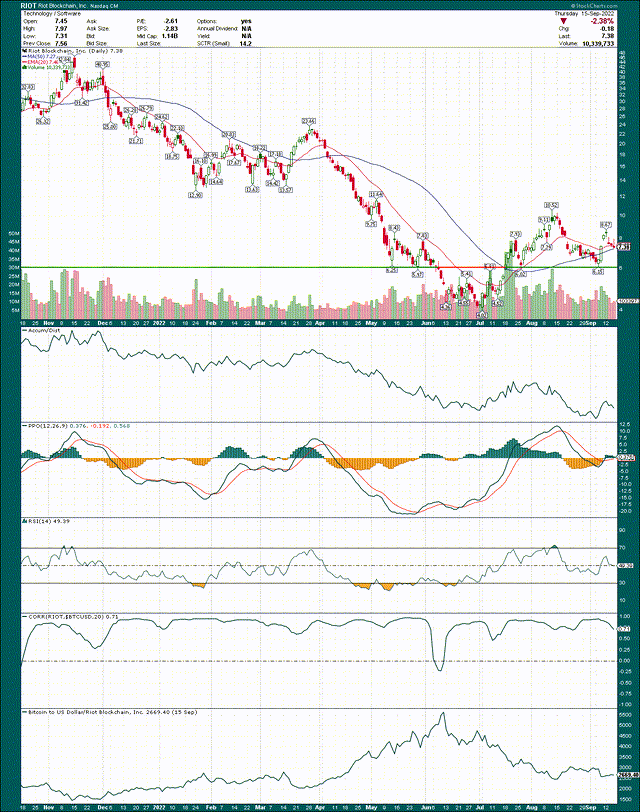

Stock charts

This is the daily chart for Riot and we can see that the stock has been doing quite well since the summer bottom. In fact, the rally from July to August saw the stock ~2.5X, but it has pulled back significantly since the peak. It looks like the stock is going to lose the 20-day EMA based on this week’s price action, but for me the line in the sand to look at is around $6, which was the line where relative lows and highs have been made a few different times over the past couple the months. If we see a breakdown of that level, we can simply retest the summer lows. It will probably take a big selloff of Bitcoin (again) to get to that level, but this market is hostile to bulls right now, so it could happen.

On the momentum side, Riot’s PPO looks ok with a center lane support test happening right now. But unless the stock goes up quickly, it’s going to struggle to hold it. My take right now is that I think we’ll see Riot break that midline support, and take a test of the ~$6 support level. We’ll see.

The last two panels show the correlation between Riot’s share price and Bitcoin on a rolling 20-day basis, and the price of Bitcoin relative to the price of Riot. The correlation is still very high, so we can reasonably expect Bitcoin and Riot to trade in the same direction. It’s probably not what Riot shareholders want at the moment, as Bitcoin doesn’t seem to be sustaining a rally these days, but it is what it is.

Additionally, the bottom panel shows that Bitcoin is actually more cheaply valued against Riot than much of 2022, or in other words, Riot is more expensive relative to Bitcoin. It is not a good situation for Riot as it means the stock is outperforming Bitcoin, perhaps in anticipation of a turnaround in the coin’s price. That leaves the stock open to a major correction if Bitcoin crashes, for example. Regardless, I would point out that Riot’s relative valuation to Bitcoin has deteriorated in recent months.

There is still a lot of growth to come

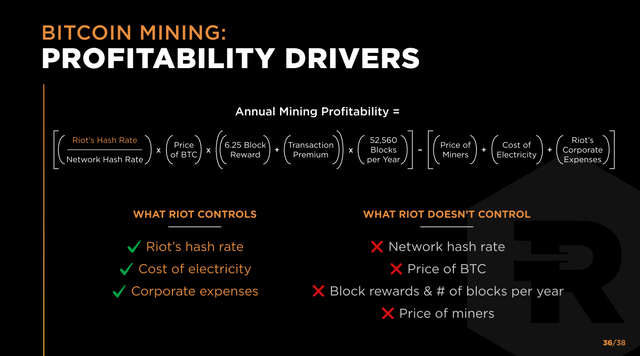

Now let’s turn our attention to the company’s progress towards becoming one of the largest Bitcoin miners on the market. This slide is a great way to see not only how Bitcoin mining works, but the things Riot can and cannot control.

Investor presentation

I won’t read the slide for you, but the three things Riot has significant control over are hash rate, power cost, and company cost. This means that we as investors can evaluate Riot on these factors, while keeping in mind all the factors over which it has no control. They also mean a lot (a lot), so we don’t want to forget them. But Riot can control its capacity, for example, so let’s take a look there given its importance to the growth story.

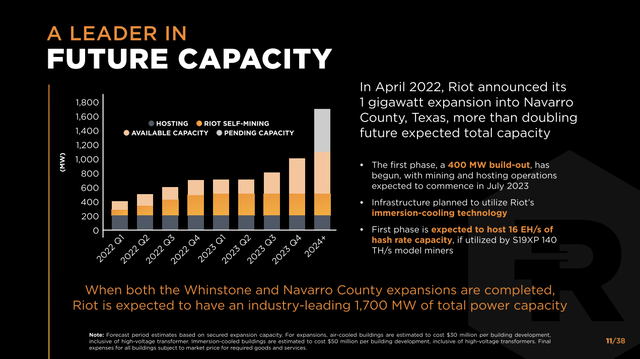

Investor presentation

Riot is very busy expanding its capacity, and is doing so with ever-increasing levels of efficiency. This includes both power consumption (lower is better) and the speed of the miners. Riot is retiring old miners and buying more efficient ones that will improve both the speed of the ability to mine in the future, as well as the amount of power used, even with higher capacity. The company has ambitious goals to triple its current capacity by 2024 (give or take), so there’s a big runway here if it can be accomplished.

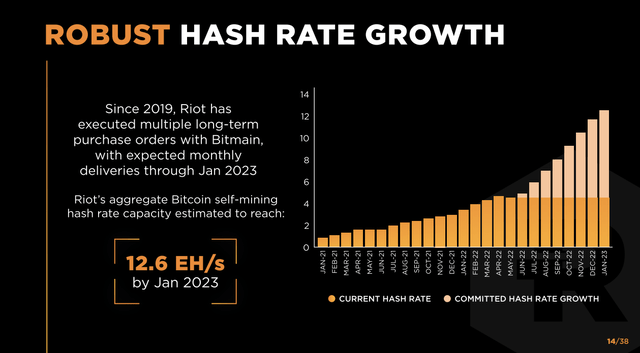

Investor presentation

Put another way, the company is committing to massive hash rate growth in the coming years, which it is certainly on track to achieve. The facility expansions and the mix of more efficient miners should make this plan a reality, and at the moment I see no reason why Riot shouldn’t be able to achieve this. That means there should be more Bitcoin available for Riot, despite the ever-increasing difficulty of mining Bitcoin. So while capacity/efficiency may triple, the number of Bitcoins mined will not. Still, the gains will be significant, and if the Bitcoin price starts a new bullish phase at some point, Riot could be a big advantage.

Reason for concern?

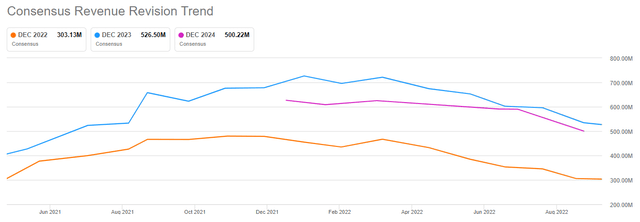

One thing I always look at is revisions for EPS and earnings. Given Riot’s current state of highly variable profitability, EPS has limited use in my view. Income is pretty useful though, so let’s take a look.

Seeking Alpha

This is not pretty. Estimates for revenue have plummeted in the last year or so, and by a large margin. For example, this year’s estimate of approx. 40% from the previous high. It’s tough to own a stock that has steadily declining earnings estimates, and that’s certainly true here. Not only is this bad for sentiment, which affects the many investors willing to pay, but it’s also bad for the valuation itself. After all, even if the multiple is flat, the number at which we value the stock continues to decline.

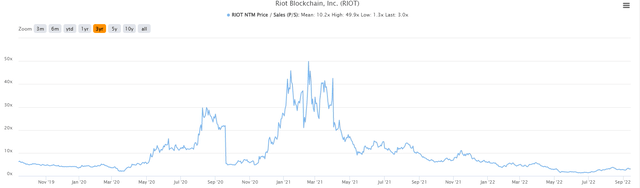

Speaking of which, let’s now value the stock based on its price-to-sales ratio over the last three years.

TICKER

It’s pretty easy to see when Bitcoin flew to new highs because miners had some really boring valuations. Riot is traded briefly at 50X forward sales, which was laughable in retrospect. Since then we have seen much more pedestrian valuations and today there are 3X forward sales.

That’s much lower than the average of 10X sales, but unless Bitcoin takes out its ATH, which is more than 3X the current price, I don’t think Riot has any chance at that kind of valuation. Rather, I would argue now, 3X is a pretty significant valuation. Keep in mind that earnings estimates continue to decline, so until that stops happening, I see more downside risk to the valuation than upside. If the Bitcoin price makes another low, we could easily see Riot at 1.5X or 2X futures again, so it’s a meaningful risk today.

So what do we do?

As I said earlier, I think Riot is a bit of a no man’s land at the moment. The stock is still in the middle of a pullback and I think it has downside risk towards $6 at the moment. At that point, if you want to own Riot, it would be a favorable risk/reward setup, assuming you use stops. Would I buy it for $7? I don’t think I would. There is still downside risk to earnings estimates, and I don’t think 3X forward sales are particularly cheap. For now, I’m in wait-and-see mode on Riot, especially given the risk-of-behavior we’re seeing in the market today. With this, I am downgrading Riot from my previous buy rating to a neutral stance.